In today’s data-driven economy, financial planning is no longer about spreadsheets and historical reports alone—it’s about anticipating the future. Enter Big Data, the game-changer that’s transforming how businesses of all sizes plan their financial strategies. By integrating vast volumes of data with advanced analytics, companies can make faster, smarter, and more strategic financial decisions. In this post, we explore how leveraging Big Data can elevate financial planning, supported by real-world analytics, statistics, and insights—plus how XerosoftGlobal empowers this transformation.

What is Big Data in Financial Planning?

Big Data in finance refers to the use of massive datasets—structured and unstructured—to gain deeper insights into financial trends, risks, and opportunities. This includes internal data like sales, cash flows, and expense reports, as well as external data such as market trends, economic indicators, and customer behavior.

When properly harnessed, Big Data doesn’t just tell you where your business stands today—it helps predict where it’s headed tomorrow.

Key Statistics Highlighting the Impact

According to Deloitte, 49% of financial institutions are already using Big Data analytics to improve decision-making.

A PwC report found that companies using data analytics in financial planning saw a 30% improvement in forecast accuracy.

IBM states that poor data quality costs the U.S. economy around 3.1 trillion per year, emphasizing the value of clean and actionable data.

These numbers underscore the importance of not just collecting data—but transforming it into strategic insights.

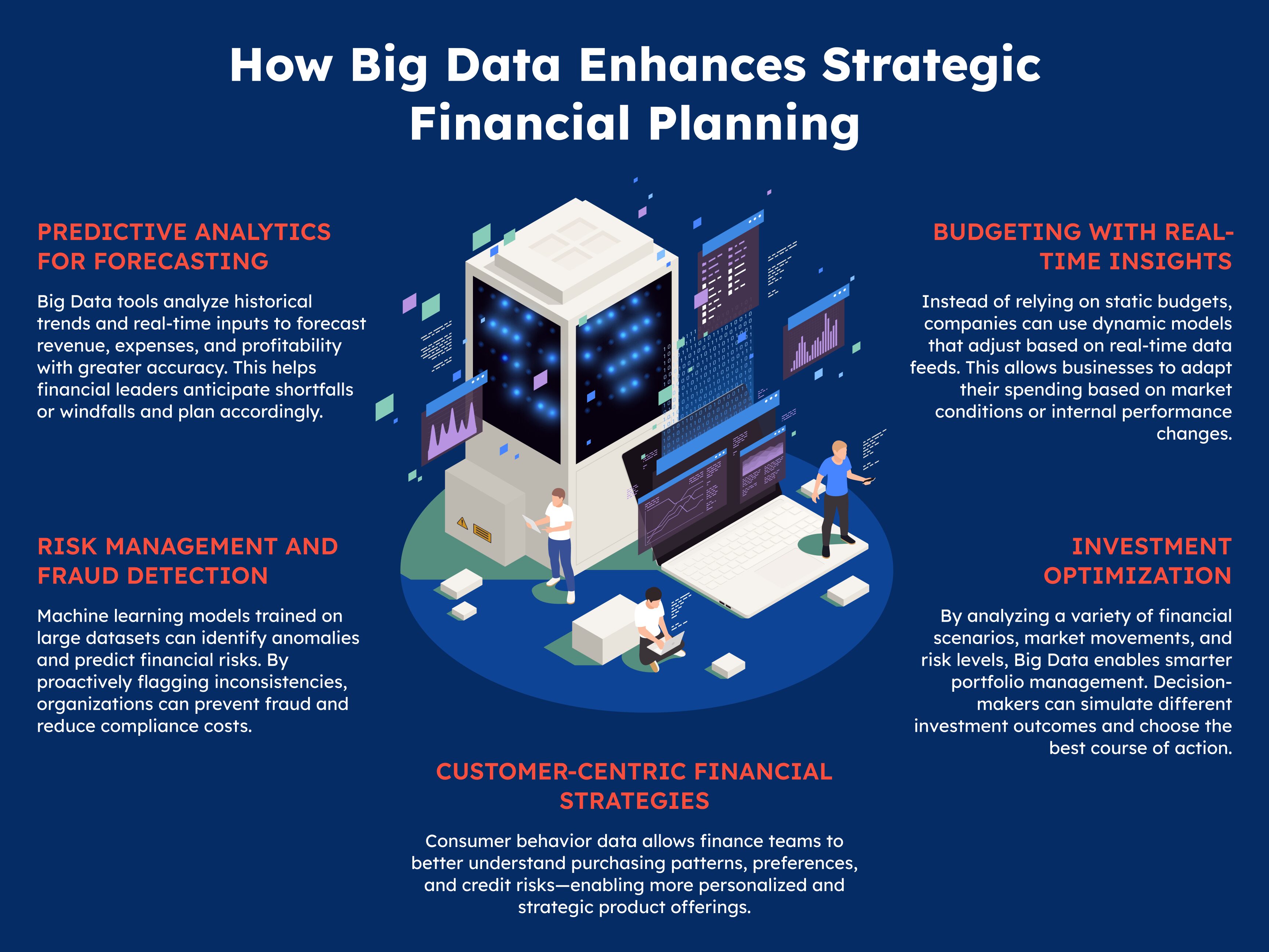

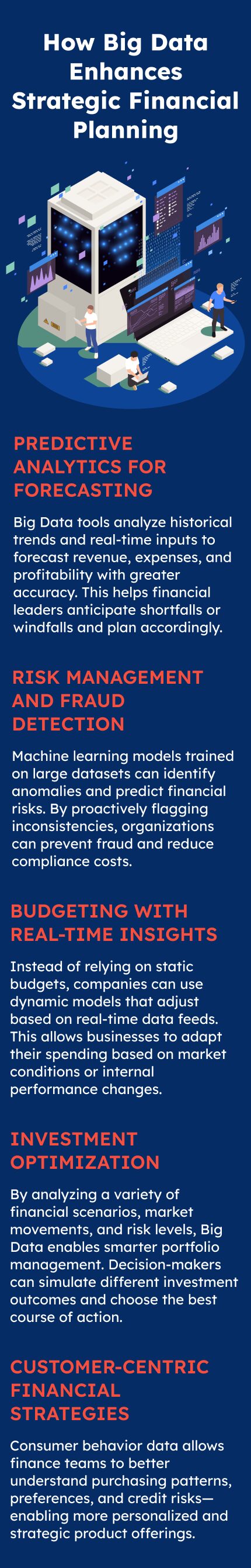

How Big Data Enhances Strategic Financial Planning

Predictive Analytics for Forecasting

Big Data tools analyze historical trends and real-time inputs to forecast revenue, expenses, and profitability with greater accuracy. This helps financial leaders anticipate shortfalls or windfalls and plan accordingly.

Risk Management and Fraud Detection

Machine learning models trained on large datasets can identify anomalies and predict financial risks. By proactively flagging inconsistencies, organizations can prevent fraud and reduce compliance costs.

Budgeting with Real-Time Insights

Instead of relying on static budgets, companies can use dynamic models that adjust based on real-time data feeds. This allows businesses to adapt their spending based on market conditions or internal performance changes.

Investment Optimization

By analyzing a variety of financial scenarios, market movements, and risk levels, Big Data enables smarter portfolio management. Decision-makers can simulate different investment outcomes and choose the best course of action.

Customer-Centric Financial Strategies

Consumer behavior data allows finance teams to better understand purchasing patterns, preferences, and credit risks—enabling more personalized and strategic product offerings.

The Role of XerosoftGlobal in Big Data Financial Planning

XerosoftGlobal offers a suite of advanced Big Data and financial analytics solutions tailored to modern enterprises. Whether you’re a CFO seeking deeper forecasting capabilities or an analyst aiming for real-time visibility, XerosoftGlobal equips you with tools to turn complex data into actionable intelligence.

Their platforms integrate seamlessly with your existing financial systems and use AI-powered engines to deliver high-impact insights for strategic planning, risk mitigation, and performance optimization.

Key Benefits of Leveraging Big Data

Improved Decision-Making

Real-time data enables faster and more informed financial choices.

Increased Forecast Accuracy

Predictive models reduce uncertainty in revenue and cost projections.

Operational Efficiency

Automation and analytics reduce manual effort and improve financial workflows.

Strategic Agility

Businesses can pivot quickly in response to economic or market changes.

Competitive Advantage

Organizations using Big Data outperform peers by recognizing trends earlier.

Conclusion

The integration of Big Data into financial planning is not just a competitive edge—it’s becoming a necessity. By unlocking insights from vast datasets, companies can make data-informed decisions, minimize risks, and drive long-term profitability. Whether you’re enhancing forecasting models, improving budget accuracy, or managing risk proactively, Big Data is the catalyst for smarter financial strategy.

Partnering with a technology leader like XerosoftGlobal ensures that your organization doesn’t just collect data—but uses it to lead. In a world where every financial decision matters, that’s a powerful advantage.