In an era of increasing globalization, multinational corporations face complex tax obligations across multiple jurisdictions. The traditional manual approach to tax filing — paper-based forms, spreadsheets, and fragmented reporting systems — is no longer sufficient. Enter digital tax filing, a transformative solution that streamlines compliance, enhances accuracy, and reduces risk.

Why Global Businesses Are Adopting Digital Tax Filing

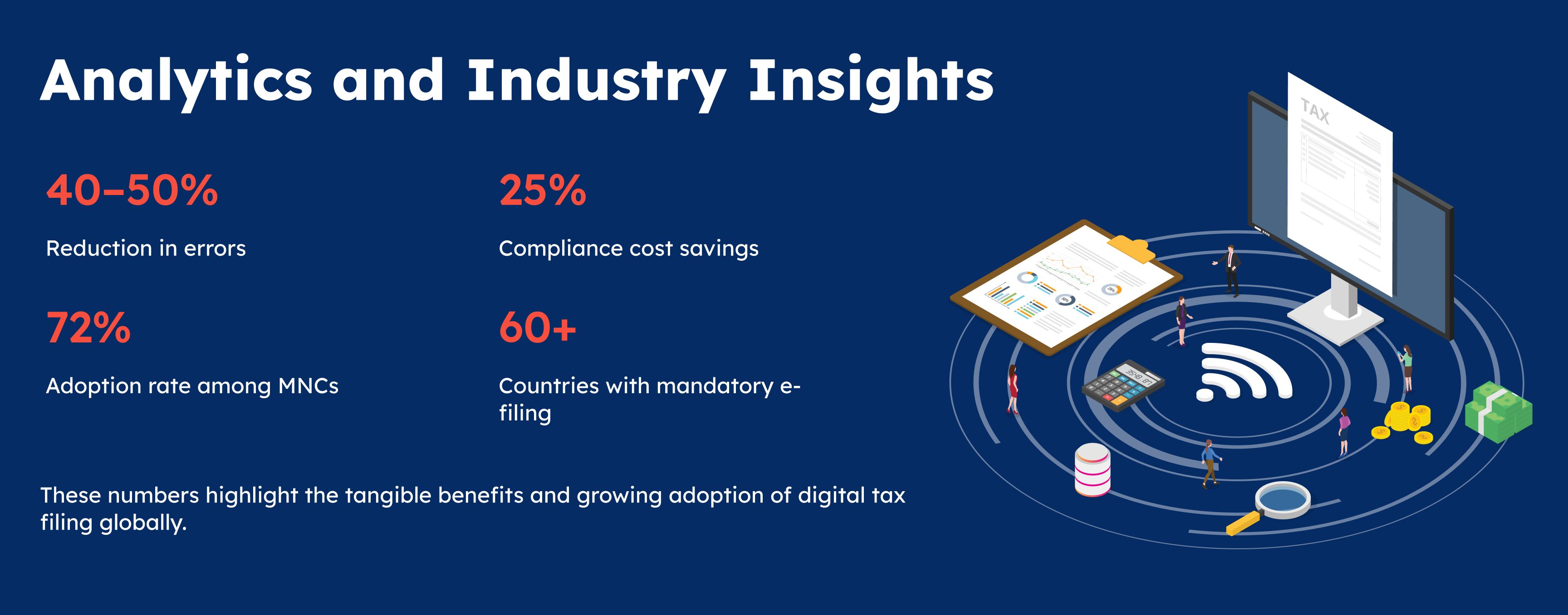

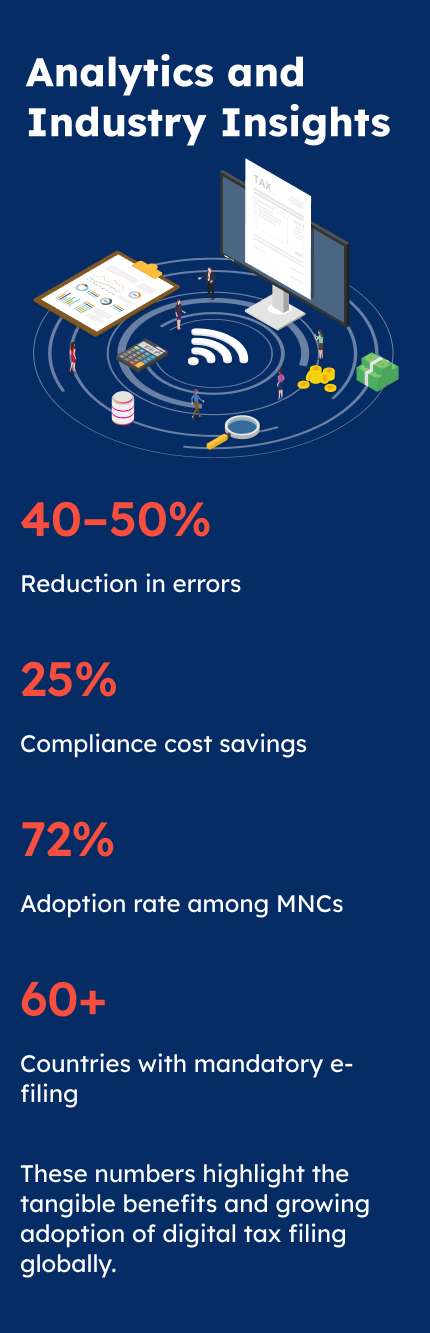

Digital tax filing leverages advanced technology to automate and centralize reporting. According to a Deloitte survey in 2024, 72% of large multinational companies reported that digital tools significantly reduced their corporate tax compliance errors. This shift is driven by several factors:

- Growing complexity of international tax rules: Measures like OECD’s Pillar Two and mandatory Country-by-Country Reporting (CbCR) require precise data tracking.

- Stricter penalties for late or inaccurate filings: Many jurisdictions now impose fines exceeding 5% of the corporate tax due for errors or delays.

Real-time reporting requirements: Countries such as Brazil, India, and the UAE increasingly demand electronic invoicing and continuous data submission.

Key Benefits of Digital Tax Filing

Enhanced Accuracy and Reduced Errors

Manual calculations and multiple data transfers introduce significant errors. Digital tax filing platforms automate calculations, flag inconsistencies, and integrate directly with accounting systems, cutting errors by an estimated 40–50%.

Streamlined Multi-Jurisdiction Compliance

Multinationals operating in 20+ countries can consolidate tax reporting through a single platform. This reduces redundancies and ensures consistency across global filings.

Time and Cost Efficiency

Automated workflows save finance teams countless hours previously spent on document preparation and reconciliation. According to PwC, companies using digital filing reduced compliance costs by an average of 25% annually.

Improved Audit Readiness

Digital platforms maintain a clear audit trail, simplifying the process during regulatory reviews and reducing the risk of penalties or disputes.

How Companies Like Xerosoft Global Are Leveraging Digital Filing

Organizations like Xerosoft Global have embraced digital tax solutions to:

- Automate multi-country corporate tax reporting

- Ensure compliance with local and international regulations

- Reduce manual workloads, enabling finance teams to focus on strategic tasks

- Gain real-time insights into tax liabilities and cash flow forecasts

This approach not only ensures compliance but also creates operational efficiencies and strengthens corporate governance.

Conclusion

Digital tax filing is no longer an optional upgrade — it’s a strategic necessity for global businesses. By automating processes, enhancing accuracy, and simplifying compliance across jurisdictions, companies can reduce costs, mitigate risks, and focus on strategic growth. For multinational corporations, adopting platforms like those used by Xerosoft Global ensures a smoother, more reliable tax filing experience, transforming a traditionally complex process into a competitive advantage.