Bookkeeping, once a labor-intensive task plagued with manual data entry and human errors, is undergoing a massive transformation. Thanks to automation, businesses are now achieving faster, more accurate financial management processes, redefining the role of accountants in the digital age. In 2025, platforms like Xerosoft Global are leading this shift, enabling companies to streamline their bookkeeping and focus on strategic growth.

The State of Bookkeeping Automation in 2025

The demand for automation in bookkeeping is at an all-time high. According to Gartner’s Finance Automation Report 2025, 85% of small to mid-sized enterprises (SMEs) have automated at least one component of their bookkeeping process, a dramatic increase from 50% in 2022. Additionally, the global accounting automation market is projected to reach P25.1 billion by 2027, growing at a CAGR of 10.5% (Statista 2025).

This surge is driven by the need for:

- Real-time financial insights

- Cost reduction in back-office operations

- Increased accuracy and compliance readiness

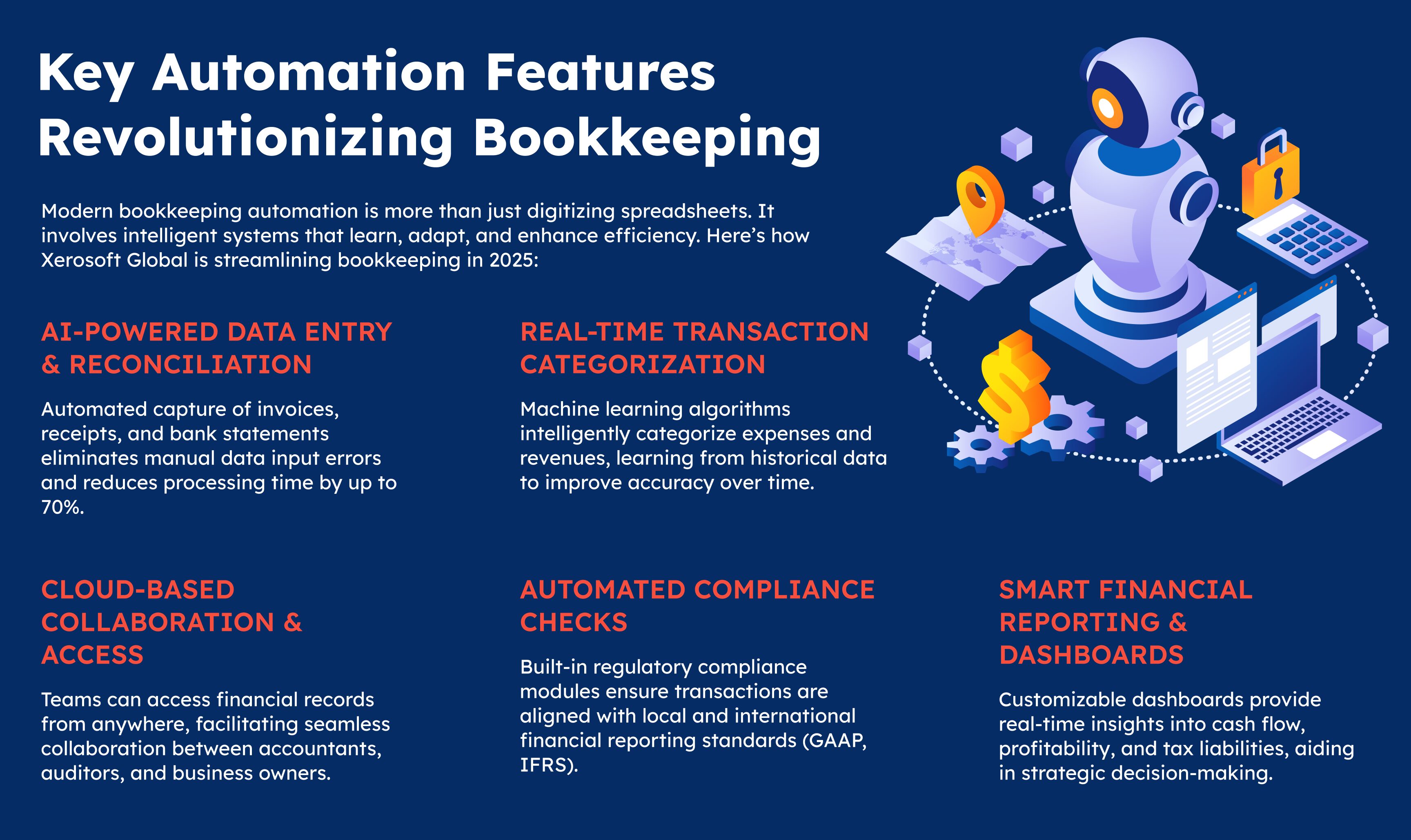

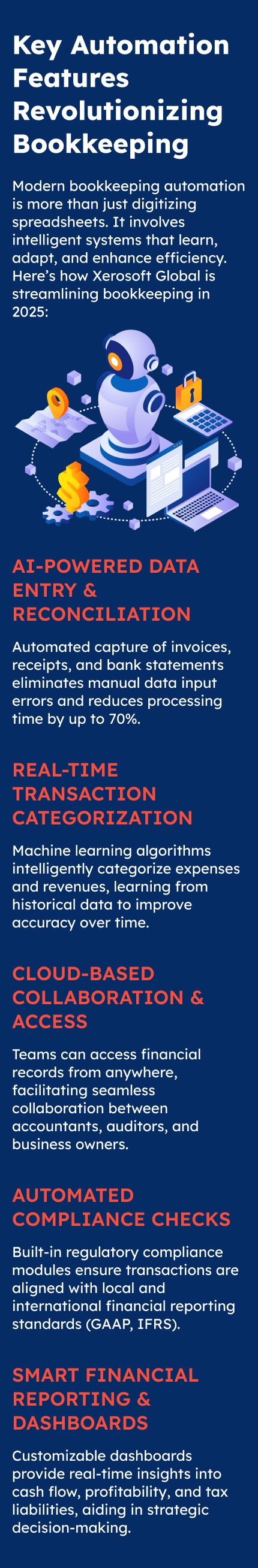

Key Automation Features Revolutionizing Bookkeeping

Modern bookkeeping automation is more than just digitizing spreadsheets. It involves intelligent systems that learn, adapt, and enhance efficiency. Here’s how Xerosoft Global is streamlining bookkeeping in 2025:

AI-Powered Data Entry & Reconciliation

Automated capture of invoices, receipts, and bank statements eliminates manual data input errors and reduces processing time by up to 70%.

Real-Time Transaction Categorization

Machine learning algorithms intelligently categorize expenses and revenues, learning from historical data to improve accuracy over time.

Cloud-Based Collaboration & Access

Teams can access financial records from anywhere, facilitating seamless collaboration between accountants, auditors, and business owners.

Automated Compliance Checks

Built-in regulatory compliance modules ensure transactions are aligned with local and international financial reporting standards (GAAP, IFRS).

Smart Financial Reporting & Dashboards

Customizable dashboards provide real-time insights into cash flow, profitability, and tax liabilities, aiding in strategic decision-making.

Benefits of Automated Bookkeeping with Xerosoft Global

Businesses that have integrated Xerosoft Global’s bookkeeping automation tools are experiencing substantial advantages, including:

Time Savings

Automation reduces bookkeeping tasks by up to 60%, freeing accountants to focus on value-added advisory roles.

Cost Efficiency

SMEs report annual savings of 25-30% on bookkeeping-related expenses through automation.

Error Reduction

AI-driven reconciliation slashes data entry errors by over 90%, ensuring clean, audit-ready books.

Enhanced Cash Flow Visibility

Real-time updates allow businesses to maintain tighter control over their financial health.

Scalability

Automation enables businesses to handle higher transaction volumes without proportionally increasing headcount.

Analytics & Market Insights

AICPA’s 2025 Tech Trends report states that 78% of accounting professionals believe automation will be a key driver of competitive advantage in the next 3 years.

A Xerosoft Global internal study found that clients who automated their bookkeeping process saw a 35% increase in reporting speed and a 40% reduction in late payment penalties due to real-time alerts and dashboards.

IDC forecasts that 90% of manual accounting tasks will be eliminated by 2027, with AI and automation handling routine processes.

Conclusion: The Future of Bookkeeping Is Automated

In 2025, automation is no longer a luxury but a necessity for efficient bookkeeping. Companies leveraging intelligent platforms like Xerosoft Global are not just cutting operational costs but are positioning themselves for agility, compliance, and data-driven decision-making.

As the technology continues to evolve, businesses that adopt automated bookkeeping today will be better prepared to navigate the complexities of tomorrow’s financial landscape, turning what was once a tedious back-office function into a strategic powerhouse.