The accounting profession is undergoing a significant transformation. Traditionally viewed as meticulous number-crunchers, accountants are now stepping into roles as strategic business advisors. This evolution is driven by automation taking over routine tasks, allowing accountants to focus on providing strategic financial planning, tax optimization, and business growth insights. Emphasizing personalized client services has become paramount in today’s market. Companies like Xerosoft Global are developing advanced accounting solutions that further enhance this shift.

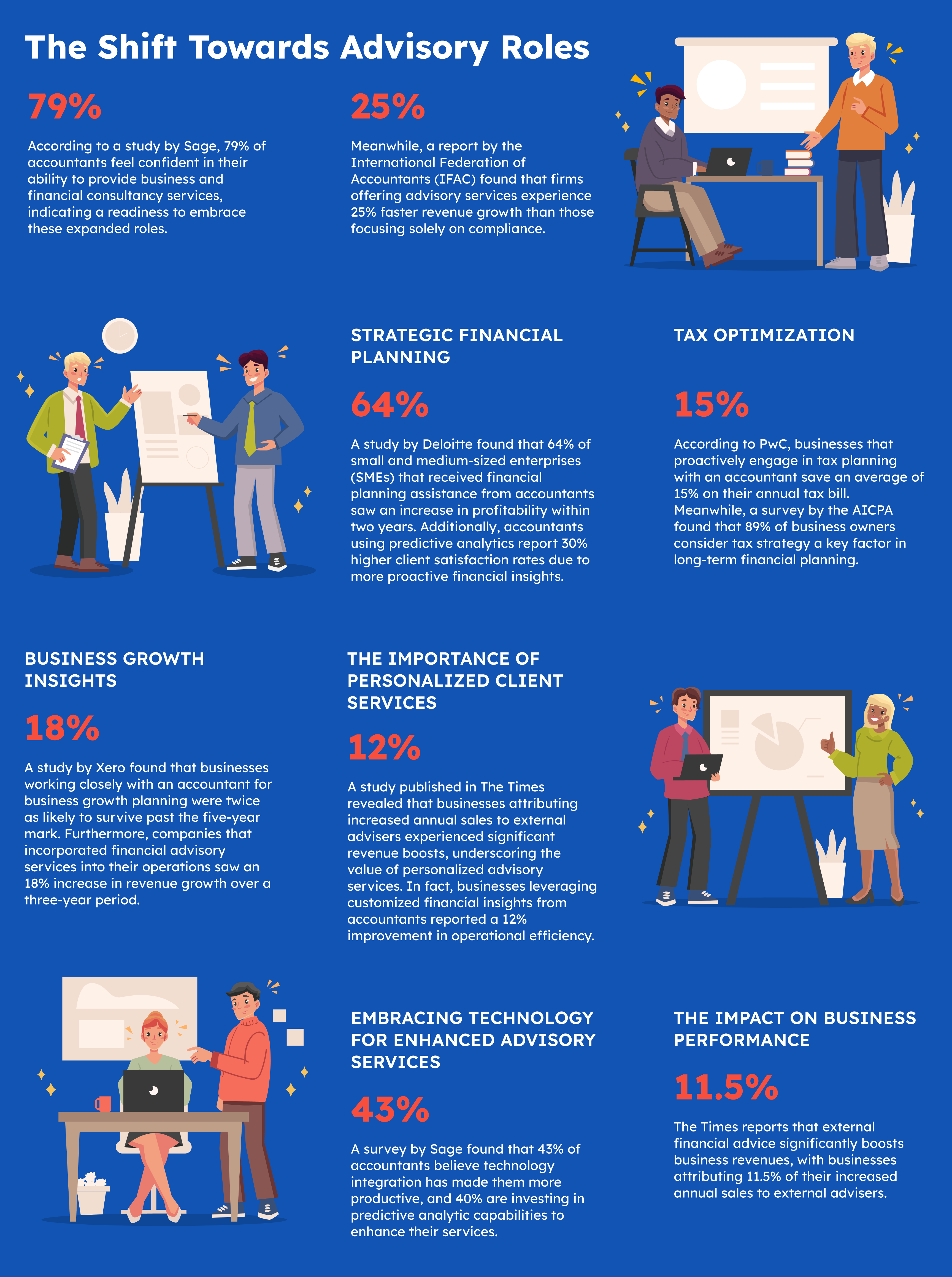

The Shift Towards Advisory Roles

Automation and technological advancements have revolutionized the accounting landscape. Tasks such as data entry, transaction recording, and basic compliance are now efficiently handled by software, reducing the need for manual intervention. This shift has freed accountants to engage in more analytical and advisory capacities.

According to a study by Sage, 79% of accountants feel confident in their ability to provide business and financial consultancy services, indicating a readiness to embrace these expanded roles. Meanwhile, a report by the International Federation of Accountants (IFAC) found that firms offering advisory services experience 25% faster revenue growth than those focusing solely on compliance.

Strategic Financial Planning

Accountants are increasingly involved in strategic financial planning, guiding businesses through complex decision-making processes. Their expertise in financial analysis and forecasting enables them to evaluate financial statements, identify trends, and assess the overall financial health of organizations. This comprehensive analysis aids business leaders in making informed, data-driven decisions.

A study by Deloitte found that 64% of small and medium-sized enterprises (SMEs) that received financial planning assistance from accountants saw an increase in profitability within two years. Additionally, accountants using predictive analytics report 30% higher client satisfaction rates due to more proactive financial insights. Xerosoft Global financial software enables accountants to provide predictive analytics and strategic insights, further strengthening their advisory role.

Tax Optimization

Navigating the intricate web of tax regulations requires specialized knowledge. Accountants play a crucial role in ensuring compliance and identifying opportunities for tax optimization. By staying abreast of changing tax laws, they help businesses minimize liabilities and capitalize on available incentives. This proactive approach not only ensures compliance but also contributes to the financial well-being of the organization.

According to PwC, businesses that proactively engage in tax planning with an accountant save an average of 15% on their annual tax bill. Meanwhile, a survey by the AICPA found that 89% of business owners consider tax strategy a key factor in long-term financial planning . Xerosoft Global AI-driven tax optimization tools provide businesses with real-time tax insights, ensuring compliance and cost savings.

Business Growth Insights

Beyond financial planning and tax matters, accountants are now pivotal in driving business growth. Their analytical skills enable them to identify market trends, assess risks, and provide insights that inform strategic decisions. By leveraging real-time data, accountants can offer guidance on expansion opportunities, investment strategies, and operational improvements.

A study by Xero found that businesses working closely with an accountant for business growth planning were twice as likely to survive past the five-year mark. Furthermore, companies that incorporated financial advisory services into their operations saw an 18% increase in revenue growth over a three-year period. Xerosoft Global business intelligence platform enables accountants to track financial performance and offer data-driven growth strategies.

The Importance of Personalized Client Services

In today’s competitive market, personalized client services have become a differentiator. Clients seek advisors who understand their unique challenges and can offer tailored solutions. Accountants, with their deep understanding of financial data and business operations, are well-positioned to provide this personalized service.

A study published in The Times revealed that businesses attributing increased annual sales to external advisers experienced significant revenue boosts, underscoring the value of personalized advisory services. In fact, businesses leveraging customized financial insights from accountants reported a 12% improvement in operational efficiency.

Embracing Technology for Enhanced Advisory Services

The integration of technology is central to the evolving role of accountants. By adopting advanced tools, accountants can automate routine tasks, allowing more time for strategic advisory functions. A survey by Sage found that 43% of accountants believe technology integration has made them more productive, and 40% are investing in predictive analytic capabilities to enhance their services.

Cloud-based accounting platforms such as QuickBooks, Xero, and SAP have enabled accountants to access real-time financial data, improving their ability to provide timely and relevant advice. Meanwhile, AI-driven accounting tools are expected to reduce manual work by 50% within the next decade, further solidifying the shift toward advisory role. Xerosoft Global AI-powered automation tools further streamline accounting workflows, enhancing efficiency and decision-making.

The Impact on Business Performance

The transition of accountants into advisory roles has tangible benefits for businesses. The Times reports that external financial advice significantly boosts business revenues, with businesses attributing 11.5% of their increased annual sales to external advisers. Sole traders earned an additional $6,175, those with 10-49 employees an extra $180,156, and those with 100-250 employees generated $553,009 more.

Challenges and Opportunities

While the evolving role of accountants presents numerous opportunities, it also comes with challenges. The profession faces a critical skills shortage, partly due to outdated stereotypes. Initiatives like Xero’s Mentor Match program aim to attract new talent by showcasing the dynamic, impactful nature of contemporary accounting work.

A report by the AICPA found that 62% of accounting firms struggle to find professionals with the right mix of technical and advisory skills. To address this, many firms are investing in ongoing professional development, ensuring accountants are equipped to handle the demands of modern advisory roles. Xerosoft Global is playing a key role in addressing this gap by offering training programs and AI-driven solutions that enhance advisory skill sets.

The role of accountants has evolved from traditional number-crunching to strategic business advisory. By embracing technology and focusing on personalized client services, accountants are now integral to strategic financial planning, tax optimization, and business growth initiatives. This evolution not only enhances the value accountants bring to their clients but also contributes significantly to the overall success and competitiveness of businesses in today’s dynamic market landscape.

As accountants continue to expand their roles, businesses that leverage their expertise stand to gain a competitive advantage in an increasingly complex financial environment. Firms that fail to adapt may find themselves falling behind, highlighting the importance of continuous learning and technological adoption in the modern accounting profession. Xerosoft Global remains at the forefront of this transformation, providing cutting-edge tools that empower accountants to thrive in their advisory roles.

Resources:

- The Guardian. ‘Life-changing conversations’: why the accounting industry is nothing like you imagine

- Reuters. AI startup Basis raises $34 million for accounting automation ‘agent’

- Business Insider. KPMG’s AI chief explains how to make AI work for your business