As global awareness of environmental and social responsibility grows, businesses face increasing pressure to operate sustainably and transparently. This shift has driven the rise of ESG reporting (Environmental, Social, and Governance) and green accounting—two crucial frameworks helping companies measure and communicate their sustainability efforts. Forward-thinking firms partnering with leaders like Xerosoft Global are leveraging these tools to enhance corporate responsibility and meet stakeholder expectations.

What is ESG Reporting and Green Accounting?

ESG reporting involves disclosing data related to a company’s environmental impact, social initiatives, and governance practices. It allows investors, customers, and regulators to evaluate how sustainably a company operates beyond traditional financial metrics.

Green accounting expands traditional accounting by incorporating environmental costs and benefits into financial statements. This approach quantifies the impact of business activities on natural resources and helps companies manage sustainability risks effectively.

Key Analytics and Statistics

According to a 2023 Deloitte survey, 85% of institutional investors now consider ESG factors critical when making investment decisions.

The Global Reporting Initiative (GRI) reports that over 75% of the world’s largest companies publish sustainability reports, a significant increase from just 20% a decade ago

A McKinsey & Company study found that companies with robust ESG practices saw a 10-15% improvement in financial performance over peers.

The UN PRI (Principles for Responsible Investment) indicates that green accounting adoption is growing at an annual rate of 12% worldwide.

These statistics reflect the rapid adoption and growing importance of ESG and green accounting globally.

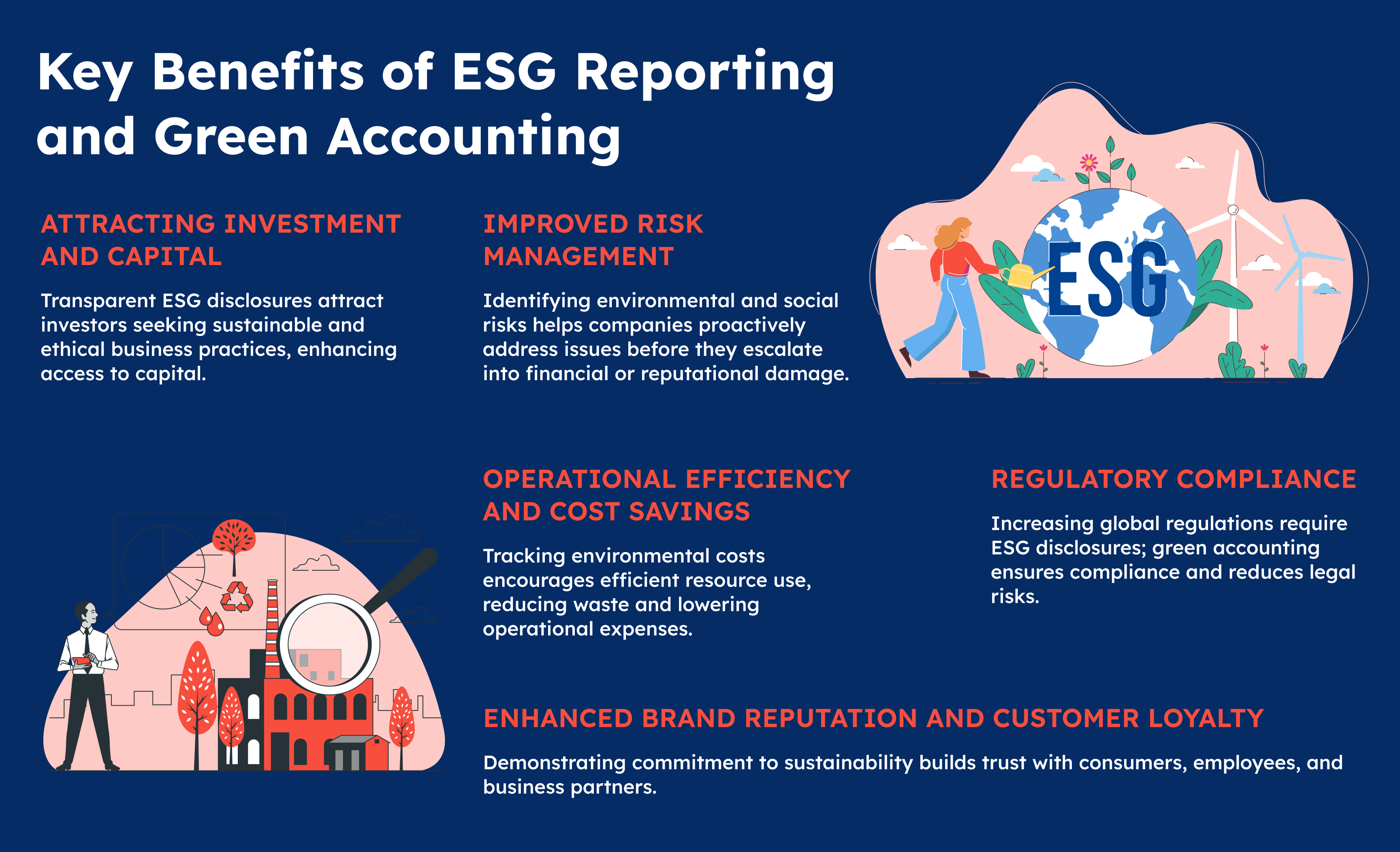

Key Benefits of ESG Reporting and Green Accounting

Attracting Investment and Capital

Transparent ESG disclosures attract investors seeking sustainable and ethical business practices, enhancing access to capital.

Improved Risk Management

Identifying environmental and social risks helps companies proactively address issues before they escalate into financial or reputational damage.

Enhanced Brand Reputation and Customer Loyalty

Demonstrating commitment to sustainability builds trust with consumers, employees, and business partners.

Regulatory Compliance

Increasing global regulations require ESG disclosures; green accounting ensures compliance and reduces legal risks.

Operational Efficiency and Cost Savings

Tracking environmental costs encourages efficient resource use, reducing waste and lowering operational expenses.

How Xerosoft Global Supports ESG and Green Accounting

- Automated data collection and real-time ESG analytics

- Customizable reporting tools aligned with global standards like GRI and SASB

- Integration of environmental costs into financial systems for accurate green accounting

- Strategic advisory on sustainability goals and regulatory compliance

- Training programs to build internal ESG expertise

Conclusion

The emergence of ESG reporting and green accounting marks a transformative shift in how businesses operate and communicate their sustainability impact. By adopting these frameworks, companies not only meet stakeholder demands but also unlock new opportunities for growth, risk management, and operational excellence.

Partnering with experts like Xerosoft Global empowers organizations to implement robust ESG and green accounting practices, ensuring they stay ahead in a rapidly evolving sustainability landscape.