In today’s increasingly conscious business environment, companies are expected to do more than just turn a profit—they must also demonstrate their commitment to environmental, social, and governance (ESG) values. This is where sustainable finance comes in, and accountants are uniquely positioned to play a pivotal role. As firms like Xerosoft Global continue to help businesses transform their financial operations, integrating sustainability into financial strategy has become not just beneficial, but essential.

What Is Sustainable Finance?

Sustainable finance refers to the integration of ESG considerations into financial decision-making. It supports economic growth while reducing pressures on the environment, taking into account social inequalities and promoting good governance. For accountants, this means expanding their scope beyond traditional financial metrics to include sustainability data.

Key Statistics That Highlight the Shift

88% of institutional investors say they will invest more heavily in ESG-focused companies in the next five years. (Source: EY Global Institutional Investor Survey)

70% of CFOs believe sustainability will be a critical component of financial performance in the next 3–5 years. (Source: Deloitte CFO Signals Survey)

Companies with strong ESG performance enjoy up to 20% lower cost of capital compared to their peers. (Source: MSCI Research)

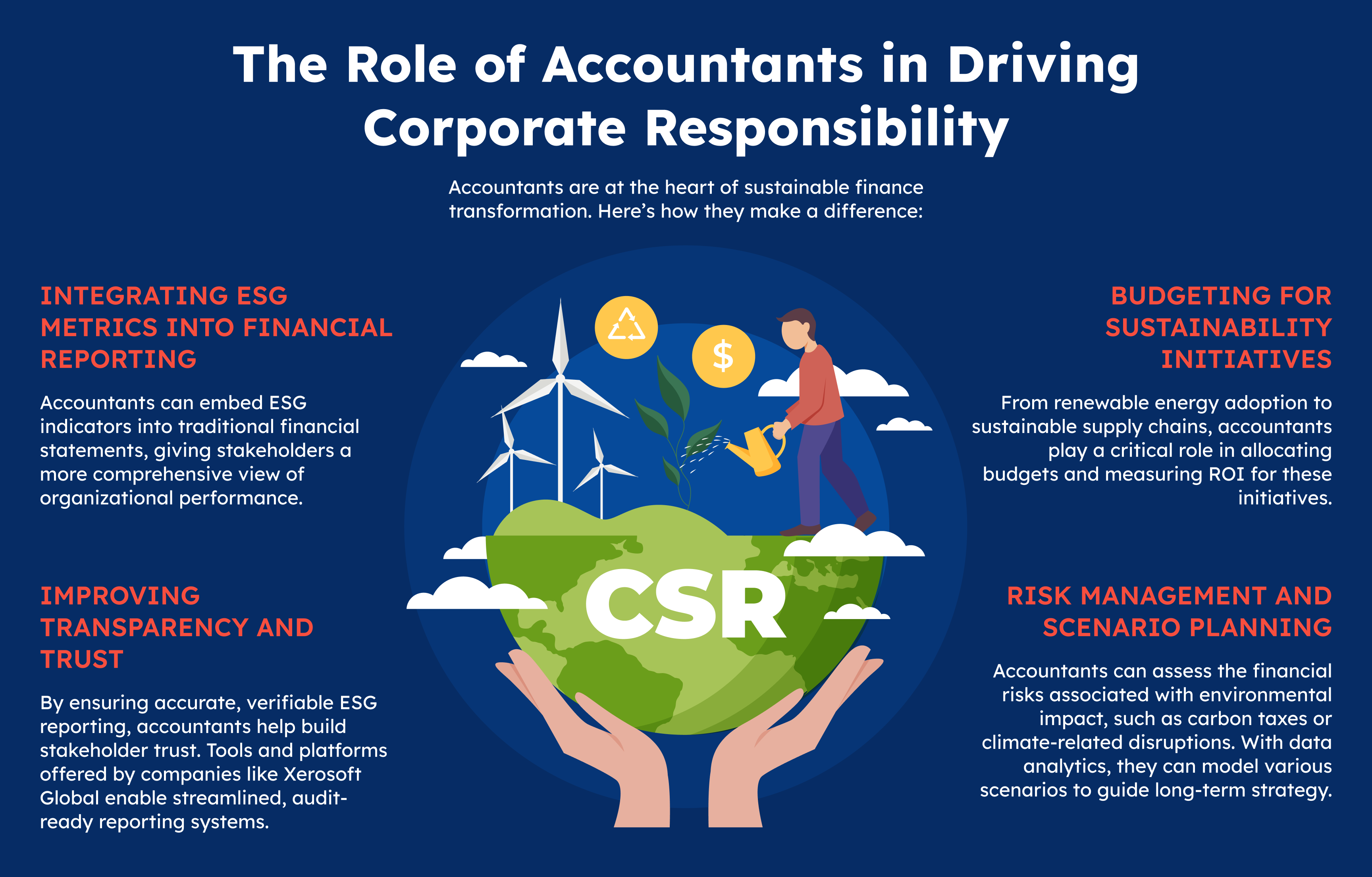

The Role of Accountants in Driving Corporate Responsibility

Accountants are at the heart of sustainable finance transformation. Here’s how they make a difference:

Integrating ESG Metrics into Financial Reporting

Accountants can embed ESG indicators into traditional financial statements, giving stakeholders a more comprehensive view of organizational performance.

Improving Transparency and Trust

By ensuring accurate, verifiable ESG reporting, accountants help build stakeholder trust. Tools and platforms offered by companies like Xerosoft Global enable streamlined, audit-ready reporting systems.

Risk Management and Scenario Planning

Accountants can assess the financial risks associated with environmental impact, such as carbon taxes or climate-related disruptions. With data analytics, they can model various scenarios to guide long-term strategy.

Budgeting for Sustainability Initiatives

From renewable energy adoption to sustainable supply chains, accountants play a critical role in allocating budgets and measuring ROI for these initiatives.

Key Benefits of Sustainable Finance for Businesses

- Enhanced Brand Reputation: Consumers prefer companies that align with ethical and environmental values.

- Investor Appeal: ESG-compliant businesses attract more investment.

- Cost Savings: Green initiatives often lead to lower energy, waste, and material costs.

- Regulatory Compliance: Accountants help ensure that firms stay ahead of evolving ESG regulations.

- Long-Term Resilience: Sustainable finance supports stable growth amid environmental and social changes.

How Xerosoft Global Supports Sustainable Financial Practices

Xerosoft Global empowers accounting teams to seamlessly integrate sustainability into their financial operations. By leveraging advanced cloud accounting solutions, real-time analytics, and automation tools, Xerosoft Global helps businesses:

- Track ESG metrics alongside financial KPIs

- Automate compliance reporting

- Identify sustainable investment opportunities

- Enhance visibility for executive decision-making

This data-driven approach ensures companies not only meet compliance requirements but also use sustainability as a lever for growth and innovation.

Conclusion: Accountants as Catalysts for Change

As the corporate world embraces sustainability, accountants are stepping into a more strategic role—shaping financial decisions that align with ESG values. With the right tools and insights from leaders like Xerosoft Global, accounting professionals can lead the charge toward responsible, profitable, and future-proof business practices.

Sustainable finance isn’t just the future—it’s the present. And accountants are its most trusted stewards.