When it comes to keeping your Singapore-based company compliant, the team at Xerosoft Global has you covered. Their specialised corporate tax return service for Singapore corporations ensures that your Form C or Form C-S gets filed on time, accurately and with minimal fuss.

Why Corporate Tax Filing Matters

In Singapore, all companies are required to electronically file their annual corporate income tax return via the Inland Revenue Authority of Singapore (IRAS), typically using either Form C or Form C-S.

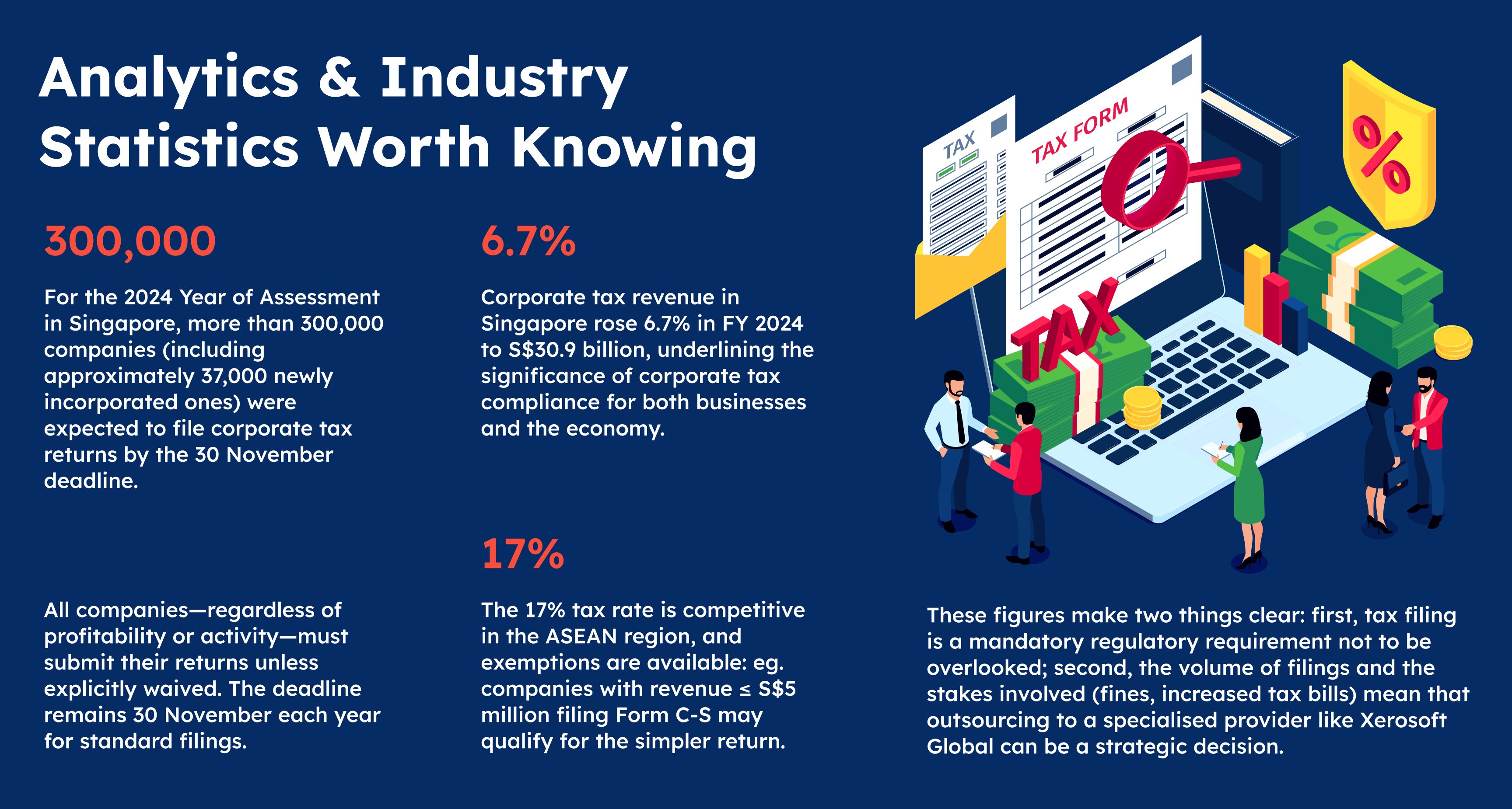

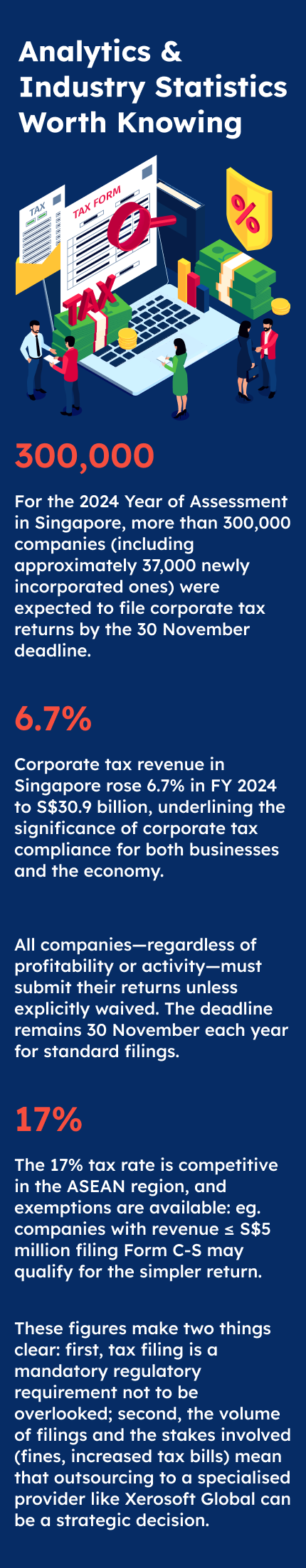

Missing deadlines or filing incorrectly can lead to penalties, and even an enforced Notice of Assessment (NOA) issued by IRAS. As of the 2024 Year of Assessment, the on-time filing rate reached 90.4% — illustrating that the majority of companies are compliant—but also that there remains a non-negligible portion that aren’t.

With the headline corporate tax rate at 17% in Singapore for standard chargeable income, and specific exemptions or reliefs available to smaller companies, the filing itself must be done correctly in order to avoid paying more than necessary.

Key Benefits of Choosing Xerosoft Global

Dedicated qualified accountants

Xerosoft’s experts keep your books up-to-date, ensure your financial statements are ready, and oversee your tax return filing so you’re not left scrambling at the end of the year.

Timely and error-free filing

The process is designed to minimise risk of filing errors and penalties by submitting on time.

Cloud-based document management

All your tax and accounting documents are managed in a centralised cloud system—easy access, less paperwork, greater transparency.

Transparent, all-inclusive pricing

No hidden surprises. Xerosoft aims to cover the full service cost in one package so you know what you’re getting.

Support for both Form C and Form C-S filers

Whether your company qualifies for the simplified Form C-S or needs to file the full Form C, Xerosoft’s team can guide you through both.

How Xerosoft Global Helps You Stay Ahead

By partnering with Xerosoft Global, you not only get peace of mind in meeting your tax filing obligations, but you also gain the strategic advantage of having your financial processes aligned for growth. Their service helps you:

- Focus on running your business while the tax experts handle compliance

- Avoid last-minute rushes and mistakes that can trigger fines or higher assessments

- Leverage cloud infrastructure for document storage, retrieval and collaboration

- Achieve cost certainty through their all-inclusive pricing model

Whether you’re filing the simpler Form C-S or the full Form C with financial statements, having a partner who knows the Singapore tax landscape well gives you an edge.

Conclusion

In today’s fast-moving business environment, tax compliance is more than just a legal requirement—it’s a pillar of good corporate governance and financial efficiency. Xerosoft Global offers a comprehensive solution for Singapore-based companies to manage their corporate tax return filing with confidence, precision and transparency.

With the filing rate already at record highs, and regulatory scrutiny increasing, shifting to a specialist provider is no longer simply a convenience—it’s a business imperative. Make sure your company is preparing, filing and documenting properly—and if you’re ready to hand it off, Xerosoft Global is a strong partner to consider.

References

- Sleek. Singapore Corporate Tax Filing Deadline: A Simple Guide For Companies

- PwC. Corporate – Taxes on corporate income

- Inland Revenue Authority of Singapore. Corporate Income Tax Season: More Than 90% On-Time Filing Rate Achieved for First Time in YA 2024