In today’s competitive business landscape, the role of the Chief Financial Officer (CFO) has expanded far beyond financial reporting and compliance. Modern CFOs are now strategic leaders—responsible for driving business growth, optimizing performance, and guiding companies through uncertainty. To achieve these goals, CFOs are increasingly turning to accounting firms as trusted partners.

At Xerosoft Global, we’ve seen how the right collaboration between accounting firms and CFOs empowers businesses to transform data into actionable insights, accelerate decision-making, and strengthen financial resilience.

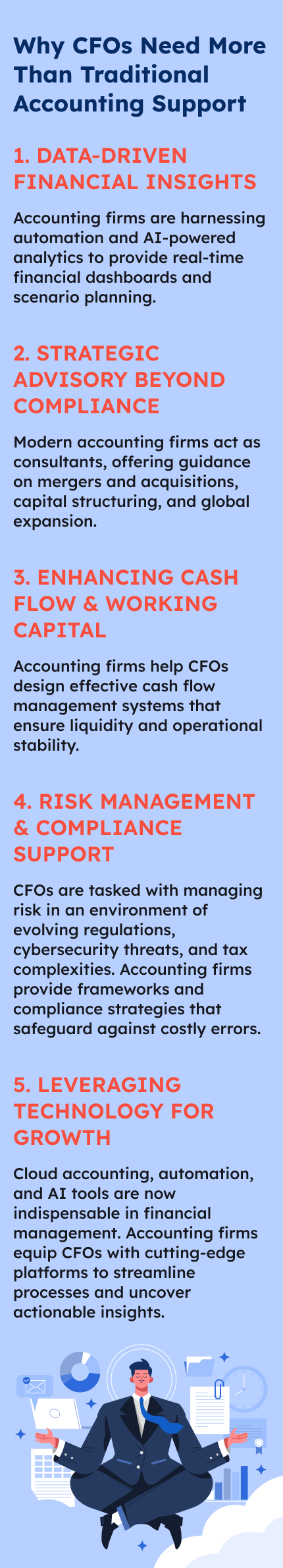

Why CFOs Need More Than Traditional Accounting Support

Gone are the days when accounting firms simply prepared tax returns and balanced books. Today’s firms leverage advanced technology, data analytics, and advisory services to provide CFOs with the tools and strategies necessary for growth. According to PwC’s 2024 CFO Pulse Survey, 73% of CFOs say they are focused on growth initiatives over cost-cutting, underscoring the strategic shift in their role.

1. Data-Driven Financial Insights

Accounting firms are harnessing automation and AI-powered analytics to provide real-time financial dashboards and scenario planning.

Statistic: Gartner reports that 70% of CFOs plan to increase spending on digital tools that enhance decision-making and analytics.

Key Benefit: With deeper visibility into performance, CFOs can identify growth opportunities, reduce inefficiencies, and make faster, more informed decisions.

2. Strategic Advisory Beyond Compliance

Modern accounting firms act as consultants, offering guidance on mergers and acquisitions, capital structuring, and global expansion.

Analytics Insight: Deloitte found that 65% of CFOs rely on external advisors when navigating strategic financial decisions, especially in volatile markets.

Key Benefit: CFOs gain a partner that understands complex financial landscapes and provides solutions tailored for scaling.

3. Enhancing Cash Flow & Working Capital

Accounting firms help CFOs design effective cash flow management systems that ensure liquidity and operational stability.

Statistic: A U.S. Bank study revealed that 82% of business failures are linked to poor cash flow management.

Key Benefit: With accounting firms’ expertise, CFOs can optimize working capital, prevent financial strain, and support sustainable growth.

4. Risk Management & Compliance Support

CFOs are tasked with managing risk in an environment of evolving regulations, cybersecurity threats, and tax complexities. Accounting firms provide frameworks and compliance strategies that safeguard against costly errors.

Analytics Insight: The Association of Certified Fraud Examiners (ACFE) estimates that businesses lose 5% of annual revenue to fraud—a risk significantly reduced with proper oversight.

Key Benefit: By leveraging accounting firms, CFOs minimize risk exposure and protect business continuity.

5. Leveraging Technology for Growth

Cloud accounting, automation, and AI tools are now indispensable in financial management. Accounting firms equip CFOs with cutting-edge platforms to streamline processes and uncover actionable insights.

Statistic: According to Sage, 67% of finance leaders believe automation has improved both accuracy and efficiency in financial management.

Key Benefit: CFOs can reallocate time from manual processes to high-value strategy and innovation initiatives.

Conclusion

CFOs today are expected to be visionaries who drive growth, not just guardians of the balance sheet. By partnering with forward-thinking accounting firms, they gain access to analytics, technology, and strategic expertise that accelerate business performance.

At Xerosoft Global, we empower CFOs with the insights and solutions needed to not only manage financial operations but also unlock new avenues for growth. In an era where financial leadership defines competitive advantage, the collaboration between CFOs and accounting firms is more crucial than ever.