In today’s rapidly evolving business landscape, staying financially agile is not just beneficial—it’s essential. With economic uncertainties and digital transformation accelerating across industries, companies like Xerosoft Global understand that regular bookkeeping reviews are no longer optional—they’re business-critical.

The Numbers Don’t Lie: Analytics & Statistics

A QuickBooks survey revealed that 50% of small business owners feel stressed about finances because they lack clarity and understanding of their numbers. Regular financial reviews can dramatically reduce this burden.

Shockingly, around 5% of businesses fail directly due to poor bookkeeping practices—underlining how critical accurate record keeping truly is.

The bookkeeping industry continues to show tremendous growth, with estimates placing its value at $585 billion, reflecting rising adoption of bookkeeping and accounting solutions.

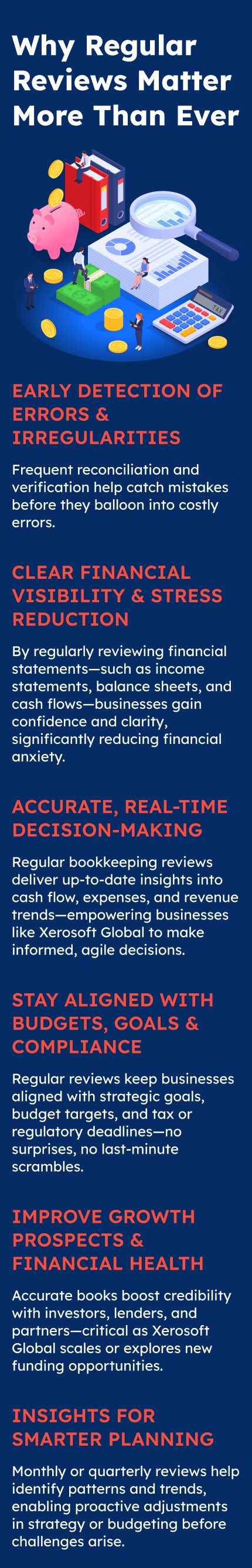

Why Regular Reviews Matter More Than Ever

Early Detection of Errors & Irregularities

Frequent reconciliation and verification help catch mistakes before they balloon into costly errors.

Accurate, Real-Time Decision-Making

Regular bookkeeping reviews deliver up-to-date insights into cash flow, expenses, and revenue trends—empowering businesses like Xerosoft Global to make informed, agile decisions.

Clear Financial Visibility & Stress Reduction

By regularly reviewing financial statements—such as income statements, balance sheets, and cash flows—businesses gain confidence and clarity, significantly reducing financial anxiety.

Stay Aligned with Budgets, Goals & Compliance

Regular reviews keep businesses aligned with strategic goals, budget targets, and tax or regulatory deadlines—no surprises, no last-minute scrambles.

Improve Growth Prospects & Financial Health

Accurate books boost credibility with investors, lenders, and partners—critical as Xerosoft Global scales or explores new funding opportunities.

Insights for Smarter Planning

Monthly or quarterly reviews help identify patterns and trends, enabling proactive adjustments in strategy or budgeting before challenges arise.

Key Benefits at a Glance

Error Prevention

Identifies mistakes early, preventing cascading problems

Improved Decision-Making

Enables real-time, data-driven strategies

Reduced Stress

Clarity on finances = reduced anxiety

Compliance & Preparedness

Always ready for tax filing and audits

Better Financial Reputation

Builds trust with stakeholders and supports growth ambitions

Strategic Insights

Reveals trends that help refine budgets, operations, and goals

Why Xerosoft Global Should Prioritize Regular Reviews

Xerosoft Global positions itself as an innovative and forward-thinking business hub. By embedding regular bookkeeping reviews into workflows, the company will:

- Ensure financial accuracy and reliability, safeguarding its reputation.

- Empower leadership to make swift and informed decisions backed by up-to-date insights.

- Strengthen stakeholder trust, be it investors, partners, or clients.

- Maintain financial flexibility and resilience, remaining adaptive amid market shifts.

Conclusion

In an era where agility, clarity, and precision define business success, regular bookkeeping reviews are more than best practice—they’re indispensable. For Xerosoft Global and similar enterprises, these reviews serve as guardrails for accuracy, clarity for decision-making, and a platform for confident growth.

Make reviewing your books a regular routine—it’s the backbone of financial health and the catalyst for future success.

References

- Out Of The Box. The Benefits of Regular Financial Reviews for Small Businesses

- Rigits. 14 Bookkeeping Statistics You Need to Know

- CFO Consultants. How Often Should You Review Your Bookkeeping Records To Keep Your Business on Track?

- Remote Books. The Importance of Regular Financial Reviews: Why You Can’t Skip Them