The role of accounting firms is evolving rapidly. Beyond balancing books and filing taxes, modern firms are embracing Client Advisory Services (CAS) to deliver strategic guidance and real-time financial insights. As businesses seek more than compliance, firms like Xerosoft Global are redefining what it means to be a trusted financial partner—helping clients make proactive, data-driven decisions that drive long-term success.

What Are Client Advisory Services (CAS)?

- Financial forecasting and budgeting

- Business performance analytics

- Strategic planning and cash flow management

- KPI tracking and dashboards

- Cloud accounting integration and training

Why CAS Is Booming in 2025

According to a 2024 AICPA survey, 60% of small businesses now prefer advisory-focused firms over compliance-only services. The reason is clear: as markets become more volatile and competition intensifies, businesses want guidance, not just bookkeeping.

💡 Quick Stat:

Firms offering CAS reported 1.5x faster revenue growth and 30% higher client retention rates compared to traditional firms (Source: AICPA & CPA.com, 2024).

How Xerosoft Global Is Leading the Shift

Xerosoft Global is at the forefront of this shift, integrating technology and expert insights to deliver high-value advisory services. Here’s how they stand out:

Data-Driven Dashboards

Xerosoft Global uses real-time analytics tools to provide visual dashboards, enabling clients to make informed decisions quickly.

Proactive Forecasting

Their advisors offer monthly and quarterly financial projections to help businesses prepare for market changes.

Industry-Specific Expertise

From retail to SaaS, Xerosoft Global tailors CAS to each client's unique industry challenges.

Cloud Integration

Seamless integration with platforms like QuickBooks, Xero, and NetSuite ensures smooth financial operations.

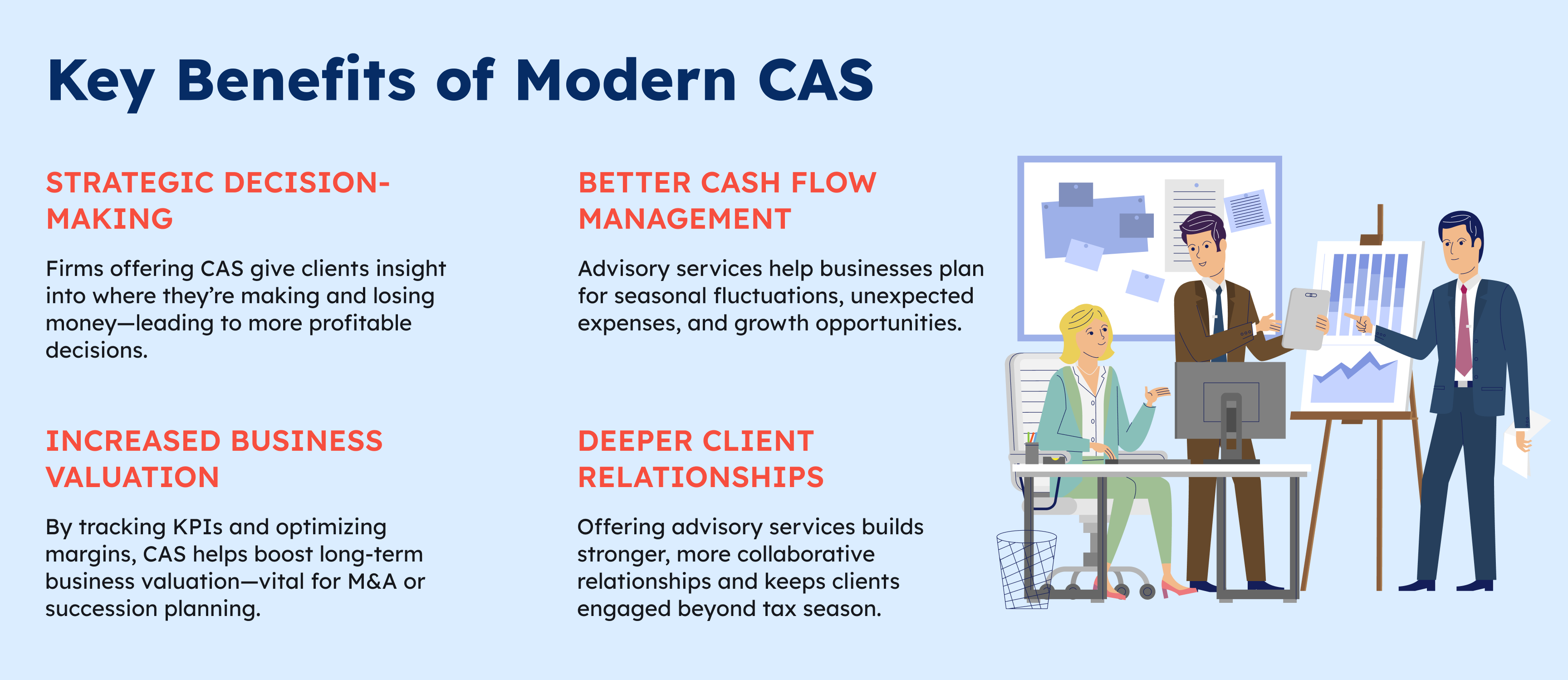

Key Benefits of Modern CAS

Strategic Decision-Making

Firms offering CAS give clients insight into where they’re making and losing money—leading to more profitable decisions.

Better Cash Flow Management

Advisory services help businesses plan for seasonal fluctuations, unexpected expenses, and growth opportunities.

Increased Business Valuation

By tracking KPIs and optimizing margins, CAS helps boost long-term business valuation—vital for M&A or succession planning.

Deeper Client Relationships

Offering advisory services builds stronger, more collaborative relationships and keeps clients engaged beyond tax season.

The Numbers Speak Volumes

72% of accounting clients expect more advisory input from their firms in 2025 (Source: CPA.com).

$13 billion: The projected global market size of client advisory services by 2027 (Allied Market Research).

Firms with CAS as a core offering see 40% of their revenue come from advisory work (AICPA, 2024).

Conclusion

As financial complexity grows, businesses no longer want passive accounting support—they need proactive, strategic partners. By embracing Client Advisory Services, accounting firms like Xerosoft Global are setting a new industry standard: one where compliance meets consultation, and data becomes direction.

If you’re looking to unlock financial clarity and business growth, partnering with a CAS-driven firm like Xerosoft Global could be the smartest move you make in 2025.

References

- CPA.com. Inform your CAS practice strategy with insights from the 2024 CAS Benchmark Survey