In today’s fast-paced digital economy, financial forecasting can no longer rely on outdated spreadsheets and month-end reports. Businesses need immediate access to accurate financial data to respond to market shifts, control costs, and plan for growth. This is where real-time bookkeeping plays a critical role. By capturing financial transactions as they happen, companies gain clearer visibility into their financial health—enabling smarter, faster, and more reliable forecasting.

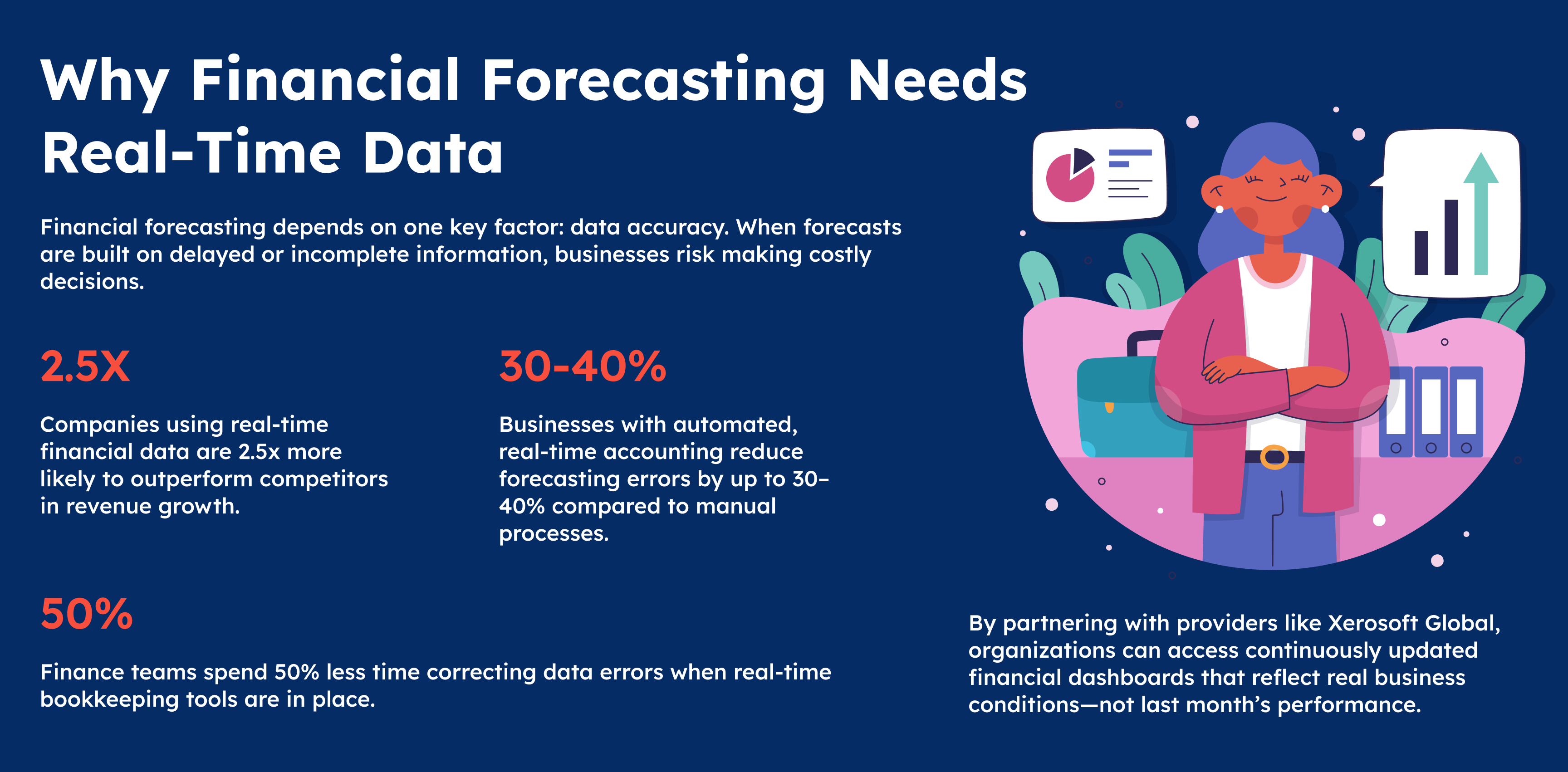

Organizations working with modern accounting solutions such as Xerosoft Global are increasingly leveraging real-time bookkeeping to transform how they predict cash flow, manage risk, and make strategic decisions.

What Is Real-Time Bookkeeping?

Real-time bookkeeping is the continuous recording, categorizing, and updating of financial transactions as they occur. Unlike traditional bookkeeping—where data is often entered weekly or monthly—real-time systems integrate directly with bank feeds, payment platforms, payroll systems, and expense tools.

This approach ensures that financial data is always current, accurate, and ready for analysis, forming a solid foundation for forecasting models and strategic planning.

How Real-Time Bookkeeping Improves Financial Forecasting

Accurate Cash Flow Predictions

Real-time bookkeeping provides immediate visibility into receivables, payables, and operating expenses. This allows businesses to forecast cash flow with greater precision and avoid liquidity issues before they arise.

Statistic:

Over 60% of small and mid-sized businesses cite cash flow uncertainty as their biggest financial challenge—real-time data directly addresses this risk.

Faster Scenario Planning

With up-to-date financial data, finance teams can quickly model best-case, worst-case, and expected scenarios. This agility is critical in volatile markets where conditions can change overnight.

Real-time platforms supported by Xerosoft Global enable leaders to test assumptions instantly and adjust forecasts based on real-world performance.

Improved Budget Accuracy

Budgets are only effective when aligned with actual spending trends. Real-time bookkeeping highlights variances as they happen, allowing businesses to recalibrate forecasts instead of waiting for quarterly reviews.

Analytics Insight:

Organizations using real-time budget tracking improve budget accuracy by up to 25% annually.

Data-Driven Strategic Decisions

Real-time financial insights empower leadership teams to make proactive decisions—whether scaling operations, hiring talent, or investing in new markets—based on current performance rather than historical estimates.

Key Benefits of Real-Time Bookkeeping for Forecasting

- Enhanced Forecast Accuracy: Live data reduces assumptions and guesswork.

- Reduced Financial Risk: Early detection of cash flow gaps or overspending.

- Time Efficiency: Automation cuts manual data entry and reconciliation.

- Better Stakeholder Confidence: Investors and executives trust forecasts backed by real-time numbers.

- Scalability: Supports growth without increasing accounting complexity.

Businesses that adopt real-time bookkeeping solutions through partners like Xerosoft Global gain both operational efficiency and strategic clarity.

The Role of Technology and Automation

Cloud-based accounting platforms, AI-powered categorization, and automated reconciliations are the backbone of real-time bookkeeping. These technologies not only ensure accuracy but also provide predictive insights by analyzing trends and historical patterns.

Statistic:

By 2026, more than 80% of finance teams are expected to rely on automated, real-time accounting systems for forecasting and reporting.

Conclusion

Real-time bookkeeping is no longer a luxury—it is a necessity for businesses that want smarter, more reliable financial forecasting. By providing immediate access to accurate financial data, it empowers organizations to predict outcomes with confidence, respond quickly to change, and plan strategically for the future.

Companies that embrace real-time bookkeeping through trusted solutions like Xerosoft Global position themselves ahead of the curve, turning financial data into a powerful tool for growth, resilience, and long-term success.

References

- Finalert. Real-Time Bookkeeping: Why U.S. Businesses Are Adopting It Fast

- Phoenix Strategy Group. How Real-Time Bookkeeping Improves Cash Flow

- HTF Market Insights. Global Real-Time Bookkeeping Market – Global Outlook 2020-2033

- IngeniumWeb. Why Real-Time Financial Forecasting is Becoming a Competitive Advantage