In today’s fast-paced business landscape, bookkeeping has evolved far beyond spreadsheets and manual data entry. With cloud technology, automation, and artificial intelligence reshaping the accounting field, bookkeepers are expected to work smarter and faster while ensuring accuracy and compliance. To meet these demands, adopting the right digital tools is no longer optional—it’s essential.

At Xerosoft Global, we understand how modern bookkeepers thrive when equipped with cutting-edge solutions. Below, we outline the top five tools every modern bookkeeper should be using in 2025, backed by analytics, statistics, and the clear benefits they bring.

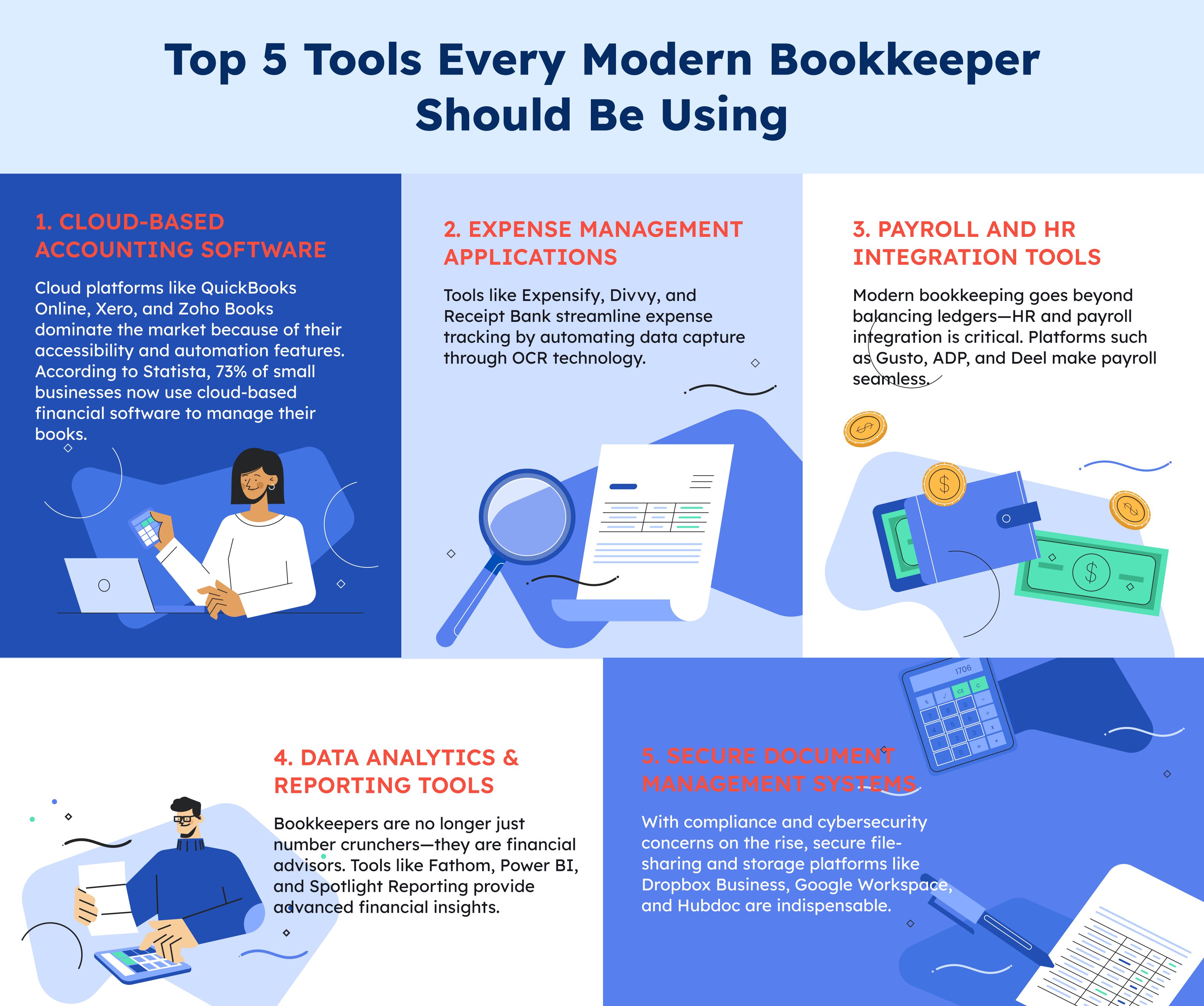

1. Cloud-Based Accounting Software

Cloud platforms like QuickBooks Online, Xero, and Zoho Books dominate the market because of their accessibility and automation features. According to Statista, 73% of small businesses now use cloud-based financial software to manage their books.

Key Benefits:

- Access financial data anywhere, anytime

- Real-time collaboration with clients and accountants

- Automated bank feeds and transaction categorization

Analytics Insight: Companies using cloud accounting tools save an average of 7 hours per week on manual bookkeeping tasks, increasing productivity and accuracy.

2. Expense Management Applications

Tools like Expensify, Divvy, and Receipt Bank streamline expense tracking by automating data capture through OCR technology.

Key Benefits:

- Eliminates manual receipt entry

- Provides real-time expense reports for better cash flow management

- Enhances compliance with tax-ready documentation

Statistic: Businesses using automated expense tools reduce reimbursement errors by over 50%, according to FinancesOnline.

3. Payroll and HR Integration Tools

Modern bookkeeping goes beyond balancing ledgers—HR and payroll integration is critical. Platforms such as Gusto, ADP, and Deel make payroll seamless.

Key Benefits:

- Automated tax filing and compliance updates

- Real-time salary calculations

- Direct integration with accounting platforms

Analytics Insight: A Deloitte study revealed that businesses integrating payroll with bookkeeping cut administrative overhead by 25% annually.

4. Data Analytics & Reporting Tools

Bookkeepers are no longer just number crunchers—they are financial advisors. Tools like Fathom, Power BI, and Spotlight Reporting provide advanced financial insights.

Key Benefits:

- Customizable dashboards and reports

- Forecasting and trend analysis for better decision-making

- Simplified client presentations

Statistic: 82% of businesses using financial analytics tools report improved strategic decision-making, according to PwC.

5. Secure Document Management Systems

With compliance and cybersecurity concerns on the rise, secure file-sharing and storage platforms like Dropbox Business, Google Workspace, and Hubdoc are indispensable.

Key Benefits:

- Centralized, secure storage of financial documents

- Easy access control and audit trails

- Integration with accounting systems for smoother workflows

Analytics Insight: Cybersecurity Ventures predicts that 60% of SMBs close within six months of a data breach—making secure document management critical for survival.

Conclusion

The role of the bookkeeper is transforming rapidly. By adopting modern tools—cloud accounting platforms, expense management apps, payroll solutions, analytics dashboards, and secure document systems—bookkeepers not only improve efficiency but also provide more value to clients.

At Xerosoft Global, we empower businesses and bookkeepers alike to stay ahead of the curve with technology-driven financial solutions. As the bookkeeping profession evolves, those who embrace innovation will not just keep up—they’ll lead.

Resources

- DocuClipper. 2025 Accounting & Bookkeeping Trends: 51 Key Statistics

- B2B Reviews. Small Business Accounting Statistics

- LLC Buddy. Expense Management Statistics

- ExpenseOut. 20+ Business Expense Reimbursement & Management Statistics and Trends for 2025

- LLC Buddy. Accounting Statistics