In an era where digital transformation is redefining every business function, virtual bookkeeping has emerged as a game-changer for small and medium-sized enterprises (SMEs). No longer confined to in-house teams or paper-based records, businesses are increasingly outsourcing bookkeeping services to remote professionals powered by cloud-based tools and automation. At the forefront of this shift is Xerosoft Global, helping SMEs gain financial clarity and control without the traditional overhead costs.

Why Virtual Bookkeeping is on the Rise

According to a 2024 report by Statista, the global cloud accounting market is expected to exceed P6.7 billion by 2027, with small businesses being the biggest adopters. This growth is driven by the increasing demand for cost-effective, accurate, and scalable financial solutions—core attributes of virtual bookkeeping.

Furthermore, a survey by Accounting Today revealed that 74% of small businesses who switched to virtual bookkeeping saw significant improvements in data accuracy and reporting speed.

Key Benefits of Virtual Bookkeeping for SMEs

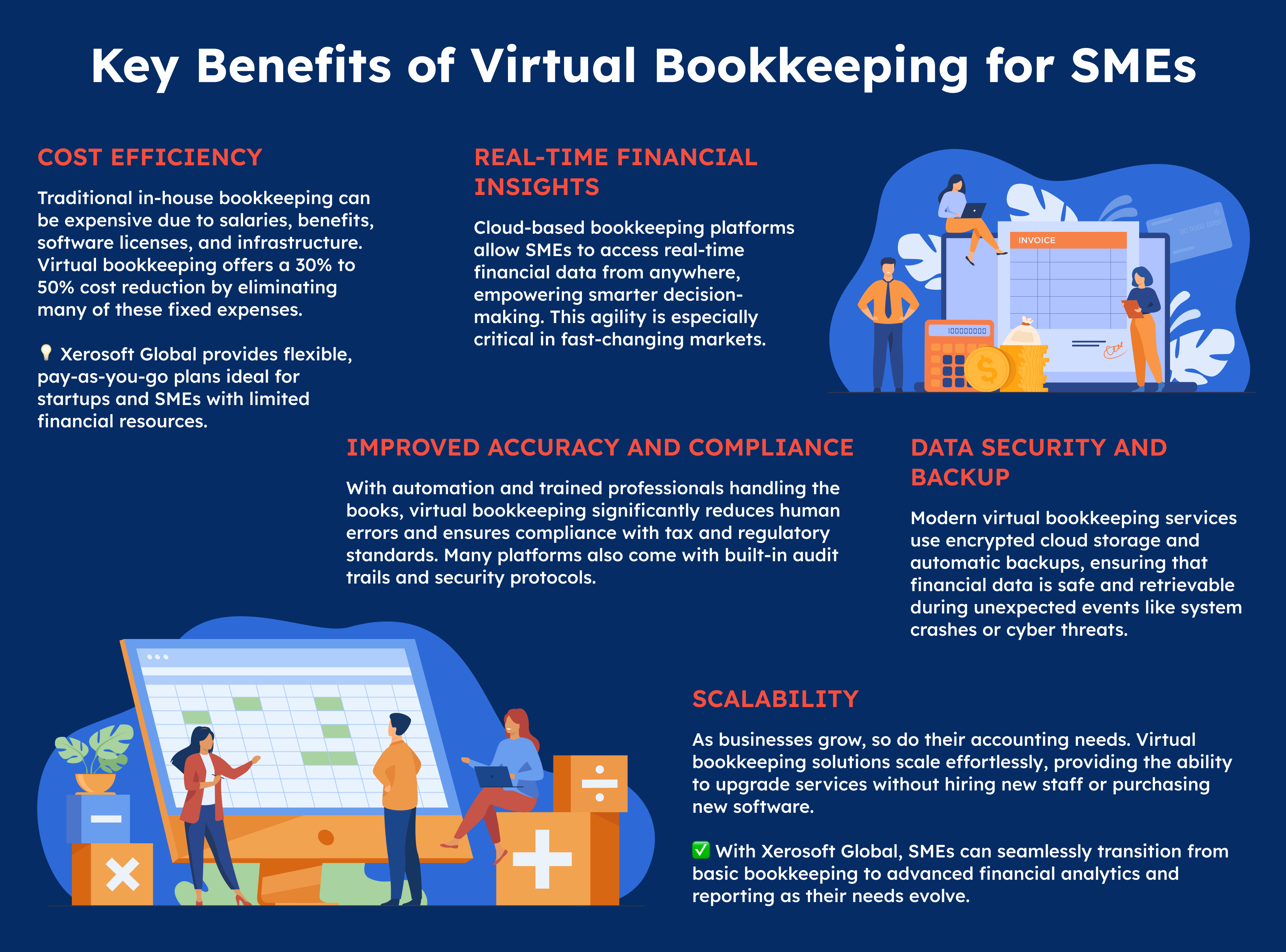

Cost Efficiency

Traditional in-house bookkeeping can be expensive due to salaries, benefits, software licenses, and infrastructure. Virtual bookkeeping offers a 30% to 50% cost reduction by eliminating many of these fixed expenses.

💡 Xerosoft Global provides flexible, pay-as-you-go plans ideal for startups and SMEs with limited financial resources.

Real-Time Financial Insights

Cloud-based bookkeeping platforms allow SMEs to access real-time financial data from anywhere, empowering smarter decision-making. This agility is especially critical in fast-changing markets.

Improved Accuracy and Compliance

With automation and trained professionals handling the books, virtual bookkeeping significantly reduces human errors and ensures compliance with tax and regulatory standards. Many platforms also come with built-in audit trails and security protocols.

Scalability

As businesses grow, so do their accounting needs. Virtual bookkeeping solutions scale effortlessly, providing the ability to upgrade services without hiring new staff or purchasing new software.

✅ With Xerosoft Global, SMEs can seamlessly transition from basic bookkeeping to advanced financial analytics and reporting as their needs evolve.

Data Security and Backup

Modern virtual bookkeeping services use encrypted cloud storage and automatic backups, ensuring that financial data is safe and retrievable during unexpected events like system crashes or cyber threats.

Analytics: The Measurable Impact

30%+ improvement in financial reporting time after adopting virtual bookkeeping (Forbes, 2024).

42% reduction in bookkeeping-related errors reported by SMEs using remote services.

Companies using cloud-based accounting are 1.5x more likely to see revenue growth year-over-year (Xero Small Business Insights, 2025).

How Xerosoft Global Supports SMEs

Xerosoft Global specializes in providing reliable and scalable virtual bookkeeping services designed for small and mid-sized enterprises. By combining advanced cloud tools, trained professionals, and customizable service tiers, Xerosoft Global ensures your business enjoys the benefits of streamlined financial operations, without the burden of traditional bookkeeping.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Conclusion

The rise of virtual bookkeeping is more than just a trend—it’s a strategic shift that offers SMEs greater control, efficiency, and scalability. As the business landscape continues to evolve, partnering with an expert provider like Xerosoft Global empowers SMEs to make data-driven decisions and stay financially agile in a competitive market.

If you’re ready to upgrade your bookkeeping process and reduce operational friction, Xerosoft Global is your trusted partner for digital accounting excellence.

References

- Xero. Small Business Insights (XSBI)

- Intuit Quickbooks. How to hire a bookkeeper for your small business