As businesses navigate through the complexities of tax regulations, staying compliant with constantly evolving tax laws has become an ongoing challenge. Governments worldwide are making continuous updates to tax systems to reflect changing economic conditions, technological advancements, and political shifts. For businesses, this creates an ever-changing landscape that demands attention to avoid penalties, maintain a good reputation, and optimize profitability. In this article, we’ll explore the future of tax compliance and how businesses can stay ahead of changes in tax laws.

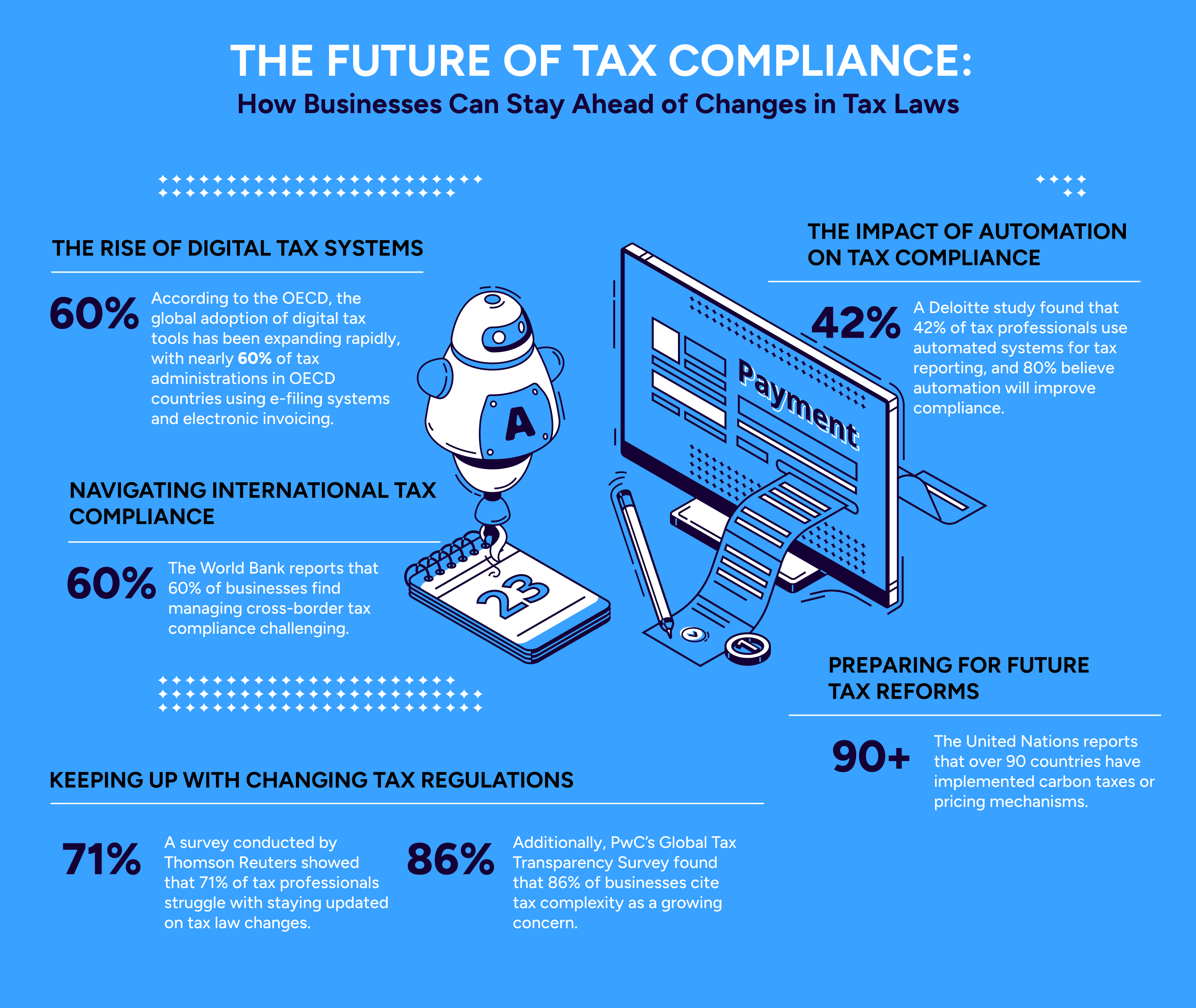

The Rise of Digital Tax Systems

In recent years, tax authorities have increasingly shifted toward digital tax systems to enhance efficiency, reduce fraud, and streamline processes. According to a report by the OECD, digitalization in tax administrations is expected to increase by 50% in the next decade, with over 100 countries already implementing digital tax tools1. This trend is pushing businesses to adopt technology-driven solutions for tax compliance to stay competitive in an increasingly globalized market.

These digital tax tools often include automated tax reporting, e-filing systems, and digital invoicing, which aim to simplify processes, improve accuracy, and reduce manual errors. However, businesses must stay vigilant about keeping their tax systems updated and ensuring they comply with both local and international digital tax standards.

Statistics: According to the OECD, the global adoption of digital tax tools has been expanding rapidly, with nearly 60% of tax administrations in OECD countries using e-filing systems and electronic invoicing1.

Keeping Up with Changing Tax Regulations

One of the most significant challenges businesses face is the frequent updates to tax regulations. According to Thomson Reuters’ annual survey, 71% of tax professionals report difficulty staying up to date with changes in tax legislation2. Tax laws are being updated regularly to keep pace with economic shifts, environmental concerns, and international trade developments. A study by PwC revealed that 86% of companies believe managing tax complexity is increasingly difficult, especially for global businesses dealing with multiple jurisdictions3.

The complexity of tax compliance means businesses must allocate more resources to monitor and understand new regulations, which can be time-consuming and costly. These changes can range from new tax rates and exemptions to altered regulations around international transactions and digital goods. Failing to stay updated can result in expensive penalties and lost business opportunities.

Statistics: A survey conducted by Thomson Reuters showed that 71% of tax professionals struggle with staying updated on tax law changes2. Additionally, PwC’s Global Tax Transparency Survey found that 86% of businesses cite tax complexity as a growing concern3.

Navigating International Tax Compliance

As businesses expand globally, managing tax compliance across multiple countries becomes an even more intricate process. According to the World Bank, 60% of businesses operating internationally face challenges in dealing with different tax laws, particularly in terms of reporting, regulations, and managing cross-border taxation4. This is compounded by various tax treaties, which aim to eliminate double taxation but add further complexity to tax compliance efforts.

To manage these complexities, businesses need access to experts who are well-versed in international tax laws and tax treaties. They must understand how to apply international tax laws correctly, avoid double taxation, and minimize the risk of penalties due to non-compliance. With more countries adopting digital tax regimes, businesses will also need to ensure their cross-border operations are digitally compliant.

Statistics: The World Bank reports that 60% of businesses find managing cross-border tax compliance challenging4.

The Impact of Automation on Tax Compliance

Automation in tax compliance offers a promising solution to many of the challenges businesses face in staying compliant with constantly changing regulations. A study by Deloitte found that 42% of tax professionals already use automated systems for their tax reporting, and 80% of them believe automation will significantly improve their tax compliance efforts5. Automated tax systems can help reduce errors, save time, and ensure compliance with the latest tax rules by automatically updating tax rates and regulations.

However, while automation can help streamline tax processes, it is essential that businesses ensure their automation tools are integrated correctly and that their teams are properly trained. Businesses must also stay ahead of technological trends to ensure they are using the most efficient and secure systems for tax management.

Statistics: A Deloitte study found that 42% of tax professionals use automated systems for tax reporting, and 80% believe automation will improve compliance5.

Preparing for Future Tax Reforms

As governments focus on improving tax fairness, efficiency, and sustainability, businesses will face more pressure to stay compliant with evolving rules. In particular, many countries are focusing on green taxes and environmental regulations as part of their broader climate change agendas. According to the United Nations, over 90 countries now have some form of carbon tax or carbon pricing in place, and more are likely to follow6. For businesses, this means an increased need to understand the environmental tax regulations in the regions where they operate.

In the coming years, businesses must be proactive in preparing for such reforms by integrating sustainable practices into their business models and ensuring compliance with new environmental tax rules. This will help them avoid penalties while demonstrating corporate social responsibility, a growing priority for consumers and investors alike.

Statistics: The United Nations reports that over 90 countries have implemented carbon taxes or pricing mechanisms6.

Conclusion: Staying Ahead of the Tax Compliance Curve

The future of tax compliance is one that is increasingly influenced by digitalization, global tax regulations, and environmental concerns. For businesses, staying ahead of tax law changes requires continuous education, investment in automation tools, and a proactive approach to understanding international tax complexities. With the right strategies and support, businesses can navigate the future of tax compliance efficiently and effectively, avoiding costly errors and seizing opportunities for growth and profitability.

By leveraging the expertise of tax professionals and adopting the latest technology, businesses can stay compliant and competitive in an ever-evolving tax landscape.

References:

- OECD. (2023). Digitalisation of Tax Administration.

- Thomson Reuters. (2023). Annual Survey on Tax Compliance.

- PwC. (2022). Global Tax Transparency Survey.

- World Bank. (2023). Taxation and International Business.

- Deloitte. (2023). Advancing Tax Automation.

- UN. (2023). Carbon Pricing and Global Taxation.