Business succession planning is one of the most critical yet often overlooked aspects of long-term business sustainability. Whether it’s a family-owned enterprise, a startup, or a well-established corporation, planning for leadership transition is vital. This is where accounting firms—especially those like Xerosoft Global—play an indispensable role.

In this blog, we’ll explore how accounting firms contribute to effective succession strategies, supported by statistics, key benefits, and insights into why partnering with firms like Xerosoft Global is a strategic decision.

Why Succession Planning Matters

According to a 2024 report by PwC, 47% of private business owners do not have a formal succession plan. This lack of planning poses a significant threat to business continuity. Effective succession planning ensures:

- Smooth leadership transition

- Preservation of company values and vision

- Financial stability during transitional periods

- Reduced operational and legal risks

Yet, many businesses delay this planning due to lack of time, expertise, or the false belief that it’s too early to start.

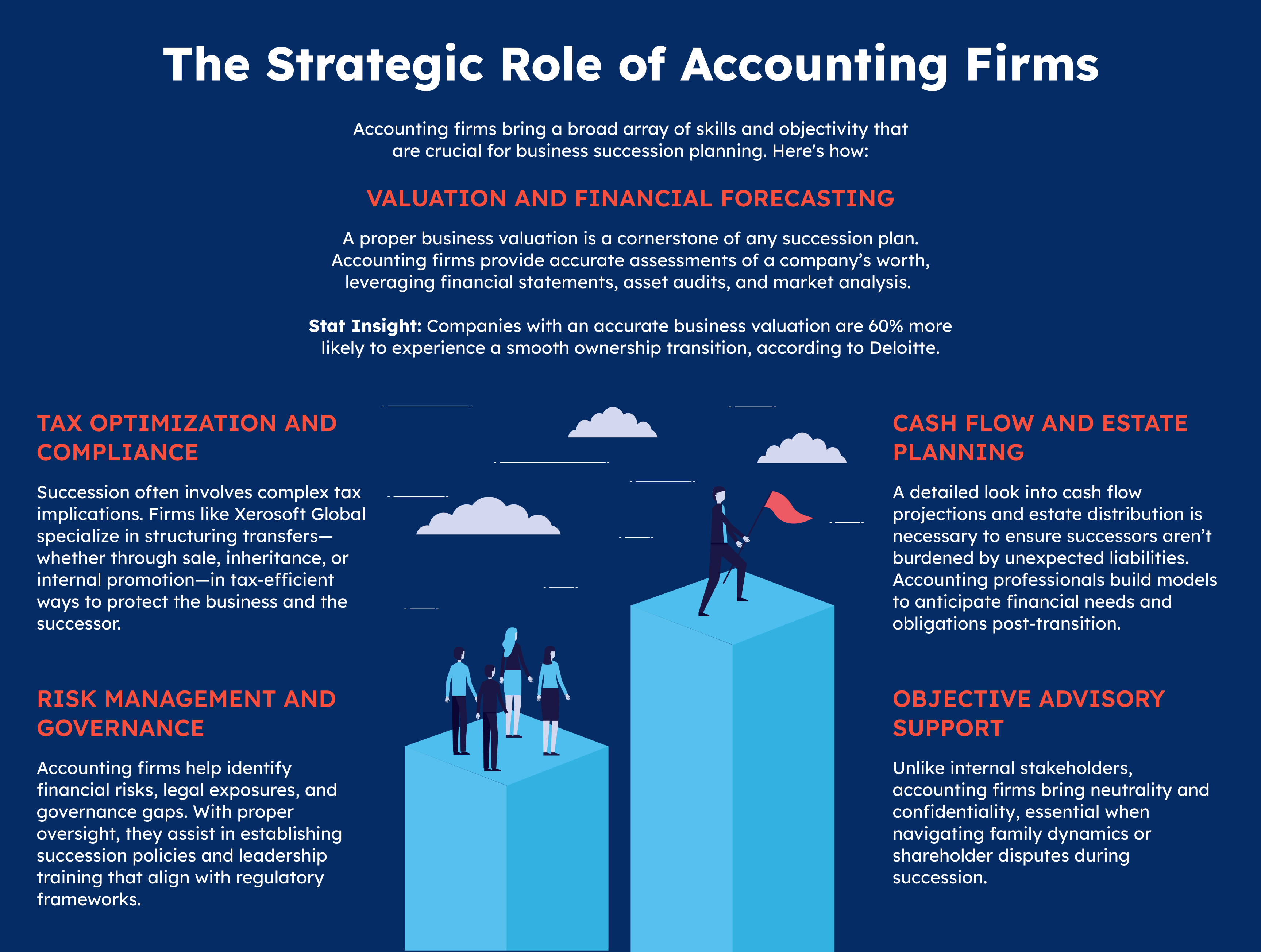

The Strategic Role of Accounting Firms

Accounting firms bring a broad array of skills and objectivity that are crucial for business succession planning. Here's how:

Valuation and Financial Forecasting

A proper business valuation is a cornerstone of any succession plan. Accounting firms provide accurate assessments of a company’s worth, leveraging financial statements, asset audits, and market analysis.

Stat Insight: Companies with an accurate business valuation are 60% more likely to experience a smooth ownership transition, according to Deloitte.

Tax Optimization and Compliance

Succession often involves complex tax implications. Firms like Xerosoft Global specialize in structuring transfers—whether through sale, inheritance, or internal promotion—in tax-efficient ways to protect the business and the successor.

Cash Flow and Estate Planning

A detailed look into cash flow projections and estate distribution is necessary to ensure successors aren’t burdened by unexpected liabilities. Accounting professionals build models to anticipate financial needs and obligations post-transition.

Risk Management and Governance

Accounting firms help identify financial risks, legal exposures, and governance gaps. With proper oversight, they assist in establishing succession policies and leadership training that align with regulatory frameworks.

Objective Advisory Support

Unlike internal stakeholders, accounting firms bring neutrality and confidentiality, essential when navigating family dynamics or shareholder disputes during succession.

Why Choose Xerosoft Global?

Xerosoft Global stands out in the accounting landscape for its holistic approach to succession planning. The firm combines financial analytics, tax expertise, and strategic advisory services tailored to each client’s unique business model.

Key strengths of Xerosoft Global:

- Cross-border succession planning support

- Advanced forecasting and reporting tools

- A dedicated team of succession advisors and legal partners

- Proven success with SMEs and large enterprises alike

Client Insight

Businesses that worked with Xerosoft Global reported a 40% increase in succession readiness and 35% faster transition timelines compared to industry benchmarks.

Key Benefits of Engaging an Accounting Firm in Succession Planning

Clarity and Direction

Develop a structured roadmap for leadership transition

Financial Efficiency

Save significantly on taxes, legal fees, and valuation errors

Stakeholder Confidence

Reassure investors, employees, and clients of long-term stability

Dispute Minimization

Reduce internal conflicts through objective planning

Conclusion

Succession planning is more than just choosing a successor—it’s about safeguarding a legacy, optimizing financial performance, and ensuring long-term viability. Accounting firms like Xerosoft Global provide the tools, insights, and strategic guidance needed to make that transition successful and sustainable.

Whether your business is preparing for leadership change in five years or facing it imminently, the time to act is now. Trust the experts to guide you through it.

References