In today’s fast-evolving global workplace, payroll is no longer a back-office task—it’s a critical compliance function. With stricter regulations, cross-border hiring, and heightened employee expectations, mistakes in payroll compliance are more costly than ever. From financial penalties to reputational damage, even minor oversights can cripple business operations.

At Xerosoft Global, we help organizations avoid these pitfalls by combining advanced payroll technology with expert compliance support, ensuring companies stay ahead of regulatory changes in 2025.

Common Payroll Compliance Mistakes in 2025

Misclassifying Employees and Contractors

With the rise of gig workers and freelancers, misclassification can trigger tax penalties, back payments, and even lawsuits.

Ignoring Country-Specific Regulations

Global teams face diverse tax codes, labor laws, and benefits requirements. Missing even one filing deadline in a region can be expensive.

Inaccurate Tax Withholding

Incorrect deductions or late submissions often lead to heavy penalties and strained employee trust.

Poor Recordkeeping

Incomplete or outdated payroll records can make audits a nightmare and create compliance gaps.

Manual Errors Due to Outdated Systems

Businesses relying on spreadsheets or legacy software increase their exposure to human error, delays, and miscalculations.

Key Benefits of Getting Payroll Compliance Right

Financial Protection

Avoids fines, penalties, and unplanned back payments.

Employee Satisfaction

Accurate, timely pay strengthens trust and retention.

Operational Efficiency

Automation reduces manual errors and saves HR teams valuable time.

Global Scalability

Businesses can expand into new markets without worrying about compliance barriers.

Data Security

Modern payroll systems protect sensitive employee data against breaches and fraud.

How Xerosoft Global Protects Businesses

- Automate payroll processes to reduce compliance risks

- Ensure accuracy in multi-country payroll and tax filings

- Stay ahead of changing global labor and tax regulations

- Scale payroll operations seamlessly as businesses expand

Conclusion

In 2025, payroll compliance mistakes are no longer “small errors”—they’re costly risks that can damage financial stability and employee trust. Businesses that continue to rely on outdated systems or manual processes leave themselves vulnerable to fines, penalties, and reputational harm.

By working with Xerosoft Global, companies can safeguard compliance, streamline operations, and build a payroll strategy that supports long-term growth.

References

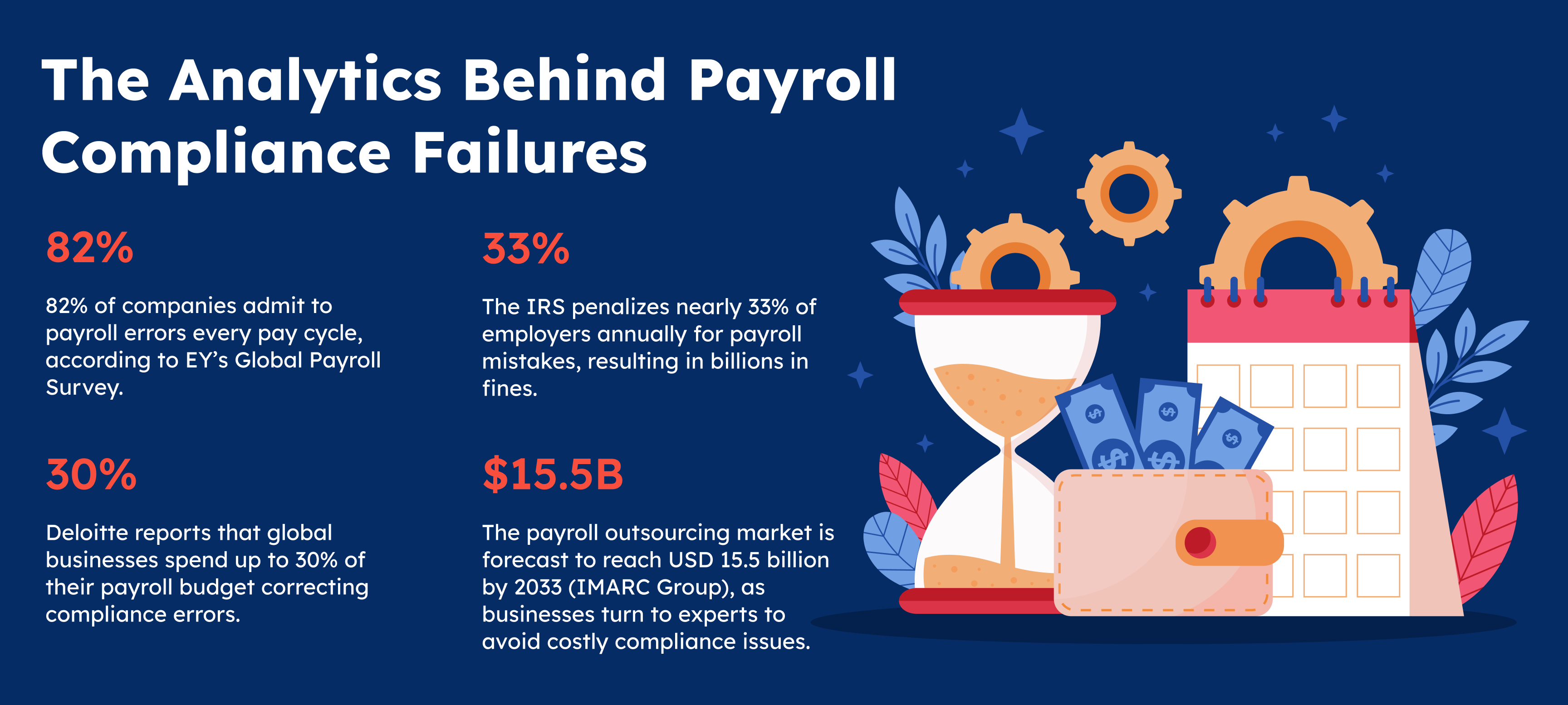

- EY. Learn how the EY-Microsoft Alliance leverages AI to simplify global payroll employee experiences, ensure compliance and enhance operations.

- Straits Research. Payroll Outsourcing Market Size & Outlook, 2025-2033

- imarc Group. Payroll Outsourcing Market Report by Type (Full-Managed Outsourcing, Co-Managed Outsourcing), Application (Small Business, Medium Business, Large Business), End Use Industry (BFSI, Consumer and Industrial Products, IT and Telecommunication, Public Sector, Healthcare, and Others), and Region 2025-2033

- HR Dive. Employers make 15 corrections per pay period on average, costing thousands annually, EY says

- EY Quest. Cost and risks due to payroll errors: Results of the 2022 HR Processing Risk and Cost Survey