As cryptocurrencies become increasingly integrated into mainstream finance, accounting firms and finance professionals are faced with the complex task of managing and reporting digital assets. Despite the innovation and potential that cryptocurrencies bring, they pose unique challenges from an accounting and regulatory standpoint. In this blog post, we’ll explore the key challenges in accounting for cryptocurrencies, offer best practices to stay compliant, and highlight how Xerosoft Global supports businesses in navigating this emerging financial landscape.

The Rise of Cryptocurrency in Business

According to a 2024 report by Chainalysis, global cryptocurrency transaction volume reached over $11 trillion, a staggering increase from previous years. More than 300 million people worldwide now own or use cryptocurrency, and thousands of businesses accept crypto payments. As a result, understanding the accounting implications of digital assets is no longer optional—it’s essential.

Key Challenges in Cryptocurrency Accounting

Valuation and Volatility

Cryptocurrencies are highly volatile. Their values can fluctuate dramatically within minutes, making it difficult to accurately assess their fair market value at any given time.

Classification Dilemma

Should cryptocurrencies be classified as inventory, an intangible asset, or investment? There’s no universal consensus. While U.S. GAAP treats them as intangible assets, IFRS may allow different interpretations.

Lack of Regulatory Uniformity

Different countries have adopted varied standards for crypto accounting. This lack of consistency leads to compliance risks, especially for multinational firms.

Tax Implications

Every crypto transaction—whether it’s a sale, trade, or conversion—can trigger a taxable event. Keeping accurate records for each of these is labor-intensive and error-prone without the right systems.

Security and Audit Trail

Ensuring the integrity of crypto transactions and maintaining a reliable audit trail is a major concern. The anonymity and decentralized nature of blockchain can complicate traditional auditing methods.

Best Practices for Crypto Accounting

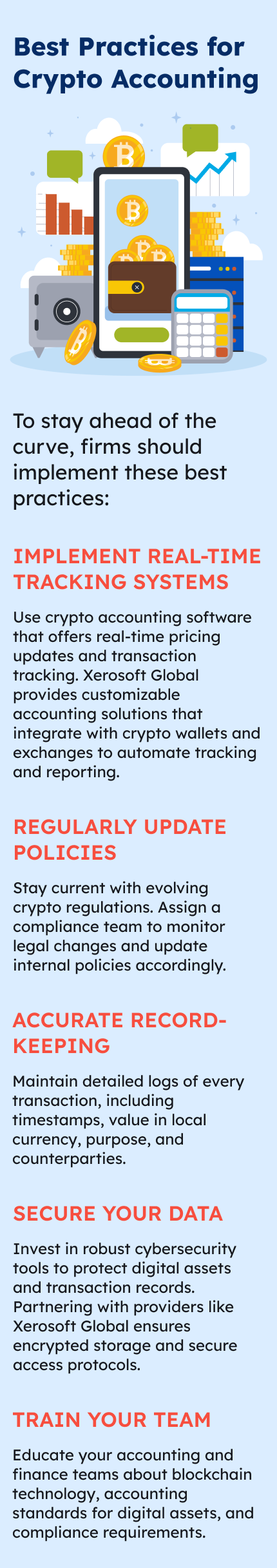

To stay ahead of the curve, firms should implement these best practices:

Implement Real-Time Tracking Systems

Use crypto accounting software that offers real-time pricing updates and transaction tracking. Xerosoft Global provides customizable accounting solutions that integrate with crypto wallets and exchanges to automate tracking and reporting.

Regularly Update Policies

Stay current with evolving crypto regulations. Assign a compliance team to monitor legal changes and update internal policies accordingly.

Accurate Record-Keeping

Maintain detailed logs of every transaction, including timestamps, value in local currency, purpose, and counterparties.

Secure Your Data

Invest in robust cybersecurity tools to protect digital assets and transaction records. Partnering with providers like Xerosoft Global ensures encrypted storage and secure access protocols.

Train Your Team

Educate your accounting and finance teams about blockchain technology, accounting standards for digital assets, and compliance requirements.

Key Benefits of Structured Crypto Accounting

Adopting a structured approach to cryptocurrency accounting brings measurable advantages:

- Reduced Compliance Risk – Automated systems lower the risk of reporting errors.

- Improved Financial Transparency – Accurate valuation and reporting enhance investor and stakeholder trust.

- Operational Efficiency – Integrated solutions save time and reduce manual workloads.

- Better Decision-Making – Real-time insights into asset performance support strategic planning.

Analytics: How Crypto Impacts Financial Reporting

A survey conducted by Deloitte in 2024 revealed that 62% of CFOs find cryptocurrency reporting to be the most confusing aspect of digital finance. Furthermore, companies using crypto in daily operations reported an 18% increase in audit-related hours compared to non-crypto counterparts. This data underscores the need for streamlined processes and expert support.

Why Choose Xerosoft Global?

Xerosoft Global stands out as a trusted partner for firms seeking clarity in crypto accounting. With robust integrations, regulatory compliance tools, and industry-specific insights, Xerosoft Global empowers businesses to embrace the future of finance with confidence. Whether you’re just beginning to accept crypto payments or managing a diversified digital asset portfolio, Xerosoft Global has the solutions to simplify your journey.

Conclusion

Accounting for cryptocurrency may be complex, but with the right strategies and support, businesses can overcome these challenges. As the crypto landscape evolves, proactive accounting practices and expert partnerships—like those offered by Xerosoft Global—will be essential for long-term success. Don’t let the intricacies of digital assets derail your operations—embrace best practices today and secure your financial future.

References