When it comes to securing funding or maintaining a strong credit profile, bookkeeping is often the overlooked backbone of business success. Investors, banks, and lenders rely on accurate financial records to assess risk, creditworthiness, and growth potential. Without organized books, even profitable businesses may struggle to secure loans or favorable credit terms.

In today’s competitive financial landscape, solutions like Xerosoft Global are helping businesses maintain accurate bookkeeping, ensure compliance, and present strong financial profiles to potential funders.

The Link Between Bookkeeping, Funding, and Credit

Transparency for Lenders and Investors

- Lenders want to see clear financial records before extending loans. A business with messy or incomplete bookkeeping raises red flags about reliability.

- According to the Federal Reserve’s Small Business Credit Survey (2024), 56% of small business applicants were denied funding due to poor financial documentation or lack of financial history.

Accurate Credit Risk Assessment

- Credit bureaus and financial institutions evaluate financial statements to assess repayment capacity. Proper bookkeeping provides the data needed to calculate debt-to-income ratios, liquidity, and overall financial health.

Cash Flow Insights

- Strong bookkeeping reveals patterns in receivables and payables, helping businesses forecast cash flow. Since 82% of small businesses fail due to poor cash flow management (U.S. Bank study), bookkeeping directly impacts survival rates and fundability.

Key Benefits of Good Bookkeeping for Business Funding

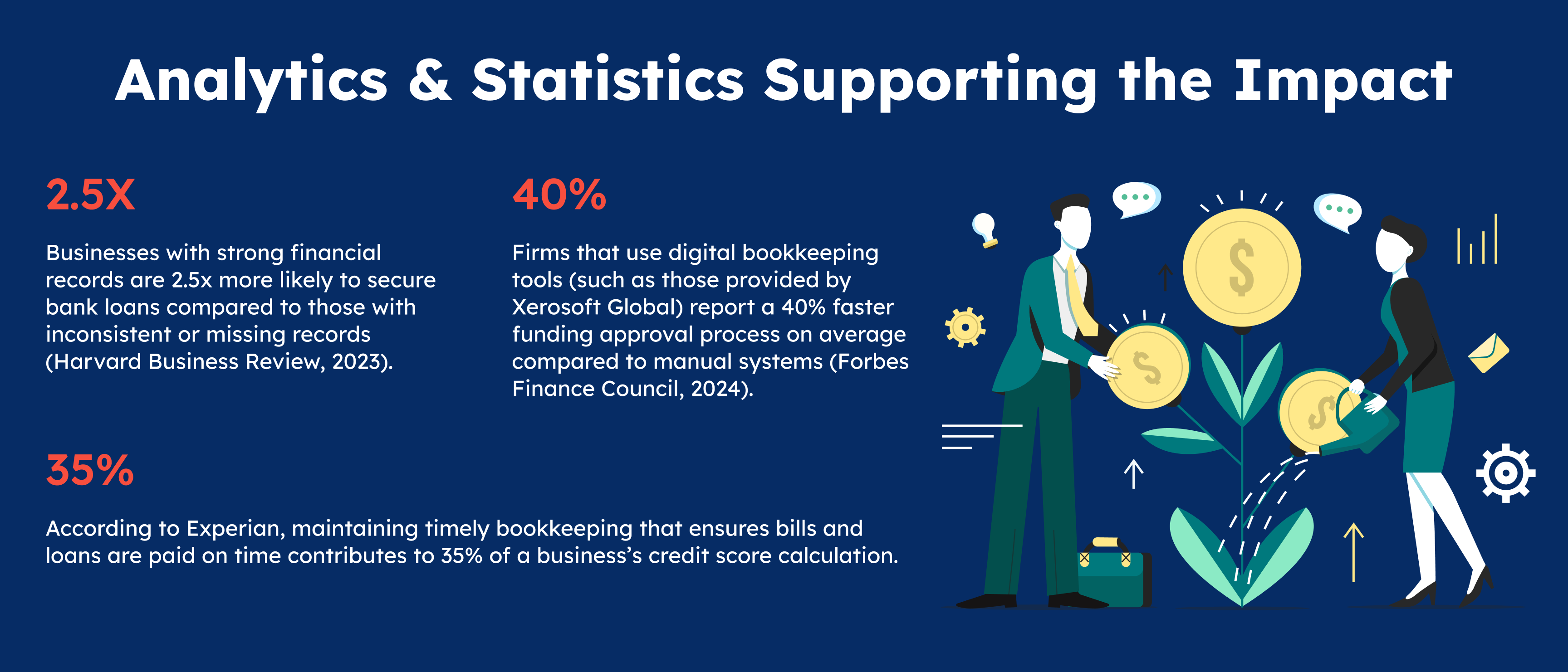

Improved Loan Approval Chances

Clean books demonstrate credibility and reduce lender hesitation.

Better Credit Ratings

Accurate tracking of liabilities and on-time payments builds a stronger credit profile.

Investor Confidence

Investors are more likely to fund companies with transparent, data-backed financials.

Faster Funding Cycles

Lenders spend less time verifying and correcting errors, speeding up approvals.

Regulatory Compliance

Avoid penalties or funding rejections due to non-compliance with financial reporting standards.

Conclusion

Bookkeeping isn’t just about tracking expenses—it’s a critical driver of business funding and credit health. Companies with accurate, transparent records are far more likely to gain lender trust, secure capital, and negotiate better credit terms.

In today’s data-driven financial environment, Xerosoft Global empowers businesses to streamline bookkeeping, minimize errors, and build a financial foundation that attracts investors and lenders alike.

Strong books don’t just keep your business compliant—they open doors to growth opportunities.

References