For decades, biweekly or monthly pay cycles have been the standard in employment contracts. However, as Singapore’s workforce evolves—especially with the rise of the gig economy and flexible work arrangements—there is increasing demand for more dynamic payment solutions. One such innovation is on-demand pay, which allows employees to access their earned wages before payday.

This model not only enhances financial wellness for workers but also benefits employers by improving employee retention, satisfaction, and productivity. As companies strive to attract and retain top talent in an increasingly competitive market, Xerosoft Global is leading the way in modern payroll solutions, integrating on-demand pay into its cloud-based payroll and workforce management platforms.

What is On-Demand Pay?

On-demand pay, also known as Earned Wage Access (EWA), enables employees to withdraw a portion of their earned wages before payday. This system offers immediate financial relief, allowing workers to manage unexpected expenses without relying on high-interest loans or credit cards.

A study by Instant Financial found that 79% of workers would be more likely to apply for a job offering same-day pay—a 30% increase from 2018. This highlights the growing expectation for greater payroll flexibility in today’s job market.

The Gig Economy and Financial Flexibility

Singapore’s gig economy has expanded beyond ride-hailing and food delivery to sectors like retail, healthcare, and professional services. While gig work offers greater autonomy, it often lacks financial stability, as workers may face delayed payments or irregular income.

Recognising this shift, Xerosoft Global has developed payroll solutions tailored for gig workers and freelancers. Its platform enables businesses to integrate on-demand pay with real-time earnings tracking, ensuring that workers are compensated promptly and fairly.

Financial Stress and Employee Productivity

Financial stress is one of the most common factors affecting employee morale and performance. Employees worried about covering daily expenses may struggle with concentration and productivity, leading to higher absenteeism and lower efficiency.

Offering on-demand pay can help alleviate financial anxiety, empowering employees to manage their earnings more effectively. In markets such as the Philippines, businesses that have implemented EWA solutions have observed higher employee satisfaction and reduced turnover.

Employer Benefits of On-Demand Pay

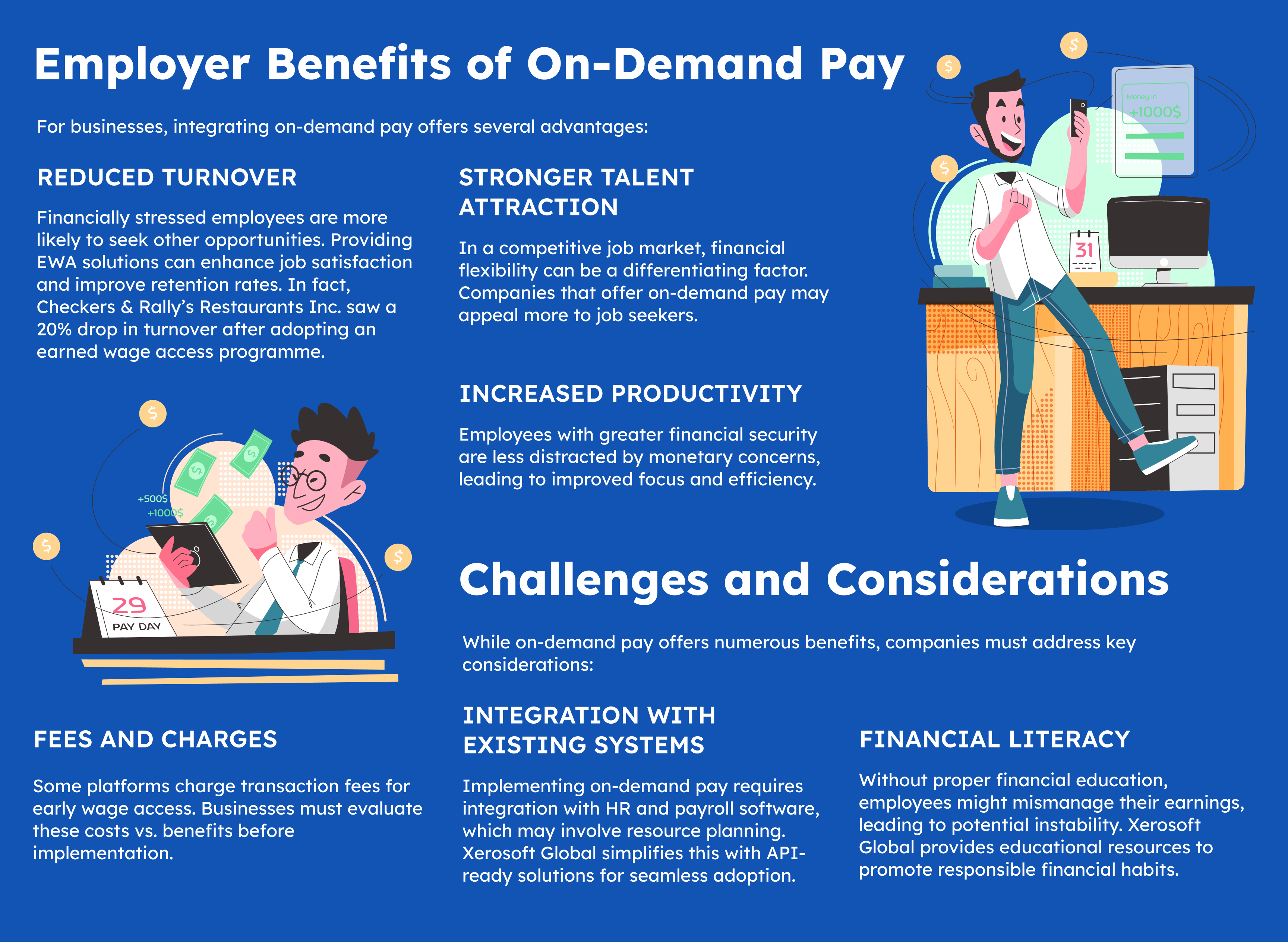

For businesses, integrating on-demand pay offers several advantages:

Reduced Turnover

Financially stressed employees are more likely to seek other opportunities. Providing EWA solutions can enhance job satisfaction and improve retention rates. In fact, Checkers & Rally’s Restaurants Inc. saw a 20% drop in turnover after adopting an earned wage access programme.

Stronger Talent Attraction

In a competitive job market, financial flexibility can be a differentiating factor. Companies that offer on-demand pay may appeal more to job seekers.

Increased Productivity

Employees with greater financial security are less distracted by monetary concerns, leading to improved focus and efficiency.

At Xerosoft Global, businesses leveraging its on-demand payroll solutions benefit from AI-powered automation, real-time analytics, and secure payment processing, ensuring a seamless and efficient payroll experience.

Challenges and Considerations

While on-demand pay offers numerous benefits, companies must address key considerations:

Integration with Existing Systems

Implementing on-demand pay requires integration with HR and payroll software, which may involve resource planning. Xerosoft Global simplifies this with API-ready solutions for seamless adoption.

Financial Literacy

Without proper financial education, employees might mismanage their earnings, leading to potential instability. Xerosoft Global provides educational resources to promote responsible financial habits.

Fees and Charges

Some platforms charge transaction fees for early wage access. Businesses must evaluate these costs vs. benefits before implementation.

The Future of Payroll in Singapore

As workplace expectations evolve, real-time payroll solutions will likely become the norm. Employees increasingly expect instant access to their earnings—just as they do with banking, e-commerce, and digital payments.

By adopting on-demand pay, businesses can stay ahead in a competitive labour market, attracting top talent and fostering a more engaged workforce.

Xerosoft Global: Leading the Payroll Revolution

Xerosoft Global is pioneering the future of payroll, making financial flexibility a standard, not a luxury. Through AI-driven automation, predictive analytics, and secure digital payment systems, the company enables businesses to seamlessly implement on-demand pay, ensuring both employee well-being and operational efficiency.

On-demand pay is transforming traditional payroll models, offering greater financial control to employees while delivering strategic advantages to employers. As businesses in Singapore look for ways to improve employee satisfaction, attract top talent, and enhance payroll efficiency, Xerosoft Global’s innovative payroll solutions provide the answer.