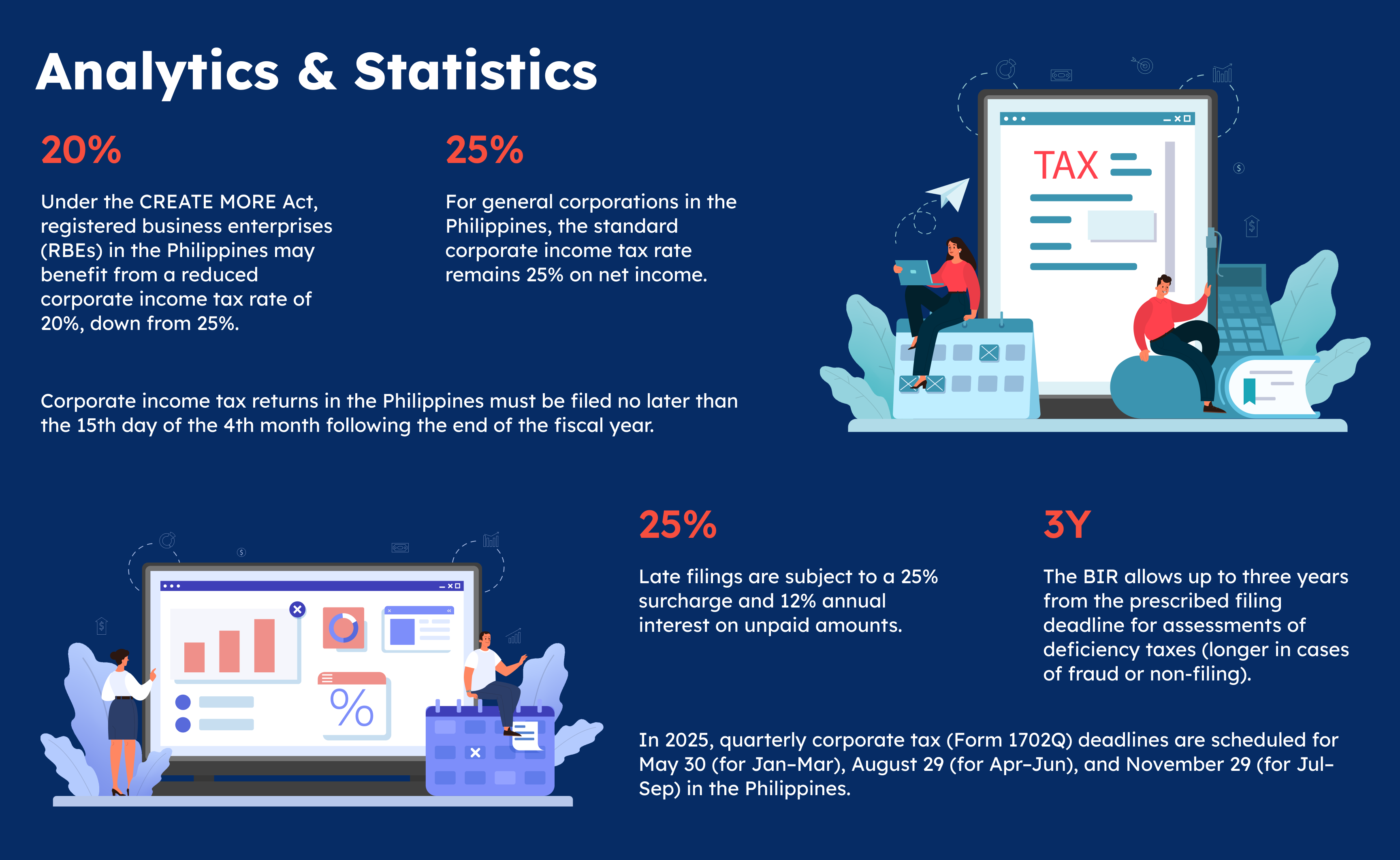

In 2025, corporations must navigate not only evolving tax regulations but also updated deadlines that affect compliance strategies and planning. Using a solution like Xerosoft Global can help companies stay on top of shifting tax calendars and avoid costly penalties.

Key Benefits (of Adapting to the 2025 Changes & Using Systems like Xerosoft Global)

Timely Compliance & Avoidance of Penalties

Knowing the new 2025 deadlines ensures that your tax team doesn’t miss filing windows, avoiding surcharges, interest, or audits.

Better Cash Flow Forecasting

With clear deadlines, your finance team can more accurately plan cash reserves for tax payments, reducing surprises.

Automated Reminders & Tracking

Through platforms like Xerosoft Global, firms can automate alerts and tracking workflows for major tax deadlines, ensuring no filing is overlooked.

Centralized Documentation & Audit Trail

Keeping all tax filings, audit documents, and compliance records in one platform helps support accuracy and ease during BIR assessments.

Scalability & Multi-Jurisdiction Support

If your company operates in multiple regions or countries, a system like Xerosoft Global can adapt to differing tax calendars and rules without manual overhead.

Conclusion

The year 2025 introduces important changes and clarified deadlines for corporate tax filing, especially in jurisdictions like the Philippines under new tax reforms. As deadlines tighten and regulatory expectations grow, leveraging robust tax management tools becomes not just a convenience—but a necessity.

By integrating a specialized platform like Xerosoft Global, companies can more confidently navigate shifting tax calendars, maintain compliance, reduce risk, and free resources to focus on strategic growth.

References