Artificial Intelligence (AI) is rapidly transforming the accounting industry. From automating bookkeeping tasks to delivering predictive financial insights, AI is redefining how firms deliver value. Yet, as AI adoption accelerates, one question remains at the forefront: how do accounting firms build and maintain client trust in an era where algorithms handle sensitive financial data?

At Xerosoft Global, we believe that the integration of AI in accounting is not just about efficiency—it’s about creating transparency, accuracy, and stronger client relationships. Below, we explore how trust is built and sustained in the age of AI accounting, supported by analytics, statistics, and key benefits.

The Rise of AI in Accounting

AI adoption in accounting is surging. A recent report by Deloitte shows that 73% of finance executives are increasing investments in AI and automation to improve accuracy and reduce costs. Meanwhile, Gartner predicts that by 2026, over 80% of corporate finance teams will rely on AI-driven analytics for decision-making.

These numbers underscore the growing reliance on AI—but they also highlight why trust and transparency must be central to AI-powered accounting services.

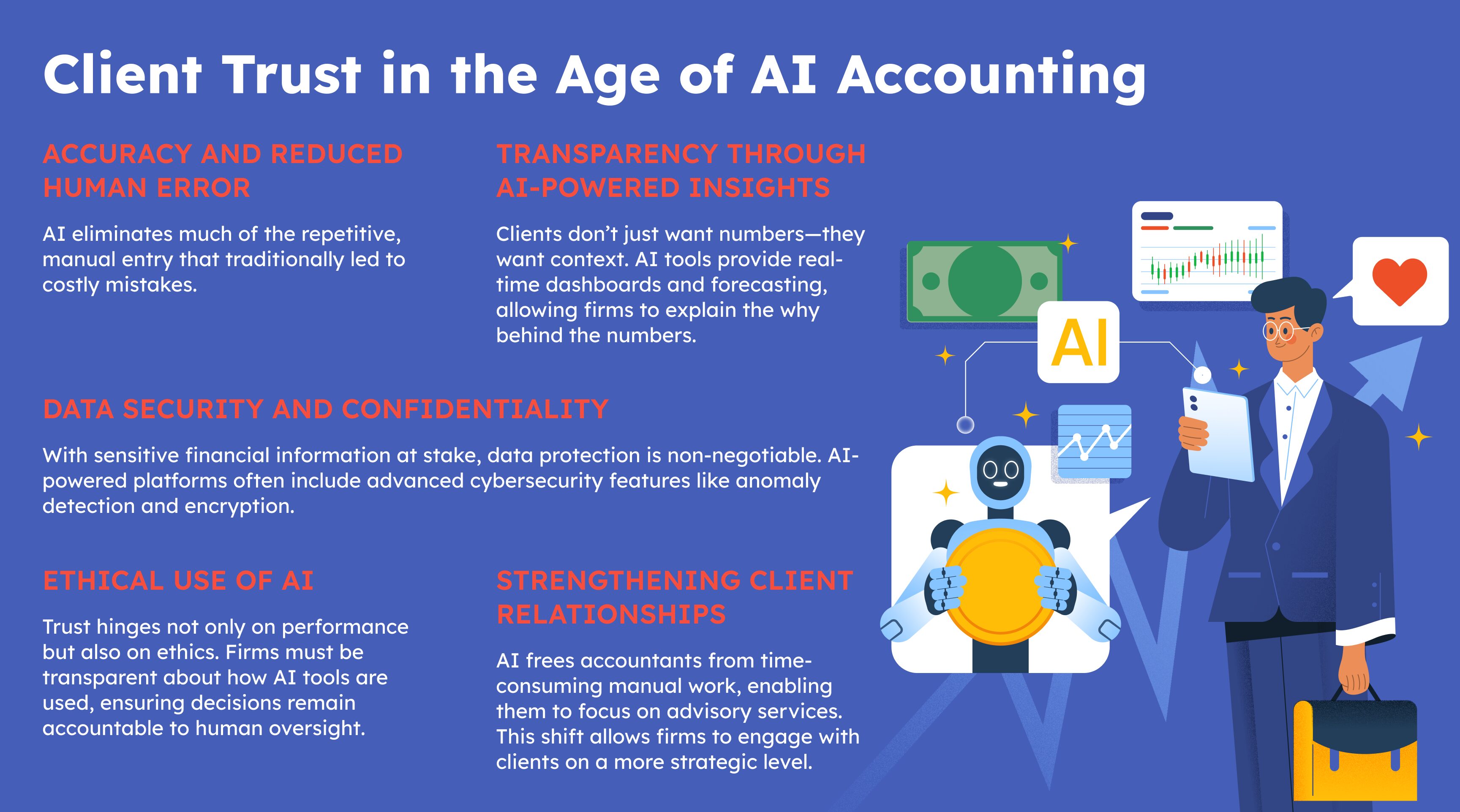

Accuracy and Reduced Human Error

AI eliminates much of the repetitive, manual entry that traditionally led to costly mistakes.

Statistic: According to the Journal of Accountancy, AI-driven automation can reduce data entry errors by up to 90%, ensuring more reliable financial statements.

Key Benefit: Clients trust firms that consistently deliver accurate financial reporting, minimizing compliance risks and tax penalties.

Transparency Through AI-Powered Insights

Clients don’t just want numbers—they want context. AI tools provide real-time dashboards and forecasting, allowing firms to explain the why behind the numbers.

Analytics Insight: A PwC survey revealed that 67% of CEOs say transparency in data use directly impacts trust with stakeholders.

Key Benefit: When clients see how their data drives actionable insights, trust in both the process and the firm grows.

Data Security and Confidentiality

With sensitive financial information at stake, data protection is non-negotiable. AI-powered platforms often include advanced cybersecurity features like anomaly detection and encryption.

Statistic: Cybersecurity Ventures estimates that global cybercrime damages will reach $10.5 trillion annually by 2025—making security a cornerstone of client trust.

Key Benefit: Firms that integrate AI while prioritizing secure data handling reassure clients that their information is protected.

Ethical Use of AI

Trust hinges not only on performance but also on ethics. Firms must be transparent about how AI tools are used, ensuring decisions remain accountable to human oversight.

Analytics Insight: An Edelman Trust Barometer study found that 60% of clients expect companies to disclose when they’re using AI in services.

Key Benefit: By openly communicating how AI is applied, firms position themselves as trustworthy partners rather than faceless tech operators.

Strengthening Client Relationships

AI frees accountants from time-consuming manual work, enabling them to focus on advisory services. This shift allows firms to engage with clients on a more strategic level.

Statistic: A Sage report found that 58% of accountants say AI enables them to spend more time building client relationships.

Key Benefit: Clients gain confidence knowing their accountants are not just number crunchers but trusted advisors helping them plan for growth.

Conclusion

In the age of AI, client trust is built on three pillars: accuracy, transparency, and ethical responsibility. Accounting firms that embrace AI while prioritizing these principles will not only streamline operations but also strengthen long-term client relationships.

At Xerosoft Global, we help businesses harness AI accounting tools responsibly—ensuring accuracy, security, and insights that clients can trust. As AI continues to evolve, the firms that lead with integrity and innovation will be the ones that win client loyalty.

References

- Deloitte. Trust Emerges as Main Barrier to Agentic AI Adoption in Finance and Accounting, Despite Optimism Around the Tech

- Botkeeper. AI for Accounting: How Artificial Intelligence is Transforming the Profession

- Financial Times. Business school teaching case study: taking accountancy from spreadsheets to AI

- Inside Public Accounting. Perspectives from the Profession: Responsible AI in Accounting