In today’s data-driven world, protecting client information has become paramount for accounting firms. Increasingly stringent data privacy laws across the globe require firms to take comprehensive measures to safeguard sensitive financial data. Understanding these regulations and adapting business practices accordingly is crucial for compliance, trust, and long-term success. Leading technology partners like Xerosoft Global offer tailored solutions to help accounting firms navigate this complex landscape.

Overview of Data Privacy Laws Affecting Accounting Firms

Several regulations impact how accounting firms collect, store, and process client data, including:

- General Data Protection Regulation (GDPR) – Europe’s comprehensive data privacy law that affects firms dealing with EU clients.

- California Consumer Privacy Act (CCPA) – U.S. regulation focusing on data privacy rights of California residents.

- Personal Data Protection Act (PDPA) – Enforced in countries like Singapore, with increasing adoption worldwide.

- Various sector-specific compliance rules like Sarbanes-Oxley Act (SOX) for financial reporting.

Analytics and Statistics

According to a 2023 IBM Security report, the average cost of a data breach in the financial sector is approximately $5.85 million.

A 2024 PwC survey found that 68% of accounting firms see data privacy compliance as a top operational priority.

Research by Deloitte highlights that 75% of firms that invest in data privacy technologies experience fewer compliance incidents.

A Cisco Data Privacy Benchmark Study shows organizations with robust privacy programs have a 50% lower likelihood of data breaches.

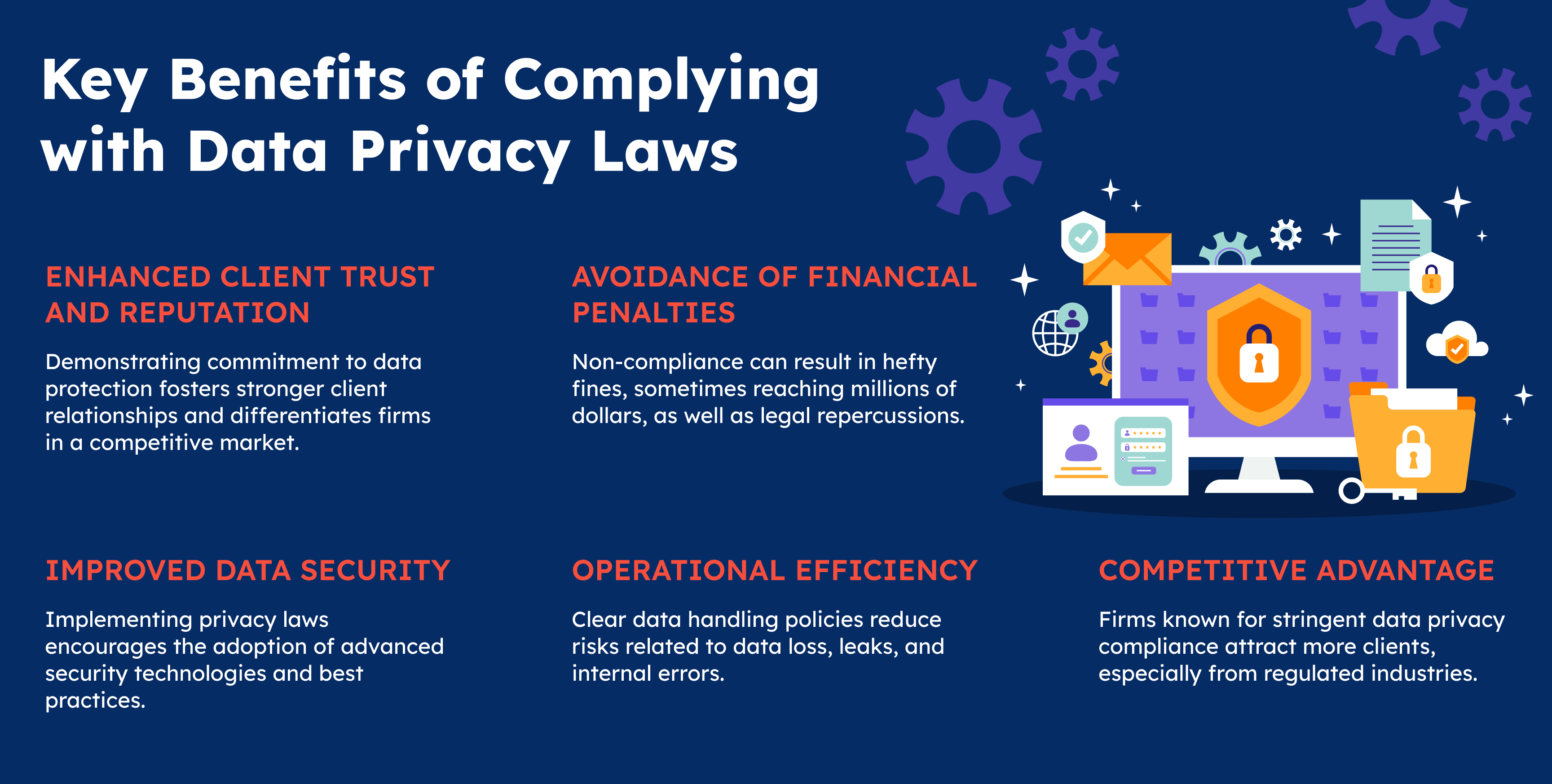

Key Benefits of Complying with Data Privacy Laws

Enhanced Client Trust and Reputation

Demonstrating commitment to data protection fosters stronger client relationships and differentiates firms in a competitive market.

Avoidance of Financial Penalties

Non-compliance can result in hefty fines, sometimes reaching millions of dollars, as well as legal repercussions.

Improved Data Security

Implementing privacy laws encourages the adoption of advanced security technologies and best practices.

Operational Efficiency

Clear data handling policies reduce risks related to data loss, leaks, and internal errors.

Competitive Advantage

Firms known for stringent data privacy compliance attract more clients, especially from regulated industries.

How Xerosoft Global Supports Accounting Firms with Data Privacy

Xerosoft Global provides comprehensive solutions designed to help accounting firms meet data privacy requirements effectively:

- Data encryption and secure cloud storage services

- Compliance management tools that automate privacy audits and reporting

- Employee training programs focused on privacy best practices

- Integration of privacy-by-design principles in IT systems

- Real-time monitoring and threat detection to prevent breaches

Partnering with Xerosoft Global equips accounting firms to confidently handle sensitive client data while adhering to evolving privacy regulations.

Conclusion

Data privacy laws are reshaping the way accounting firms operate, demanding greater vigilance and proactive measures. Compliance is not just a legal necessity but a strategic opportunity to build client trust and safeguard reputation. Leveraging technology and expertise from partners like Xerosoft Global can simplify compliance efforts, reduce risks, and position firms for sustainable growth in an increasingly privacy-conscious world.

Reference