In recent years, Initial Public Offerings (IPOs) have become an attractive path for many businesses looking to expand their capital and market reach. However, for accounting firms, navigating the complexities of IPOs presents unique challenges and opportunities. Partnering with the right resources, such as experienced financial advisors and the right technology solutions like Xerosoft Global, can be a game-changer in ensuring a successful transition.

The Rising Importance of IPOs for Accounting Firms

IPOs offer significant growth opportunities for companies, but they also come with numerous compliance, regulatory, and financial considerations. As businesses move from private to public, accounting firms play a crucial role in guiding them through this complex process. According to a report by PwC, the global IPO market saw over $300 billion in proceeds in 2020, marking a 23% increase from the previous year. This growth has continued into 2021, demonstrating that IPOs are a thriving sector that accounting firms can leverage.

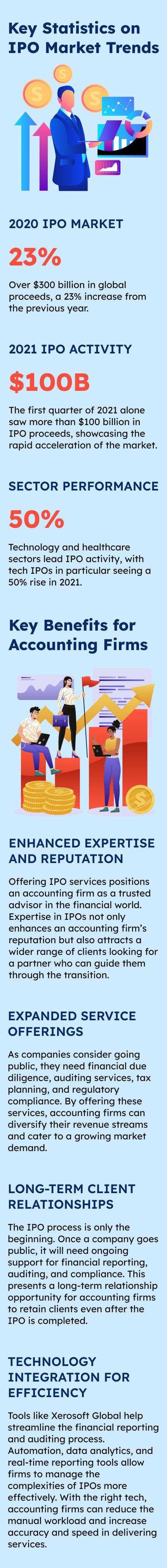

Key Statistics on IPO Market Trends:

- 2020 IPO Market: Over $300 billion in global proceeds, a 23% increase from the previous year.

- 2021 IPO Activity: The first quarter of 2021 alone saw more than $100 billion in IPO proceeds, showcasing the rapid acceleration of the market.

- Sector Performance: Technology and healthcare sectors lead IPO activity, with tech IPOs in particular seeing a 50% rise in 2021.

Key Benefits for Accounting Firms

Enhanced Expertise and Reputation

Offering IPO services positions an accounting firm as a trusted advisor in the financial world. Expertise in IPOs not only enhances an accounting firm’s reputation but also attracts a wider range of clients looking for a partner who can guide them through the transition.

Expanded Service Offerings

As companies consider going public, they need financial due diligence, auditing services, tax planning, and regulatory compliance. By offering these services, accounting firms can diversify their revenue streams and cater to a growing market demand.

Long-Term Client Relationships

The IPO process is only the beginning. Once a company goes public, it will need ongoing support for financial reporting, auditing, and compliance. This presents a long-term relationship opportunity for accounting firms to retain clients even after the IPO is completed.

Technology Integration for Efficiency

Tools like Xerosoft Global help streamline the financial reporting and auditing process. Automation, data analytics, and real-time reporting tools allow firms to manage the complexities of IPOs more effectively. With the right tech, accounting firms can reduce the manual workload and increase accuracy and speed in delivering services.

Leveraging Analytics for Success

Analytics play a critical role in the IPO process. A deep dive into a company’s financial health through robust data analytics enables accounting firms to offer strategic insights that could guide businesses through the IPO process effectively.

According to a survey by Deloitte, 63% of businesses stated that their accountants’ ability to offer data-driven insights was the most valuable aspect of the IPO preparation process. By utilizing advanced analytics and reporting tools, accounting firms can make more informed recommendations and reduce the risk of costly mistakes during the IPO process.

Embracing IPOs as a Growth Opportunity for Accounting Firms

Navigating the IPO process is a significant opportunity for accounting firms to expand their services and enhance their reputation in the market. With a comprehensive understanding of financial regulations and access to technology like Xerosoft Global, firms can efficiently manage the complexity of IPOs while offering valuable insights to clients. By capitalizing on the rise of IPOs and integrating advanced analytics into their practices, accounting firms can position themselves as indispensable partners for businesses seeking to go public.

Resources

- Ceros. IPO Readiness: Our Solutions

- 3E Accounting. Understanding Initial Public Offering (IPO)

- BDO Canada. Capital Markets & Public Company Services