When it comes to running a business in Singapore, one of the non-negotiables is timely and accurate corporate tax filing. That’s where Xerosoft Global steps in: their service for Corporate Tax Return Filing for Singapore businesses is designed to ease compliance, reduce risk and support business growth. According to their website, all Singapore corporations must electronically file their corporate income tax returns (Form C or C-S) by 30 November for the previous financial year.

Why the Filing Matters

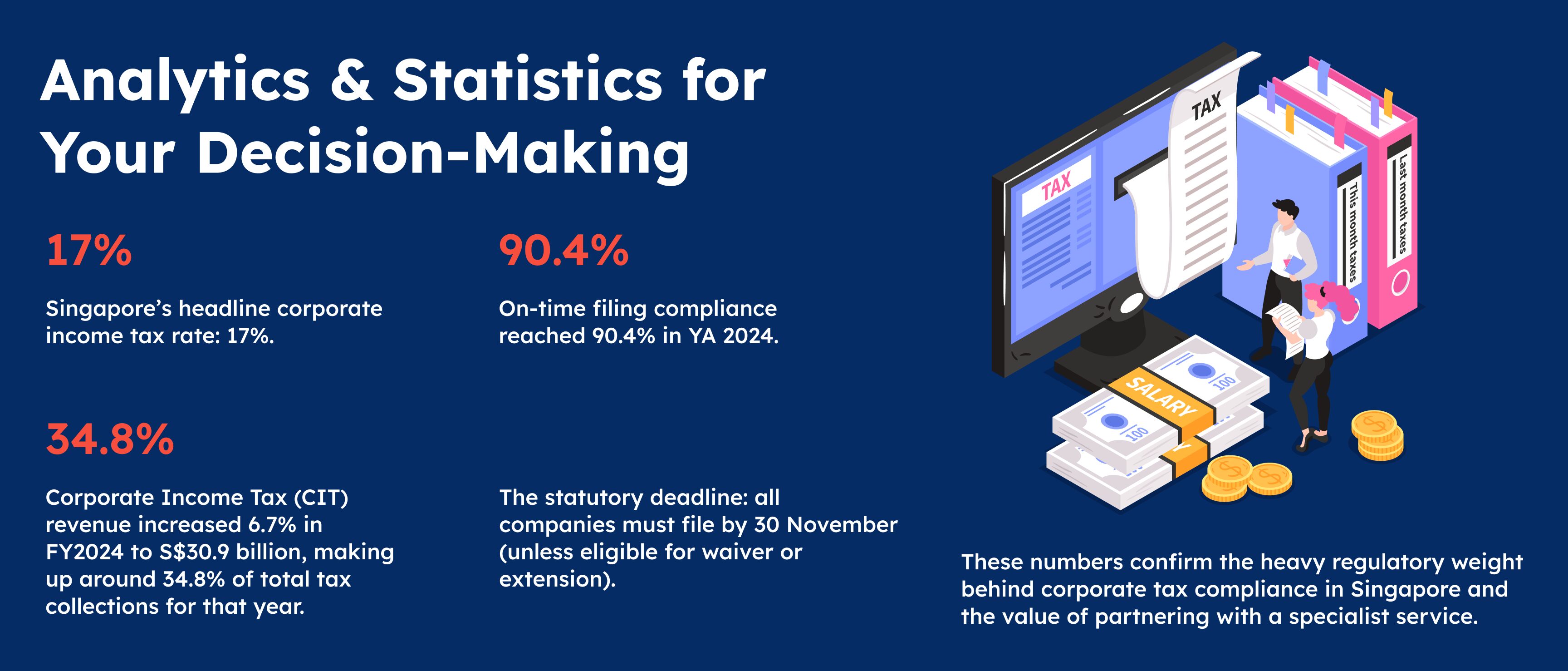

- The standard corporate income tax (CIT) rate in Singapore is 17%.

- For the Year of Assessment (YA) 2024, Singapore’s tax authority Inland Revenue Authority of Singapore (IRAS) reported that over 300,000 companies—including about 37,000 new companies—were expected to file their CIT returns by 30 Nov 2025, and the on-time filing rate reached 90.4%.

- There are stiff penalties for late or non‐filing: fines of up to S$5,000, and potential legal action for persistently non-compliant companies.

What Xerosoft Global Offers

- Dedicated and qualified accountants who keep your books up to date, and ensure your taxes, management reports and financial statements are completed and filed on time.

- A cloud-based document management system, meaning you have “all documents in one place,” which simplifies access, collaboration and transparency.

- Transparent, all-inclusive pricing to avoid surprises or hidden penalty exposure.

- Proprietary cloud bookkeeping platform for small businesses, bundled with their tax-filing service.

- Expertise in the specific tax return forms: Form C or Form C-S, including determining eligibility for Form C-S (i.e., company revenue ≤ S$5 million, taxed at 17% rate, no claim for loss carry-back, group relief, investment allowance or foreign tax credit).

Key Benefits of Choosing Xerosoft Global

Compliance assurance

With deadlines and forms becoming increasingly stringent, having expert accountants aligned with Xerosoft’s service means you reduce risk of late-filing penalties or non-compliance.

Simplified workflow

Their cloud-based document system means easier access, fewer silos, and streamlined collaboration between finance teams and external advisers.

Cost transparency

The all-inclusive pricing model means fewer surprises, helping businesses budget and avoid penalty costs hidden in messy compliance.

Tailored for Singapore corporation needs

Since the service covers eligibility for different forms (C vs C-S) and small-business thresholds (<= S$5 m revenue) it is well-suited for both local and foreign-incorporated firms operating in Singapore.

Focus on business growth

By delegating the tax filing and bookkeeping complexity to Xerosoft Global, business leaders can free up time and resources to focus on strategic growth rather than compliance minutiae.

Conclusion

In today’s competitive and highly regulated business environment, especially in a jurisdiction like Singapore with strict deadlines, having a reliable partner for corporate tax filing is more than an operational convenience — it’s a strategic necessity. Xerosoft Global positions itself as that partner, bridging the gap between legal and regulatory obligation and business-friendly operational support.

If your business is incorporated in Singapore or planning to expand there, outsourcing your corporate tax return process to Xerosoft Global gives you the twin advantages of accuracy and peace of mind — enabling you to focus on your core activities while knowing your compliance is in expert hands.

Resources

- Sleek. Singapore Corporate Tax Filing Deadline: A Simple Guide For Companies

- ASEAN Briefing. Doing Business in Singapore.

- Inland Revenue Authority of Singapore. Corporate Income Tax Season: More Than 90% On-Time Filing Rate Achieved for First Time in YA 2024

- PwC. Corporate – Taxes on corporate income