In 2025, payroll compliance is moving faster than ever. Governments and regulatory bodies are rolling out updated laws, tighter reporting requirements, new tax brackets, and stronger worker protections. For businesses of all sizes, especially those growing or operating across borders, staying compliant isn’t optional — it’s essential. Solutions providers like Xerosoft Global are helping companies navigate this shifting landscape with smarter tools and up-to-date expertise.

What’s Driving the Pace of Change

- Technological advances (automation, AI, cloud systems) make it possible to enforce, monitor, and audit payroll more strictly.

- Governments are updating wage laws (minimum wage, overtime rules), worker classification (employee vs contractor), and tax withholdings.

- There is growing demand for transparency (such as pay equity, pay bands) and data privacy/security as payroll involves sensitive employee information.

- More businesses are remote, gig-based, or global, which adds complexity across jurisdictions. Local, state, national and cross-border rules can differ greatly.

Key Changes & Regulatory Updates to Check For

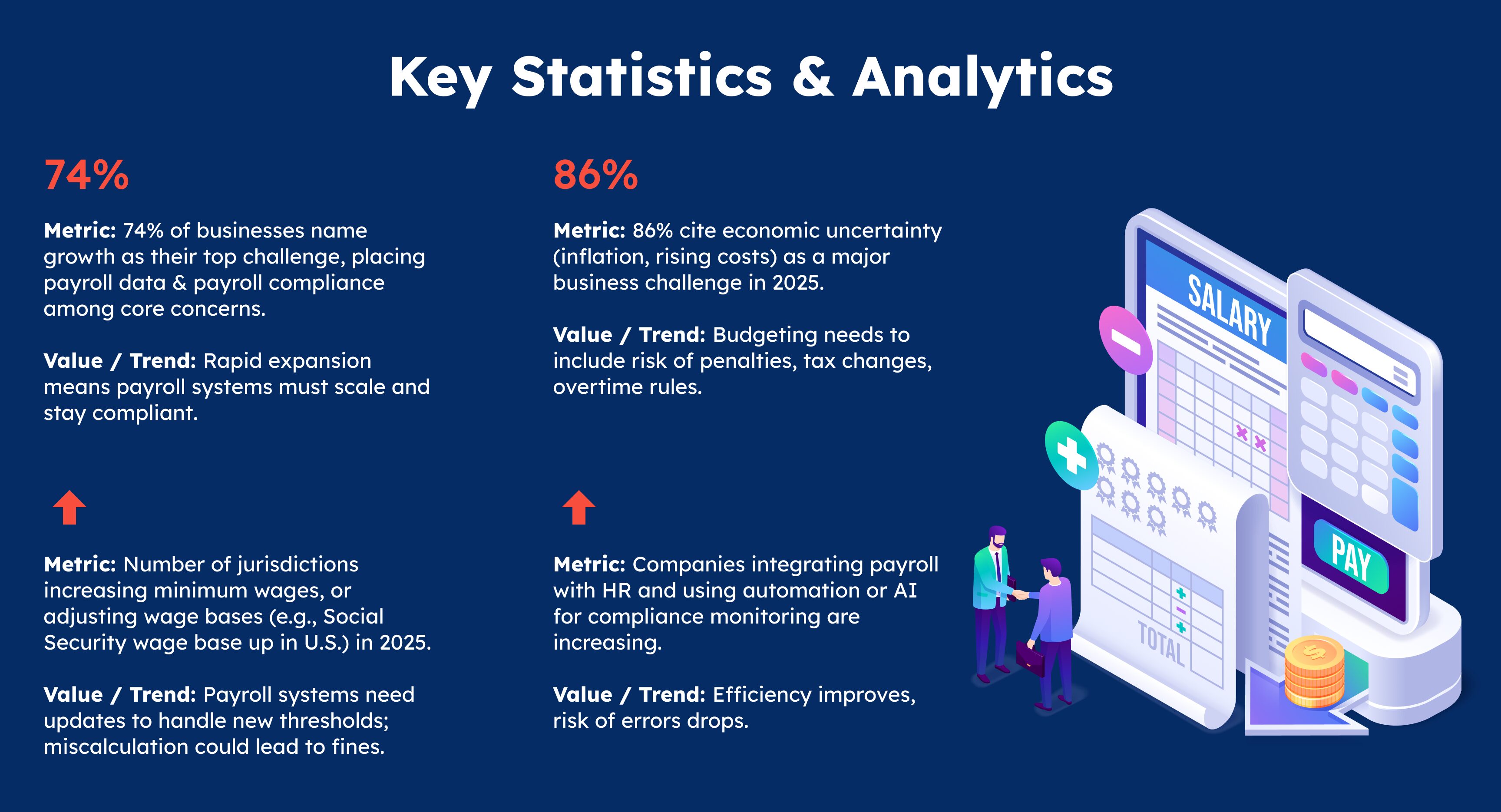

To stay compliant in 2025, businesses should monitor and prepare for:

Updated wage laws & minimum wage increases

Many states and countries are bumping up minimum wages; also increasing overtime thresholds.

Tax reporting changes

- Adjusted tax brackets and withholding rules.

- Changes in contribution limits for retirement plans, health & commuter benefits.

Employee classification rules

- Misclassification of contractors vs employees continues being a high-risk area.

Stricter data privacy & security requirements

- Payroll systems must protect sensitive information; compliance with privacy regulations is more enforced.

Transparency & pay equity laws

- Laws pushing for greater disclosure of pay ranges, gender or diversity-based pay gaps, etc.

Technology & automation standards

- More demand for payroll systems that auto-update regulatory tables, detect anomalies, support integrations.

How Xerosoft Global Helps You Stay Ahead

Here are the benefits and value propositions when you leverage a solution like Xerosoft Global for payroll compliance in 2025:

Real-time compliance updates

Xerosoft Global proactively updates its payroll software to reflect wage base changes, tax bracket adjustments, classification rule shifts, etc., minimizing risk of being out-of-date.

Automated checks and error detection

AI and validation rules reduce human error—mis-withholding, misclassification, or failure to apply latest rates get flagged.

Unified system for global/remote workforces

If your team is spread across states or countries, Xerosoft Global supports multi-jurisdiction compliance from one platform.

Transparency & reporting tools

Employee self-service for pay stubs, payroll summary, ability to generate analytics reports for equity, audit trail, etc.

Scalability & flexibility

As laws change or your team structure evolves (remote, part time, contractors), Xerosoft Global scales without disruptive overhauls of payroll process.

Security and data protection

With GDPR-like, data privacy standards, encryption, etc., to protect sensitive payroll/employee data.

Benefits of Staying Compliant

- Avoidance of hefty fines, back payments, legal penalties.

- Improved employee trust and satisfaction, as payroll is accurate, transparent and timely.

- Better efficiency in operations—less manual corrections, less staff time spent chasing errors.

- Reduced risk in audits; having clean records and systems helps.

- Competitive advantage: businesses seen as fair and modern tend to attract & retain talent more easily.

Conclusion

Payroll compliance in 2025 is not just a “nice-to-do” but a must. With evolving wage laws, emerging data privacy rules, expanded worker categories, pay transparency, and tax updates, companies that stay reactive will risk penalties, inefficiencies, and diminished trust. On the other hand, those that proactively adapt—using tools like Xerosoft Global—will gain smoother operations, better employee relations, and peace of mind.

References