In today’s complex business environment, effective tax planning is not just about compliance; it’s a critical strategy for reducing costs and maximizing profitability. For companies operating globally, navigating diverse tax regulations while minimizing corporate tax liabilities can be daunting. task. Xerosoft Global offers tailored tax planning solutions to help businesses reduce their tax burdens while staying compliant with international laws. Below, we explore key strategies and how Xerosoft Global’s expertise ensures your business reaps the maximum tax benefits.

1. Leverage Tax Deductions and Credits

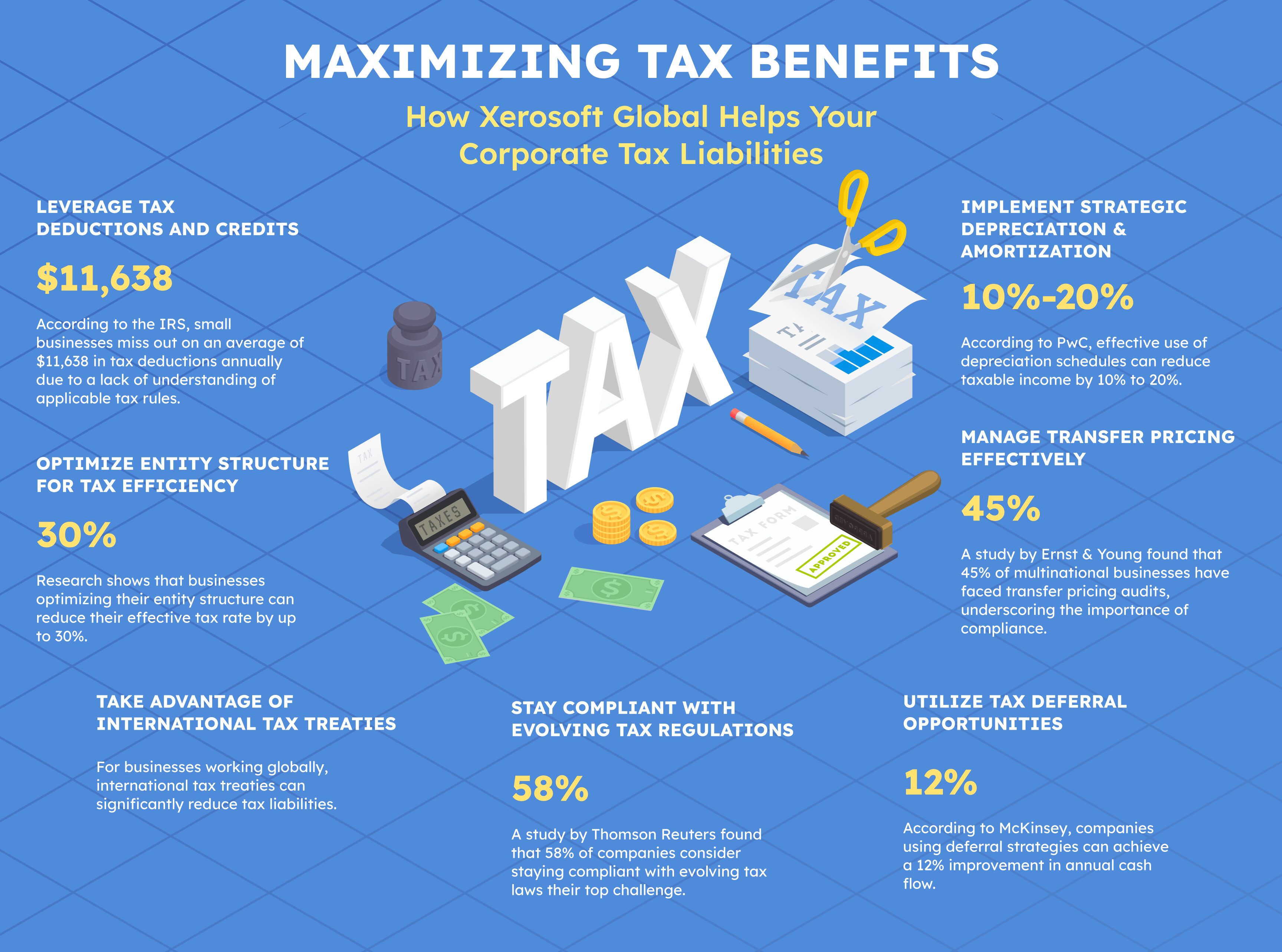

Many businesses fail to claim all the tax deductions and credits they are entitled to, which can lead to higher tax liabilities. According to the IRS, small businesses miss out on an average of $11,638 in tax deductions annually due to a lack of understanding of applicable tax rules¹. Proper tax planning ensures businesses can take advantage of deductions for expenses like employee benefits, research and development (R&D), and business travel.

How Xerosoft Global Helps:

Xerosoft Global’s team of tax experts analyzes your financial records to identify eligible deductions and credits. For example, our expertise in R&D tax credits ensures your business benefits from significant savings while remaining compliant with regulatory requirements.

2. Optimize Entity Structure for Tax Efficiency

Choosing the right legal entity structure is critical for minimizing tax liabilities. For businesses operating internationally, understanding the tax implications of various structures, such as LLCs, S-corporations, or partnerships, is essential. Research shows that businesses optimizing their entity structure can reduce their effective tax rate by up to 30%².

How Xerosoft Global Helps:

We assist in evaluating your business structure and recommending adjustments to optimize tax efficiency. For multinational corporations, we design entity frameworks that align with global tax treaties and minimize double taxation risks.

3. Take Advantage of International Tax Treaties

For businesses working globally, international tax treaties can significantly reduce tax liabilities. These treaties often include provisions to prevent double taxation and lower withholding tax rates on cross-border transactions. However, navigating the complexities of these agreements requires specialized expertise.

How Xerosoft Global Helps:

Our global tax experts at Xerosoft Global ensure your business leverages applicable international tax treaties. By analyzing treaty benefits and managing cross-border transactions, we help you minimize tax burdens in multiple jurisdictions.

4. Implement Strategic Depreciation and Amortization

Strategic use of depreciation and amortization can reduce taxable income by spreading the costs of assets over their useful life. According to PwC, effective use of depreciation schedules can reduce taxable income by 10% to 20%³. This strategy is especially relevant for businesses with significant investments in property, equipment, or intangible assets.

How Xerosoft Global Helps:

Xerosoft Global creates tailored depreciation and amortization schedules to align with your financial goals. Our approach ensures that you capitalize on available deductions without triggering compliance risks.

5. Manage Transfer Pricing Effectively

Transfer pricing, or the pricing of goods and services exchanged between subsidiaries in different countries, is a common area of scrutiny for tax authorities. Mismanaged transfer pricing can lead to audits, penalties, or double taxation. A study by Ernst & Young found that 45% of multinational businesses have faced transfer pricing audits, underscoring the importance of compliance⁴.

How Xerosoft Global Helps:

We help multinational companies implement compliant transfer pricing policies. Xerosoft Global’s tax specialists ensure that your intercompany transactions are documented and priced according to international standards, minimizing the risk of penalties.

6. Utilize Tax Deferral Opportunities

Deferring taxes can provide businesses with increased cash flow to reinvest in operations. Strategies such as reinvesting earnings in tax-deferred accounts or delaying income recognition can optimize your financial position. According to McKinsey, companies using deferral strategies can achieve a 12% improvement in annual cash flow⁵.

How Xerosoft Global Helps:

Xerosoft Global identifies deferral opportunities that align with your business operations. We design strategies to delay taxable events where possible, improving your cash flow while remaining compliant with tax laws.

7. Stay Compliant with Evolving Tax Regulations

Tax regulations are constantly changing, making compliance a moving target for businesses. Non-compliance can lead to penalties, audits, or reputational damage. In fact, a study by Thomson Reuters found that 58% of companies consider staying compliant with evolving tax laws their top challenge⁶.

How Xerosoft Global Helps:

We monitor global tax regulations and ensure your business remains compliant. From handling tax filings to preparing audit-ready records, Xerosoft Global acts as your trusted partner in navigating complex regulatory landscapes.

Conclusion: Maximize Savings with Xerosoft Global

Minimizing corporate tax liabilities requires a strategic approach that combines expertise, compliance, and proactive planning. Xerosoft Global’s tax planning services empower businesses to navigate the complexities of global tax regulations while optimizing their financial strategies. By leveraging deductions, optimizing entity structures, and staying compliant with international treaties, our team ensures that your business achieves its tax-saving potential.

Partner with Xerosoft Global today to take control of your corporate tax strategy. Let us help you maximize savings and secure financial stability for long-term success.

References:

- IRS, “Taxpayer Rights and Credits,”

- Deloitte, “The Tax Benefits of Entity Optimization,”

- PwC, “Tax Strategies for Asset Management,”

- Ernst & Young, “Transfer Pricing Trends,”

- McKinsey & Company, “Cash Flow Management through Tax Deferral,”

- Thomson Reuters, “Global Tax Compliance Challenges,”