In Singapore’s rapidly evolving business environment, AI and automation are revolutionizing payroll management by enhancing accuracy, reducing manual tasks, and ensuring compliance with regulatory requirements. With increasingly complex tax laws, evolving employee benefits, and the rise of remote and global workforces, AI-driven payroll solutions offer businesses a seamless way to optimise processes while reducing administrative burdens.

The Impact of AI on Payroll Processing

Payroll management is a vital yet time-consuming function. Traditional payroll systems often require extensive manual input, increasing the risk of errors, delays, and compliance issues. AI and automation streamline payroll by optimising salary calculations, tax deductions, regulatory compliance, and payroll analytics—allowing businesses to focus on strategic growth.

Key Industry Insights:

- AI-powered payroll systems reduce payroll errors by 30% and improve processing efficiency by 25% (Deloitte).

- Automated payroll solutions can lower payroll processing costs by up to 40% (PwC).

- 60% of payroll professionals believe automation improves compliance and reporting accuracy (Global Payroll Association).

By leveraging AI-driven payroll platforms, businesses can achieve greater efficiency, cost savings, and seamless regulatory compliance in Singapore’s business landscape.

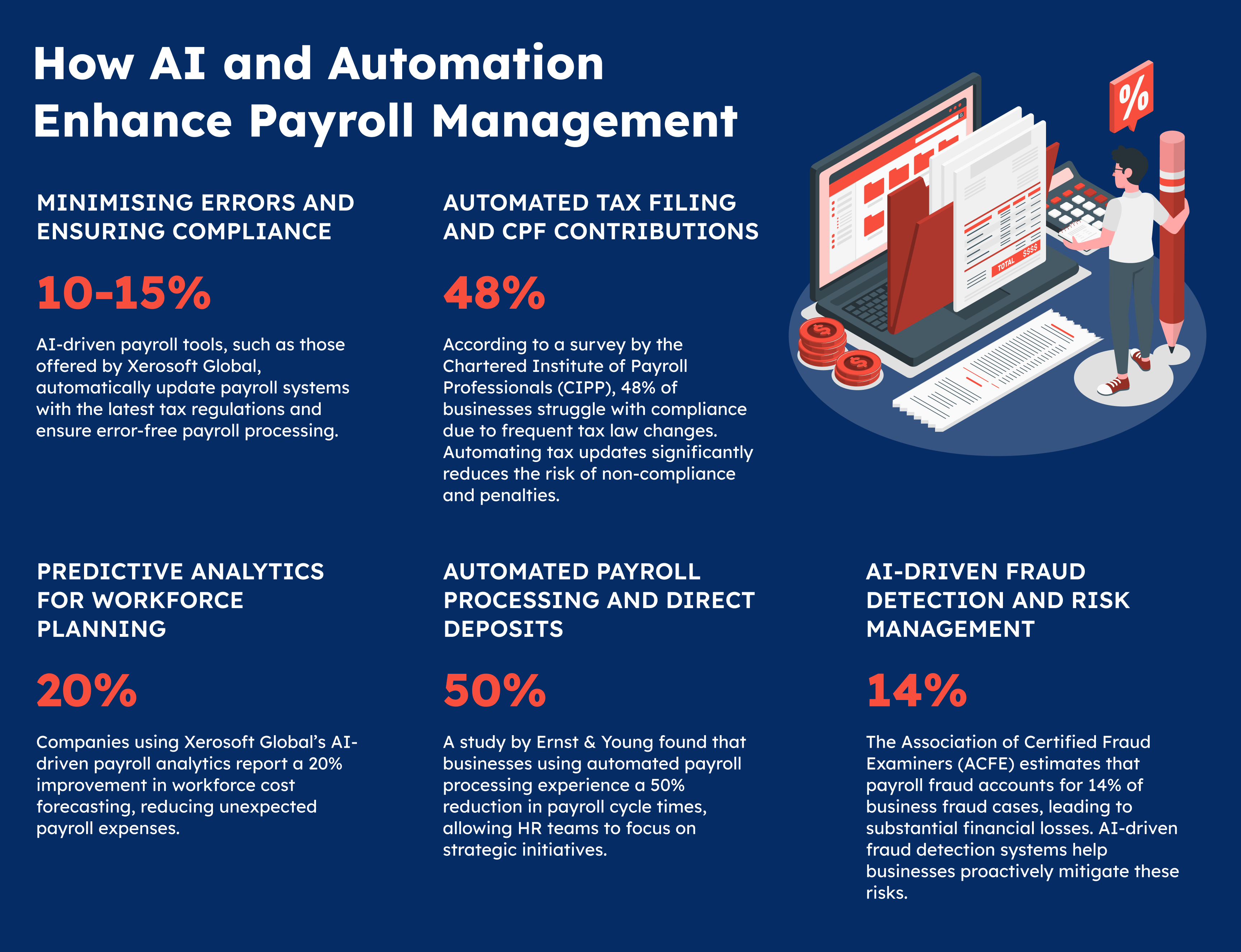

How AI and Automation Enhance Payroll Management

Minimising Errors and Ensuring Compliance

Manual payroll processes are prone to calculation errors, incorrect tax filings, and compliance risks. AI-powered payroll solutions use machine learning and data analytics to detect discrepancies, flag anomalies, and ensure compliance with Singapore’s tax and employment laws.

Example: AI-driven payroll tools, such as those offered by Xerosoft Global, automatically update payroll systems with the latest tax regulations and ensure error-free payroll processing.

Automated Tax Filing and CPF Contributions

Staying updated on regulatory changes, CPF contributions, and tax obligations can be challenging. AI-driven payroll systems automatically adjust tax calculations and CPF contributions based on real-time regulatory updates, ensuring accurate tax filings and payroll processing.

Benefit: According to a survey by the Chartered Institute of Payroll Professionals (CIPP), 48% of businesses struggle with compliance due to frequent tax law changes. Automating tax updates significantly reduces the risk of non-compliance and penalties.

Predictive Analytics for Workforce Planning

AI-powered payroll systems leverage predictive analytics to provide insights into labour costs, workforce trends, and budgeting. By analysing historical payroll data, businesses can optimise workforce planning, forecast salary costs, and manage resources effectively.

Case Study: Companies using Xerosoft Global’s AI-driven payroll analytics report a 20% improvement in workforce cost forecasting, reducing unexpected payroll expenses.

Automated Payroll Processing and Direct Deposits

Automating payroll calculations and direct salary disbursements ensures timely and accurate employee payments while reducing administrative workload. AI-powered payroll solutions integrate seamlessly with Singapore’s banking systems to streamline payroll transfers.

Market Insight: A study by Ernst & Young found that businesses using automated payroll processing experience a 50% reduction in payroll cycle times, allowing HR teams to focus on strategic initiatives.

AI-Driven Fraud Detection and Risk Management

Payroll fraud remains a significant concern for businesses. AI-powered payroll solutions use advanced anomaly detection to identify duplicate payments, unauthorised salary adjustments, and fraudulent transactions, minimising financial risks.

Industry Data: The Association of Certified Fraud Examiners (ACFE) estimates that payroll fraud accounts for 14% of business fraud cases, leading to substantial financial losses. AI-driven fraud detection systems help businesses proactively mitigate these risks.

The Future of AI in Payroll Management

As AI and automation continue to advance, future payroll systems will integrate:

Chatbot-driven employee self-service portals for payroll queries and payslip access

Blockchain-based payroll security for enhanced data integrity and compliance

AI-driven financial wellness programs to support employee benefits and compensation planning

Why Choose Xerosoft Global?

Xerosoft Global is a leading provider of AI-driven payroll solutions, offering businesses the tools and technology needed to streamline payroll operations.

- Advanced AI Technology – Automates payroll calculations, tax updates, and compliance checks

- Seamless Integration – Connects with HR, accounting, and banking systems for a unified payroll experience

- Robust Analytics – Provides predictive insights for workforce planning and budgeting

- Fraud Prevention – Detects anomalies and prevents payroll fraud with AI-powered monitoring

The integration of AI and automation into payroll management is transforming the way businesses handle payroll—improving efficiency, accuracy, and compliance. Organisations that embrace AI-driven payroll solutions can reduce costs, minimise errors, and enhance payroll security.

With Xerosoft Global, businesses in Singapore can leverage state-of-the-art AI-powered payroll technologies to ensure seamless payroll processing, regulatory compliance, and long-term operational success.

Investing in AI-powered payroll solutions is no longer a luxury—it is a necessity for staying competitive in Singapore’s evolving business landscape.

Reference:

- Zipdo. AI in the payroll industry statistics

- Slideshare. PwC Total Cost of Ownership Study – Exposing the Hidden Cost of Payroll and Hr Administration

- Payday PH. How Companies in the Philippines Benefit from Payroll Software