In today’s competitive business landscape, maintaining financial clarity is essential for success. One of the simplest yet most impactful steps a business can take is to open a dedicated business bank account. Separating business and personal finances not only improves financial management but also enhances credibility, simplifies tax compliance, and opens up access to specialized financial services. In this article, we explore the key benefits of having a dedicated business bank account and how Xerosoft Global can support your business in achieving these advantages.

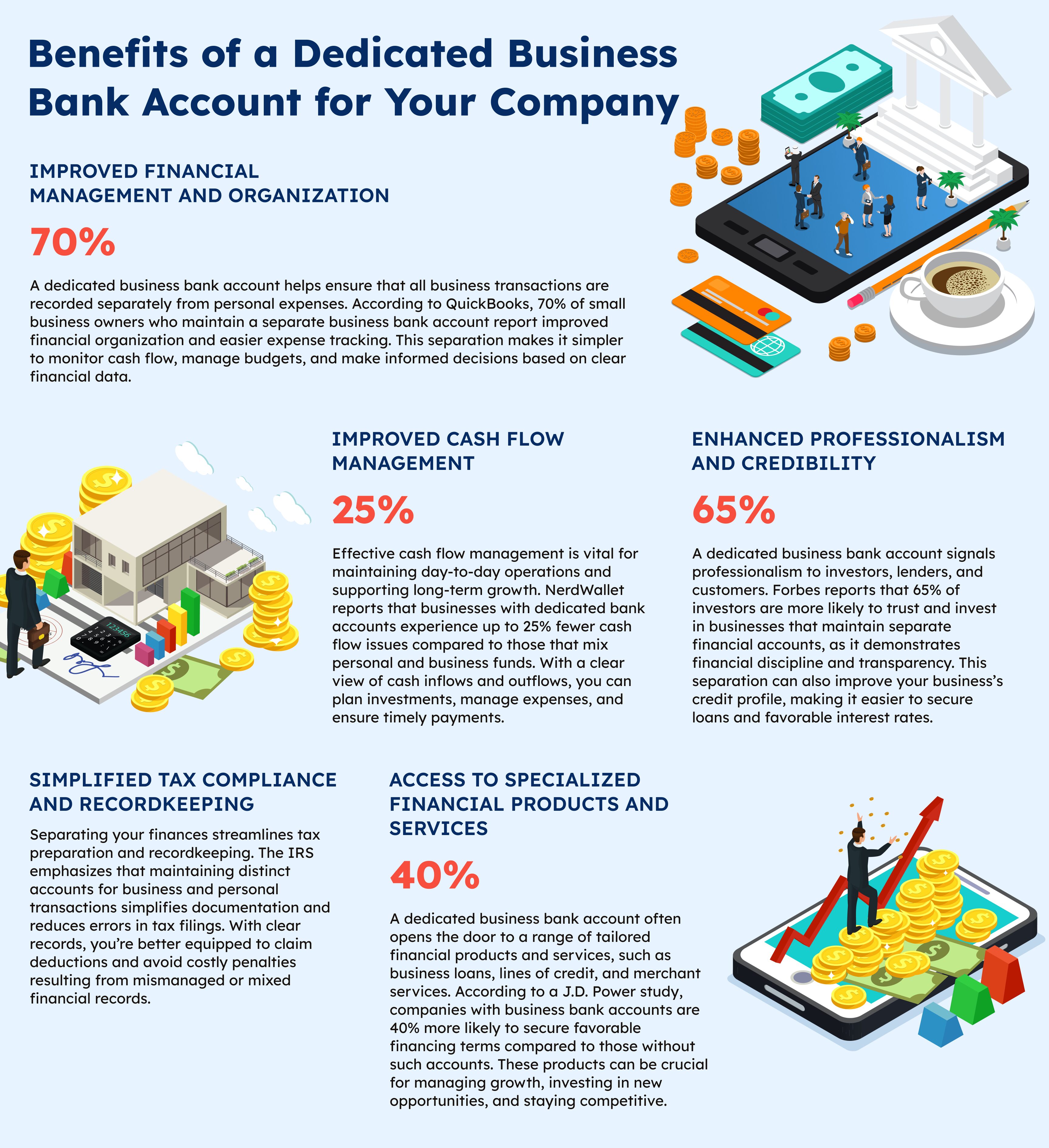

Improved Financial Management and Organization

A dedicated business bank account helps ensure that all business transactions are recorded separately from personal expenses. According to QuickBooks, 70% of small business owners who maintain a separate business bank account report improved financial organization and easier expense tracking¹. This separation makes it simpler to monitor cash flow, manage budgets, and make informed decisions based on clear financial data.

How Xerosoft Global Helps:

Xerosoft Global provides comprehensive financial management services that integrate seamlessly with your business banking. Our expert guidance ensures your accounts are set up for optimal performance, giving you clear insights into your financial health.

Simplified Tax Compliance and Recordkeeping

Separating your finances streamlines tax preparation and recordkeeping. The IRS emphasizes that maintaining distinct accounts for business and personal transactions simplifies documentation and reduces errors in tax filings². With clear records, you’re better equipped to claim deductions and avoid costly penalties resulting from mismanaged or mixed financial records.

How Xerosoft Global Helps:

Xerosoft Global assists in setting up robust accounting systems and maintains accurate records that support tax compliance, ensuring that your financial documentation is audit-ready and meets all regulatory requirements.

Enhanced Professionalism and Credibility

A dedicated business bank account signals professionalism to investors, lenders, and customers. Forbes reports that 65% of investors are more likely to trust and invest in businesses that maintain separate financial accounts, as it demonstrates financial discipline and transparency³. This separation can also improve your business’s credit profile, making it easier to secure loans and favorable interest rates.

How Xerosoft Global Helps:

By working with Xerosoft Global, you benefit from expert financial advice that reinforces the professional image of your business. We help you set up systems that not only comply with industry standards but also enhance your overall market credibility.

Improved Cash Flow Management

Effective cash flow management is vital for maintaining day-to-day operations and supporting long-term growth. NerdWallet reports that businesses with dedicated bank accounts experience up to 25% fewer cash flow issues compared to those that mix personal and business funds⁴. With a clear view of cash inflows and outflows, you can plan investments, manage expenses, and ensure timely payments.

How Xerosoft Global Helps:

Xerosoft Global offers financial advisory services that include cash flow analysis and management. Our experts help you forecast, monitor, and optimize cash flow to support your business’s operational needs and growth strategies.

Access to Specialized Financial Products and Services

A dedicated business bank account often opens the door to a range of tailored financial products and services, such as business loans, lines of credit, and merchant services. According to a J.D. Power study, companies with business bank accounts are 40% more likely to secure favorable financing terms compared to those without such accounts⁵. These products can be crucial for managing growth, investing in new opportunities, and staying competitive.

How Xerosoft Global Helps:

Xerosoft Global not only assists with setting up your business bank account but also guides you in leveraging additional financial services that can enhance your business operations. Our comprehensive financial solutions are designed to help you access the resources you need to thrive.

Empower Your Business with a Dedicated Business Bank Account

A dedicated business bank account is more than just a financial necessity—it’s a strategic asset that drives operational efficiency, enhances credibility, and simplifies tax compliance. By separating your business finances from personal funds, you pave the way for clearer financial management, better cash flow, and access to specialized financial products that support growth.

Xerosoft Global is here to help you set up and optimize your financial systems. With our expert guidance and tailored services, you can ensure that your business is built on a strong financial foundation. Contact Xerosoft Global today to learn how we can help you streamline your financial processes and unlock new opportunities for growth.

References:

- QuickBooks, “5 Key Benefits of Having a Separate Business Bank Account,”

- IRS, “Recordkeeping for Small Businesses,”

- Forbes, “Why Separating Personal and Business Finances Matters,”

- NerdWallet, “Why Your Business Needs a Separate Bank Account,”

- J.D. Power, “Business Banking Satisfaction Study,”