In today’s highly regulated and data-driven business environment, corporate tax strategy is no longer about year-end calculations alone. With tax authorities tightening compliance rules and increasing audit scrutiny, companies must be more proactive and precise in how they identify and claim deductions. Technology is now a critical enabler—helping finance teams uncover overlooked deductions, reduce risk, and improve tax efficiency.

Why Technology Is Transforming Corporate Tax Strategy

- Automating data collection across departments

- Applying tax rules consistently

- Identifying deductible items in real time

- Creating defensible audit trails

Key Technologies Driving Smarter Tax Deductions

Tax Automation Software

Automated tax platforms integrate with ERP and accounting systems to categorize expenses accurately. This reduces human error and ensures deductible costs—such as depreciation, R&D expenses, and operating costs—are properly captured.

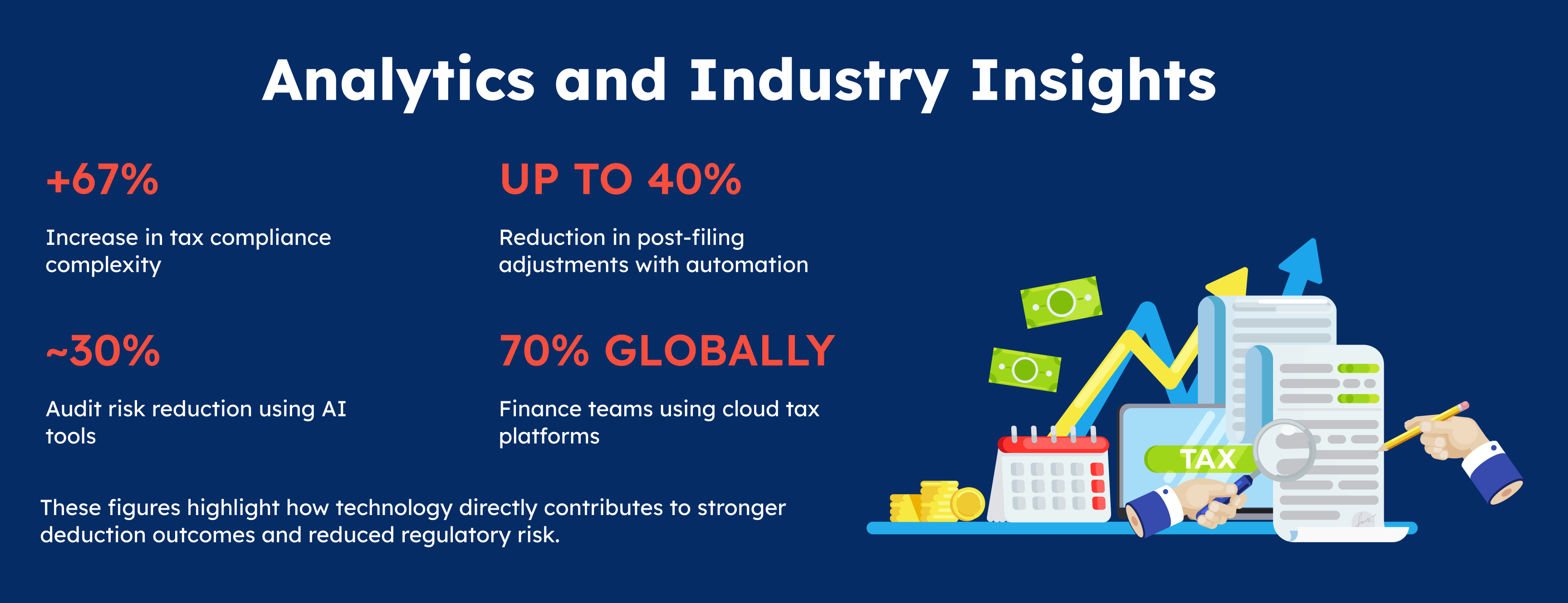

Deloitte reports that companies using automated tax tools experience up to 40% fewer filing adjustments after submission.

Advanced Data Analytics

- Identifying underutilized tax credits

- Optimizing depreciation schedules

- Comparing deductions across entities and regions

AI and Machine Learning

AI-powered tax solutions continuously learn from regulatory updates and past filings. They can flag unusual entries, recommend deduction strategies, and alert teams to compliance risks.

According to EY, organizations using AI in tax functions reduced audit exposure by 30% while improving deduction accuracy.

Cloud-Based Document Management

Cloud platforms centralize receipts, contracts, and expense records, ensuring documentation is always audit-ready. This is crucial, as lack of supporting documents is one of the most common reasons deductions are disallowed during audits.

Key Benefits of a Tech-Driven Tax Strategy

Maximized Legitimate Deductions

Automated identification and validation of deductible expenses ensure companies claim everything they are entitled to—without crossing compliance boundaries.

Improved Accuracy and Consistency

Technology eliminates inconsistent manual interpretations of tax rules, especially for organizations operating across multiple jurisdictions.

Stronger Audit Defense

Digital records, automated calculations, and analytics-backed decisions create a clear, defensible audit trail.

Strategic Financial Planning

With real-time visibility into tax positions, CFOs can make better decisions around investments, expansion, and cash flow management.

Reduced Operational Burden

Finance teams spend less time on reconciliations and corrections, freeing resources for higher-value strategic work.

Conclusion

Maximizing corporate tax deductions in today’s environment requires more than tax knowledge—it demands the intelligent use of technology. By leveraging automation, analytics, AI, and cloud-based systems, companies can transform tax strategy into a competitive advantage. The result is greater deduction accuracy, reduced audit risk, and more informed financial decision-making. As regulatory complexity continues to grow, organizations that invest in tech-enabled tax strategies will be best positioned to protect profitability and sustain long-term growth.

References

- PwC. Empowering tax operations with AI

- Thomson Reuters Institute. 2024 Corporate Tex Department Technology Report.

- Open Ledger. The Future of AI Tax Software: 5 Transformations for 2025