Artificial intelligence is rapidly reshaping the accounting industry, automating tasks that once required hours of manual effort. From transaction categorization to real-time reporting, AI-powered bookkeeping tools are transforming how financial data is managed. However, despite these advancements, human bookkeepers remain essential for judgment, strategy, and compliance.

Rather than choosing between AI and people, forward-thinking businesses are discovering that the real advantage lies in striking the right balance. Organizations working with modern accounting partners like Xerosoft Global are blending automation with human expertise to achieve accuracy, efficiency, and strategic insight.

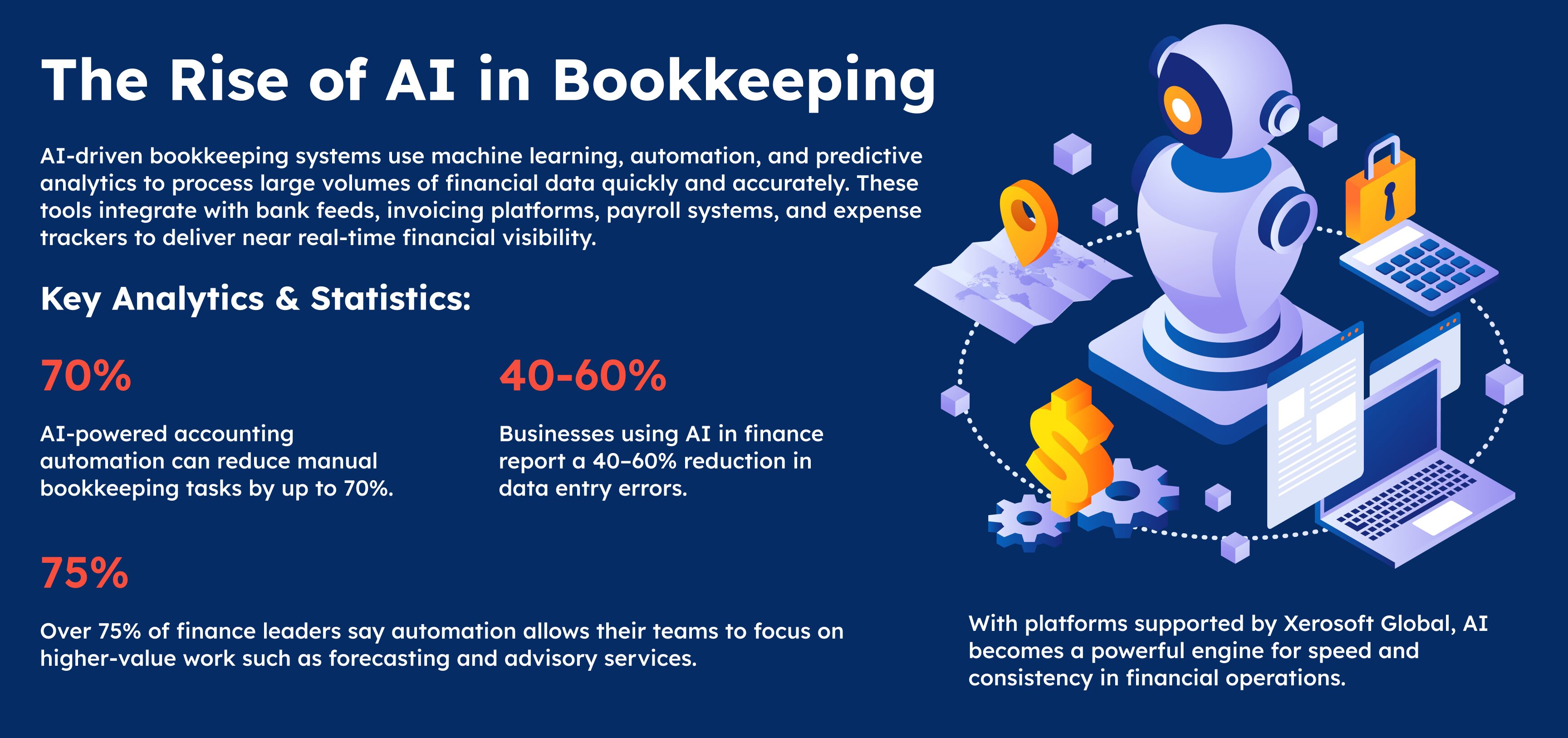

Where AI Excels in Bookkeeping

1. Speed and Efficiency

AI processes thousands of transactions in seconds, far outperforming manual methods. Routine tasks like reconciliation, expense categorization, and invoice matching are completed with minimal human intervention.

2. Cost Reduction

By automating repetitive work, businesses lower operational costs and reduce reliance on manual labor for basic bookkeeping tasks.

Statistic:

Companies adopting AI-based bookkeeping solutions save an average of 20–30% in accounting-related costs annually.

3. Real-Time Financial Insights

AI enables real-time dashboards, allowing businesses to monitor cash flow, revenue, and expenses continuously—critical for agile decision-making.

Why Human Bookkeepers Still Matter

Despite AI’s capabilities, human expertise remains irreplaceable in several key areas.

1. Professional Judgment and Context

AI follows patterns and rules, but it lacks business intuition. Human bookkeepers understand context—such as unusual transactions, industry-specific nuances, and regulatory considerations.

2. Compliance and Risk Management

Tax laws, accounting standards, and compliance requirements frequently change. Human professionals ensure financial records align with current regulations and interpret gray areas where AI cannot.

Analytics Insight:

Over 60% of compliance errors occur due to misinterpretation rather than data entry mistakes—highlighting the importance of human oversight.

3. Strategic Advisory and Forecasting

Human bookkeepers translate financial data into actionable insights. They help business owners understand trends, assess risks, and plan for growth—capabilities that AI alone cannot fully replicate.

Striking the Right Balance: AI + Human Expertise

The most effective bookkeeping models combine AI automation with skilled human oversight. AI handles speed, accuracy, and data processing, while humans provide analysis, judgment, and strategic direction.

Companies partnering with Xerosoft Global benefit from this hybrid approach—leveraging advanced AI tools while maintaining access to experienced bookkeeping professionals who ensure accuracy and compliance.

Key Benefits of a Balanced Bookkeeping Approach

- Higher Accuracy: AI reduces errors; humans validate complex entries.

- Operational Efficiency: Automation frees professionals to focus on advisory work.

- Better Decision-Making: Real-time data paired with expert interpretation.

- Improved Compliance: Human oversight ensures regulatory alignment.

- Scalable Growth: Systems and expertise grow with the business.

The Future of Bookkeeping

Looking ahead, the accounting industry will continue evolving toward collaboration between humans and intelligent systems.

Statistic:

By 2027, more than 85% of accounting workflows are expected to involve AI in some capacity—but human professionals will remain central to financial strategy and governance.

Conclusion

The debate between AI and human bookkeepers is not about replacement—it’s about collaboration. AI delivers speed, efficiency, and real-time insights, while human bookkeepers bring judgment, compliance expertise, and strategic value.

Businesses that strike the right balance gain the best of both worlds. By adopting a hybrid bookkeeping model through trusted partners like Xerosoft Global, organizations can enhance accuracy, reduce costs, and make smarter financial decisions—positioning themselves for long-term success in an increasingly digital economy.

References

- StanfordReport. How AI is improving accounting efficiency

- Entrepreneurs Accounting Academy. Human Bookkeepers vs. AI Bookkeeping Software

- AutoEntry. AI Bookkeeping vs Traditional Methods: A Complete Guide

- TechRadar. AI tools are proving to be a massive help for financial firms – but for how long?