The recent rise in National Insurance (NI) contributions has placed significant financial pressure on businesses, particularly small and medium-sized enterprises (SMEs). Faced with increased payroll expenses, many companies have been forced to make tough decisions, including restructuring and job cuts, to sustain operations. In this evolving landscape, maintaining payroll compliance is more critical than ever to avoid legal risks and financial penalties.

The Impact of Rising National Insurance Contributions

The UK government raised National Insurance contributions to support public services such as the NHS and social care. While this policy aims to strengthen national welfare, it has also led to higher labor costs for businesses.

Key Statistics:

Labor costs have risen by 6.2% over the past year due to higher taxation and wage inflation (UK Office for National Statistics).

30% of SMEs have considered staff reductions due to rising employer contributions (Federation of Small Businesses).

42% of businesses have struggled with compliance challenges following payroll legislation changes (Chartered Institute of Payroll Professionals).

Given these financial pressures, companies must adopt efficient payroll management strategies to maintain compliance while safeguarding financial stability.

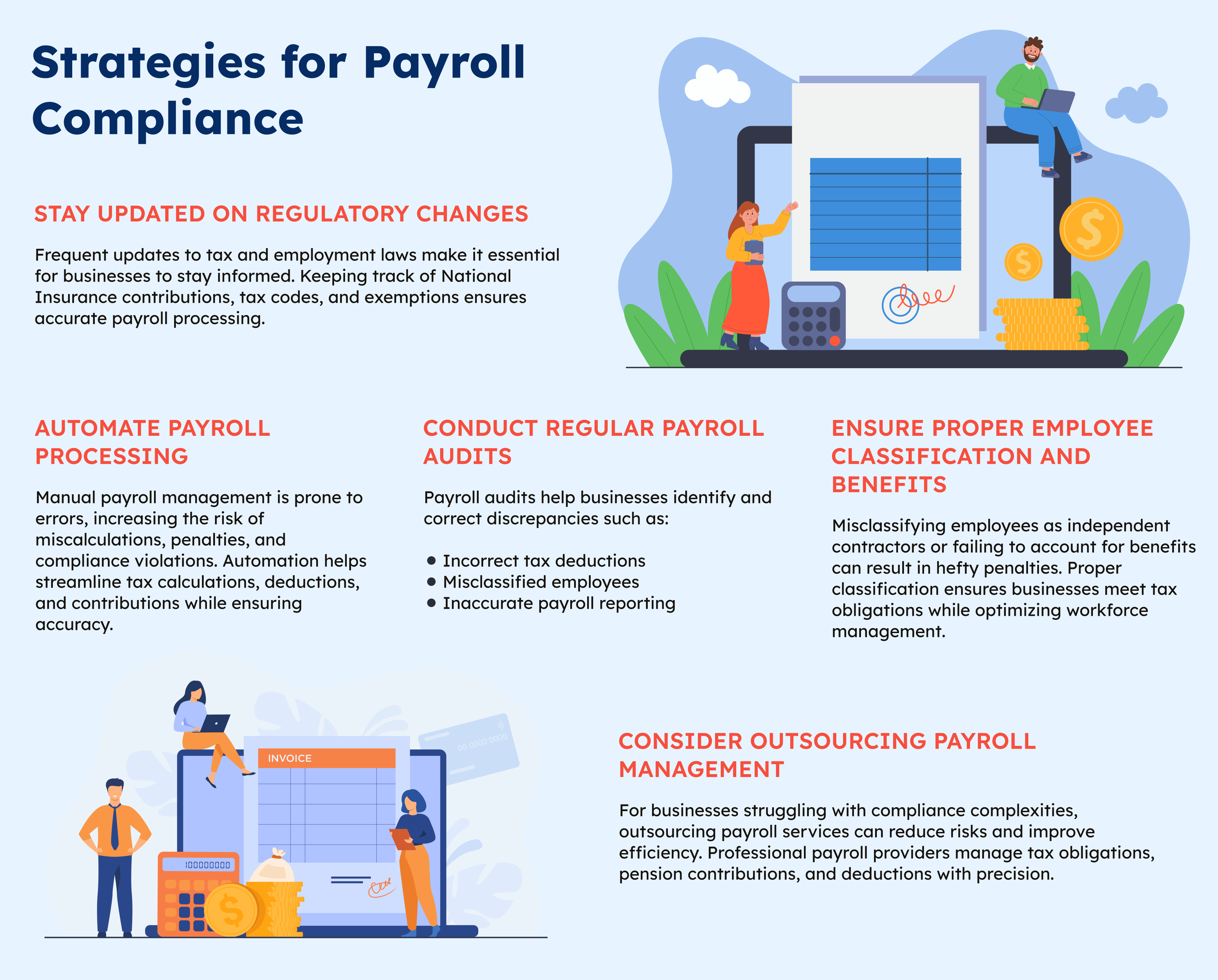

Strategies for Payroll Compliance

Stay Updated on Regulatory Changes

Frequent updates to tax and employment laws make it essential for businesses to stay informed. Keeping track of National Insurance contributions, tax codes, and exemptions ensures accurate payroll processing.

Solution: Subscribe to HMRC updates or partner with payroll service providers like Xerosoft Global, which offers real-time compliance monitoring and automated payroll tools.

Automate Payroll Processing

Manual payroll management is prone to errors, increasing the risk of miscalculations, penalties, and compliance violations. Automation helps streamline tax calculations, deductions, and contributions while ensuring accuracy.

Benefit: A PwC study found that companies using automated payroll systems saw a 35% reduction in compliance errors. Xerosoft Global provides AI-powered payroll solutions to enhance accuracy and reduce administrative burdens.

Conduct Regular Payroll Audits

Payroll audits help businesses identify and correct discrepancies such as:

- Incorrect tax deductions

- Misclassified employees

- Inaccurate payroll reporting

Best Practice: Conduct quarterly payroll audits, cross-checking employee records against tax filings to ensure compliance and prepare for potential government inspections.

Ensure Proper Employee Classification and Benefits

Misclassifying employees as independent contractors or failing to account for benefits can result in hefty penalties. Proper classification ensures businesses meet tax obligations while optimizing workforce management.

Example: In 2023, HMRC fined multiple firms for misclassifying workers, leading to substantial back payments. Xerosoft Global’s payroll analytics tools help businesses categorize employees correctly and calculate benefits efficiently.

Consider Outsourcing Payroll Management

For businesses struggling with compliance complexities, outsourcing payroll services can reduce risks and improve efficiency. Professional payroll providers manage tax obligations, pension contributions, and deductions with precision.

Market Insight: Research by Deloitte found that 59% of companies outsourcing payroll reported better compliance and up to 20% cost savings. Xerosoft Global specializes in payroll outsourcing, offering tailored solutions for various industries.

Leveraging Payroll Analytics for Smarter Decision-Making

Data-driven payroll management helps businesses optimize labor costs, tax liabilities, and compliance strategies. Advanced payroll analytics enable companies to:

- Track gross vs. net payroll costs to improve budget allocation

- Monitor tax compliance rates to reduce legal risks

- Lower payroll error rates to enhance employee satisfaction

How Xerosoft Global Supports Payroll Compliance

As a leading payroll solutions provider, Xerosoft Global helps businesses navigate complex tax regulations and compliance requirements through:

Regulatory Compliance

Automated tax law updates and compliance tools

Payroll Automation

AI-powered systems that minimize errors and manual effort

Data-Driven Insights

Analytics that support workforce planning and financial management

Custom Solutions

Scalable payroll services tailored to SMEs and large enterprises

With rising National Insurance contributions increasing financial strain, businesses must adopt efficient payroll management strategies to stay compliant and cost-effective. Automation, regular audits, and outsourcing can significantly enhance payroll accuracy and mitigate compliance risks.

Partnering with Xerosoft Global ensures seamless payroll processing, regulatory compliance, and data-driven decision-making. By leveraging advanced payroll analytics and automation, businesses can successfully navigate tax changes while focusing on growth and long-term sustainability.

Reference:

- Reuters. UK’s accelerating wage growth highlights BoE’s inflation caution

- Family Friendly Working. More than 1 in 4 small businesses consider job cuts in wake of Autumn Budget

- Workplace Journal. Small businesses scaling back on jobs amid concerns over Employment Rights Bill, says FSB

- The Guardian. Company insolvencies rise across England and Wales; interest rate cuts less likely after UK pay growth accelerates – as it happened