As businesses and individuals increasingly shift to digital solutions, tax filing and compliance are undergoing a major transformation. The future of tax management is being shaped by automation, artificial intelligence, and cloud-based platforms like Xerosoft Global, which enhance efficiency, accuracy, and security in tax reporting.

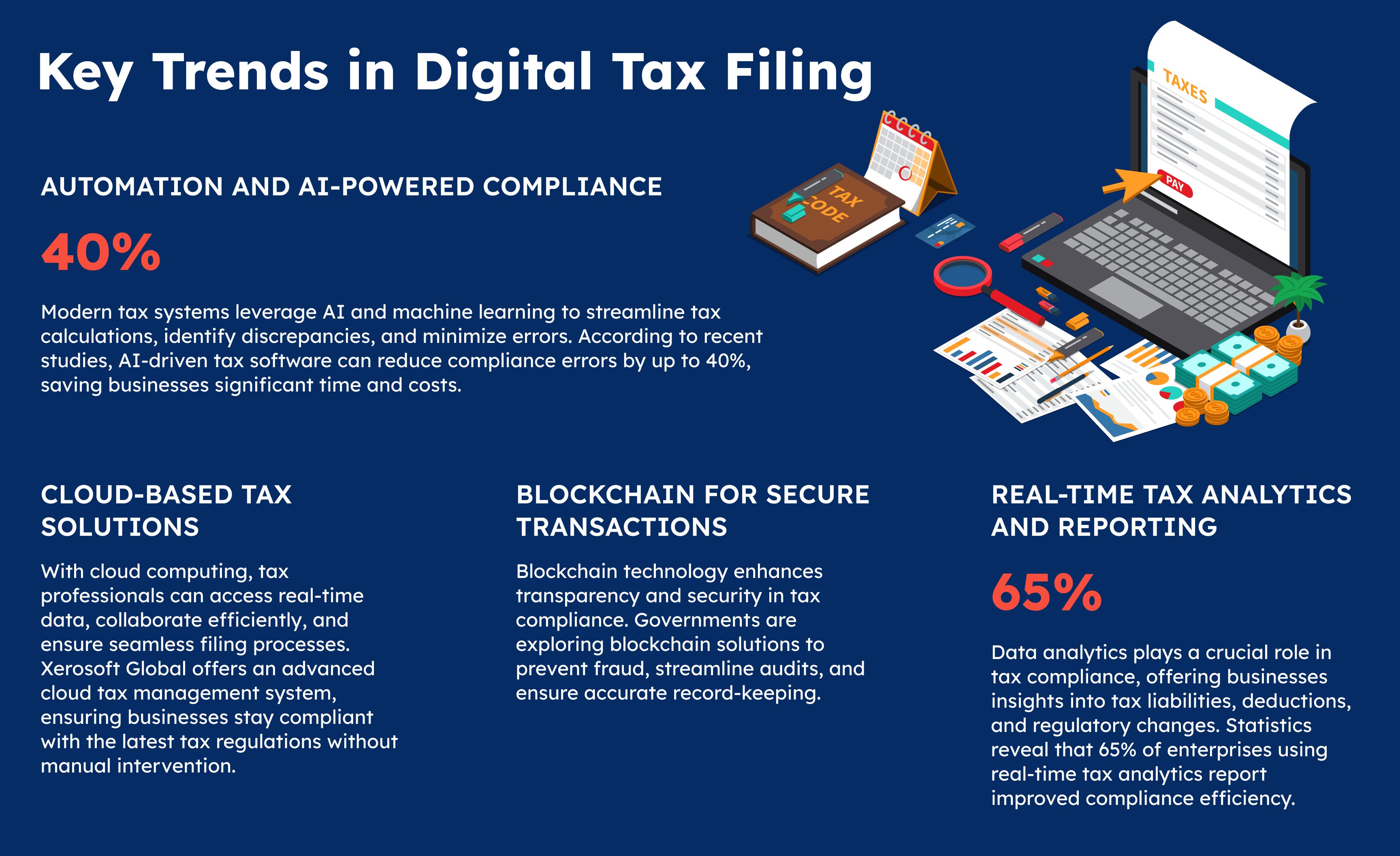

Key Trends in Digital Tax Filing

Automation and AI-Powered Compliance

Modern tax systems leverage AI and machine learning to streamline tax calculations, identify discrepancies, and minimize errors. According to recent studies, AI-driven tax software can reduce compliance errors by up to 40%, saving businesses significant time and costs.

Cloud-Based Tax Solutions

With cloud computing, tax professionals can access real-time data, collaborate efficiently, and ensure seamless filing processes. Xerosoft Global offers an advanced cloud tax management system, ensuring businesses stay compliant with the latest tax regulations without manual intervention.

Blockchain for Secure Transactions

Blockchain technology enhances transparency and security in tax compliance. Governments are exploring blockchain solutions to prevent fraud, streamline audits, and ensure accurate record-keeping.

Real-Time Tax Analytics and Reporting

Data analytics plays a crucial role in tax compliance, offering businesses insights into tax liabilities, deductions, and regulatory changes. Statistics reveal that 65% of enterprises using real-time tax analytics report improved compliance efficiency.

Key Benefits of Digital Tax Filing

Improved Accuracy

Automated tax calculations reduce human errors and ensure compliance with regulatory changes.

Time Efficiency

Cloud-based platforms cut filing time by up to 30%, allowing businesses to focus on growth.

Cost Savings

Reducing manual tax work lowers operational expenses, with businesses saving an average of $10,000 annually.

Security and Compliance

Solutions like Xerosoft Global offer encrypted data storage and real-time compliance monitoring, reducing fraud risks.

Enhanced Accessibility

Cloud solutions allow seamless access to tax data from anywhere, promoting collaboration between accountants and business owners.

Conclusion

The future of tax filing and compliance is digital, with automation, AI, and analytics driving efficiency. Platforms like Xerosoft Global are leading the way in transforming tax management, ensuring accuracy, security, and compliance. As businesses continue to embrace digital tax solutions, staying ahead of these trends will be key to maximizing benefits and minimizing risks.

Reference:

- Thomson Reuters. Unlocking efficiency: The impact of AI on tax compliance and reporting

- Xero

- TaxGPT. How Artificial Intelligence is Revolutionizing the Tax Industry