In the dynamic landscape of global business, where borders blur and markets shift rapidly, the accuracy of financial reporting has never been more vital. Companies navigating multiple regions must ensure their financial records are not only precise but also transparent, as any misstep can have far-reaching consequences. Investors, regulators, and other stakeholders depend on these reports to make informed decisions that drive investments, policies, and partnerships. Inaccurate reporting doesn’t just jeopardize financial standing—it can tarnish a company’s reputation and hinder its growth. This article delves into why financial reporting is a critical pillar for business success in the modern world, supported by key statistics that highlight its indispensable role.

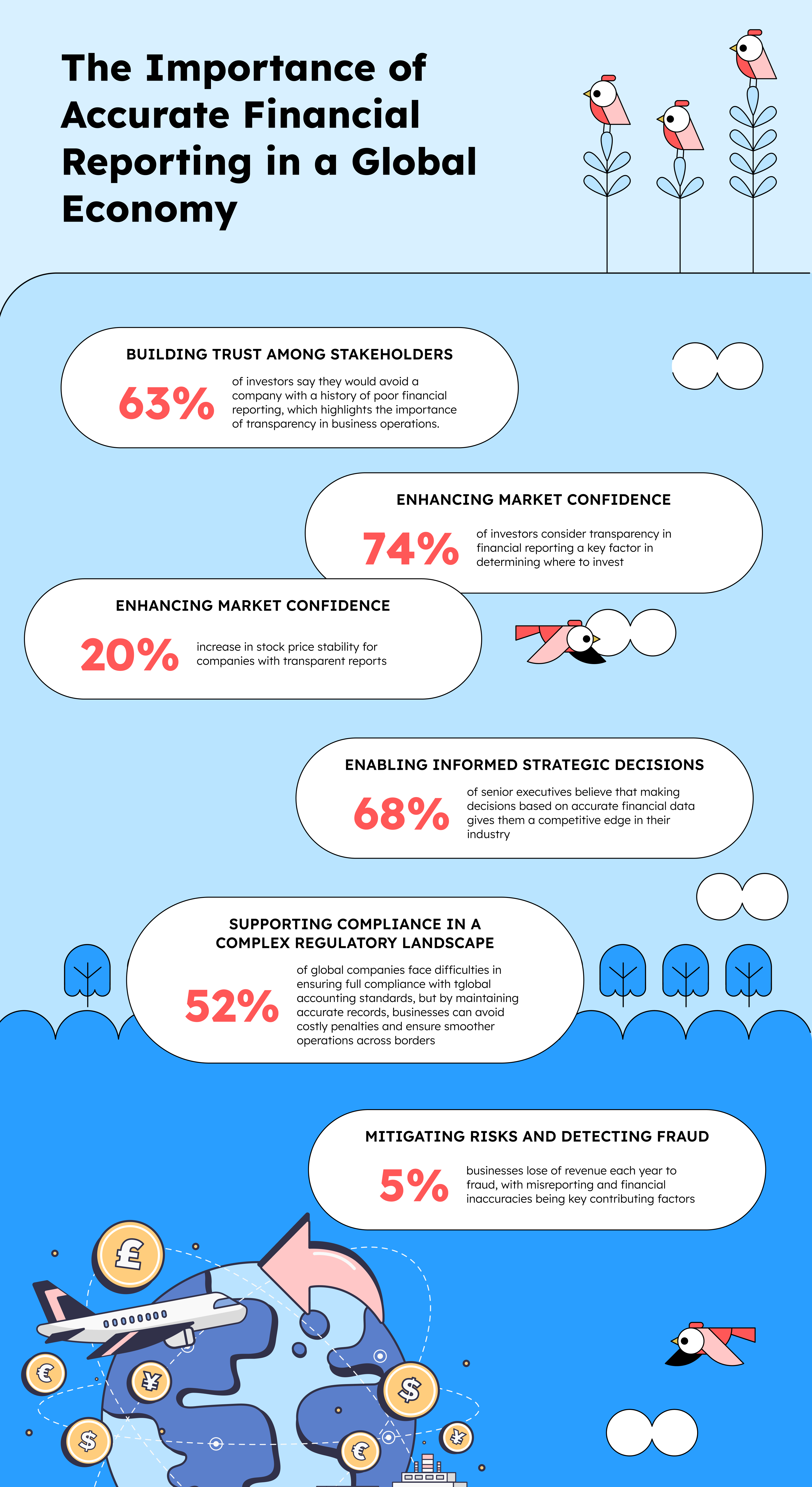

1. Building Trust Among Stakeholders

In a global economy, trust is currency. Transparent and accurate financial reports are the foundation of that trust, helping stakeholders—from investors to customers—make well-informed decisions. According to a report by the Association of Chartered Certified Accountants (ACCA), 63% of investors say they would avoid a company with a history of poor financial reporting, which highlights the importance of transparency in business operations. Investors rely on the consistency and reliability of financial data to assess risks, gauge growth, and make sound investment choices.¹

Why this matters:

When companies consistently deliver accurate and timely financial reports, they position themselves as trustworthy and committed to ethical business practices. This not only strengthens relationships with stakeholders but also reduces the likelihood of investor hesitancy. Furthermore, ethical financial practices help mitigate legal risks, improving a company’s reputation and long-term stability.

2. Enhancing Market Confidence

Clear financial reports do more than just meet legal obligations—they can boost a company’s stock price and market valuation. A 2023 McKinsey study showed that 74% of investors consider transparency in financial reporting a key factor in determining where to invest, and companies with transparent reports often see a 20% increase in stock price stability. In an era of intense competition, businesses that maintain high standards of financial accuracy can gain a significant advantage in attracting investors and enhancing market confidence.²

Why this matters:

Companies that demonstrate consistent financial accuracy and accountability are seen as more reliable, reducing perceived investment risks. This reputation can lead to stronger stock performance, improved credit terms, and enhanced access to capital—all of which fuel growth and innovation.

3. Enabling Informed Strategic Decisions

Financial reports are essential tools for internal decision-making. Accurate data about revenue, expenses, and profitability provides key insights into a company’s performance. A survey by PwC found that 68% of senior executives believe that making decisions based on accurate financial data gives them a competitive edge in their industry. For multinational corporations, having reliable financial reports across various regions is crucial to understanding performance and aligning strategies effectively.³

Why this matters:

Accurate financial reporting acts as the foundation for smart, data-driven decisions. With reliable data, executives can make confident strategic choices, from cost management to market expansion. This is particularly critical in today’s volatile global market, where companies need to be agile and responsive to changing conditions.

4. Supporting Compliance in a Complex Regulatory Landscape

As businesses operate in multiple jurisdictions, staying compliant with an increasingly complex web of international regulations becomes a significant challenge. Accurate financial reporting ensures that companies adhere to global accounting standards such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles). According to Deloitte, 52% of global companies face difficulties in ensuring full compliance with these standards, but by maintaining accurate records, businesses can avoid costly penalties and ensure smoother operations across borders.⁴

Why this matters:

Accurate financial reporting isn’t just about meeting accounting standards—it’s also about managing risk. Compliance failures can lead to severe penalties, legal disputes, and reputational damage. By staying on top of international regulations and maintaining detailed records, companies protect themselves from costly consequences and ensure they operate ethically in all markets.

5. Mitigating Risks and Detecting Fraud

Corporate fraud often arises from gaps or inaccuracies in financial reporting. In fact, a Global Fraud Study by the Association of Certified Fraud Examiners reveals that businesses lose 5% of their revenue each year to fraud, with misreporting and financial inaccuracies being key contributing factors. Precise and transparent financial reporting can act as a deterrent to fraud, helping organizations detect irregularities early on.⁵

Why this matters:

A commitment to accurate financial reporting promotes a culture of accountability. By adhering to established accounting standards and conducting regular audits, companies can uncover potential fraud, minimize errors, and ensure resources are allocated properly. Strong internal controls protect both the company’s financial health and its long-term reputation.

The Role of Xerosoft Global in Ensuring Accurate Financial Reporting

At Xerosoft Global, we recognize the complexities involved in global financial reporting. Our team of experienced professionals provides comprehensive services designed to ensure precision, compliance, and transparency. With expertise in both local and international accounting standards, Xerosoft Global helps businesses stay ahead of regulatory changes, ensuring that financial reporting is both accurate and aligned with industry best practices.

Our services include:

- Comprehensive Financial Audits: Our thorough audits help identify any discrepancies, ensuring data integrity and compliance.

- Customized Reporting Solutions: Tailored to meet industry-specific needs, our reporting solutions provide businesses with insights essential for strategic growth.

- Global Compliance Support: We guide companies through international regulatory requirements, including IFRS and GAAP compliance, tax reporting, and more.

By partnering with Xerosoft Global, businesses gain the expertise necessary to navigate the complexities of financial reporting, stay compliant, and build long-term trust with stakeholders.

Conclusion

Accurate financial reporting is more than just a regulatory requirement—it’s an essential driver of growth and sustainability in a global economy. Businesses that prioritize transparency and precision in their financial reporting are better equipped to build trust, attract investors, and mitigate risks. In today’s interconnected world, companies that excel in financial reporting set themselves up for long-term success and reputational strength.

With Xerosoft Global by your side, maintaining accurate financial reporting doesn’t have to be a daunting task. Our experts can guide you through the complexities of global compliance, enhance your transparency, and help your business build a solid foundation for the future.

References:

- Association of Chartered Certified Accountants (ACCA), “Investor Trust and Financial Reporting.”

- McKinsey & Company, “How Transparency Drives Market Confidence.”

- PwC, “The Importance of Data-Driven Decision-Making.”

- Deloitte, “Global Compliance Challenges: A Guide for International Companies.”

- Association of Certified Fraud Examiners, “Global Fraud Study.”