Starting a business is an exciting journey, but one area that often overwhelms entrepreneurs is bookkeeping. For startups, proper bookkeeping is essential for tracking expenses, managing cash flow, and ensuring compliance with tax laws. Yet, many founders struggle with the basics, leading to financial mismanagement. In this beginner’s guide, we’ll cover the fundamentals of bookkeeping and show how Xerosoft Global can support your startup with expert bookkeeping services.

What Is Bookkeeping and Why Is It Important?

Bookkeeping involves recording and organizing financial transactions to create a clear picture of your business’s financial health. It serves as the foundation for budgeting, tax preparation, and strategic decision-making. According to SCORE, 82% of businesses fail due to cash flow problems, many of which stem from poor financial management¹.

Proper bookkeeping ensures:

- Accurate financial reporting.

- Timely tax filings.

- Insights into profitability and cash flow.

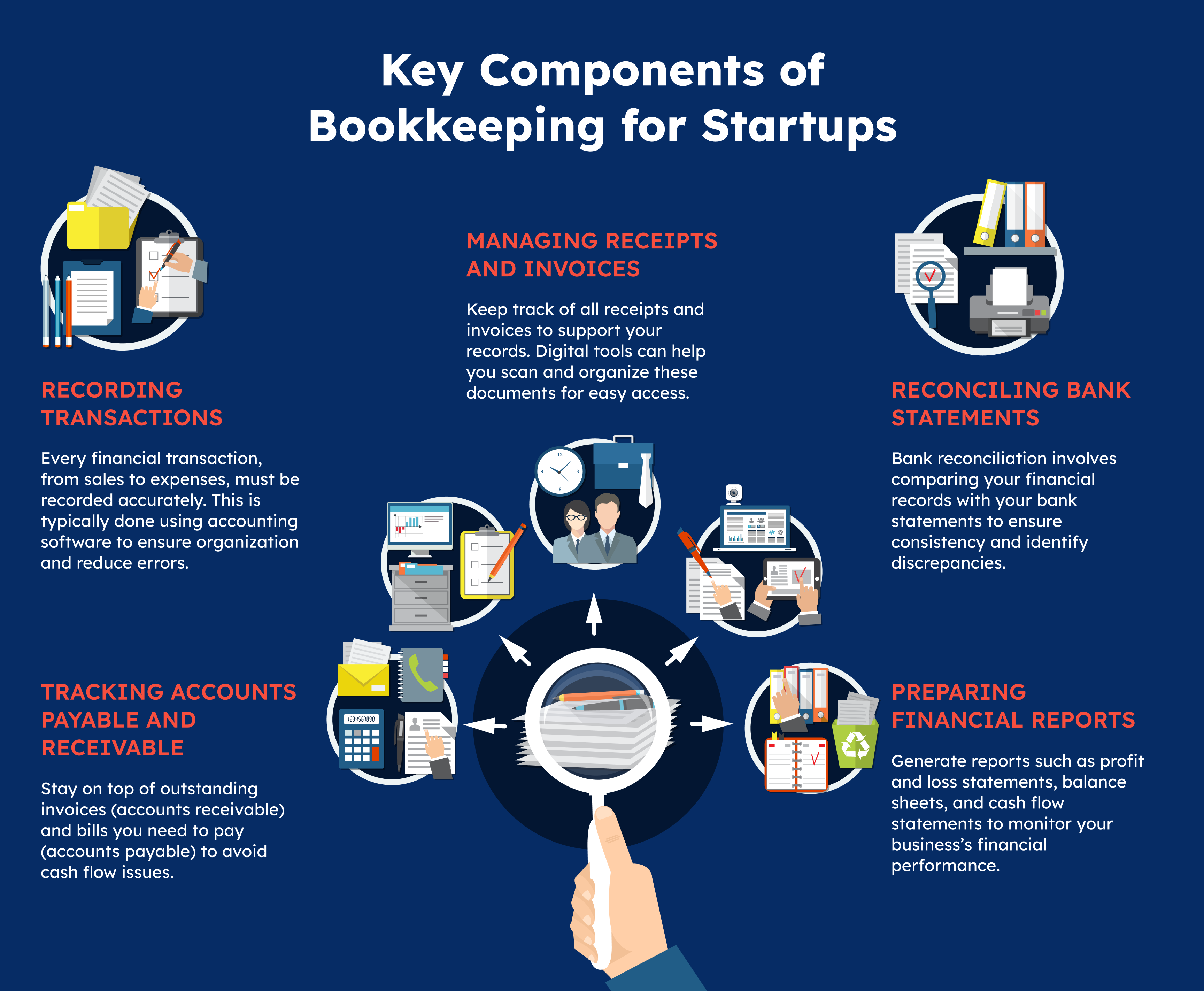

Key Components of Bookkeeping for Startups

Recording Transactions

Every financial transaction, from sales to expenses, must be recorded accurately. This is typically done using accounting software to ensure organization and reduce errors.

Managing Receipts and Invoices

Keep track of all receipts and invoices to support your records. Digital tools can help you scan and organize these documents for easy access.

Reconciling Bank Statements

Bank reconciliation involves comparing your financial records with your bank statements to ensure consistency and identify discrepancies.

Tracking Accounts Payable and Receivable

Stay on top of outstanding invoices (accounts receivable) and bills you need to pay (accounts payable) to avoid cash flow issues.

Preparing Financial Reports

Generate reports such as profit and loss statements, balance sheets, and cash flow statements to monitor your business’s financial performance.

Common Bookkeeping Challenges for Startups

Lack of Time and Resources

Startup founders often juggle multiple responsibilities, leaving little time for bookkeeping. A Xero survey found that 62% of small business owners find financial management stressful².

Inexperience with Financial Tools

Many startups lack the expertise to choose and use accounting software effectively, leading to errors.

Compliance with Tax Laws

Tax regulations can be complex, and mistakes in reporting or filing can result in penalties.

Bookkeeping Best Practices for Startups

Separate Personal and Business Finances

Open a dedicated business bank account to ensure clear records and avoid mixing personal and business transactions.

Use Reliable Accounting Software

Choose software like QuickBooks or Xero to simplify transaction recording and financial reporting.

Establish a Routine

Set aside time each week to review and update your financial records, minimizing the risk of errors.

Keep Detailed Records

Organize and retain all financial documents, such as invoices, receipts, and tax forms, for easy access during audits or tax filings.

Seek Professional Help

Outsourcing bookkeeping to experts ensures accuracy and frees up your time to focus on growing your business.

How Xerosoft Global Supports Startups

At Xerosoft Global, we understand the unique challenges startups face. Our bookkeeping services are designed to simplify your financial management, giving you peace of mind and allowing you to concentrate on innovation.

What We Offer:

- Accurate Record-Keeping: We handle transaction recording and document organization with precision.

- Customized Solutions: Our team tailors bookkeeping practices to suit your industry and business goals.

- Compliance Support: We stay updated on tax laws and regulations, ensuring your startup remains compliant.

- Advanced Tools: We use cutting-edge accounting software to streamline your financial processes.

- Actionable Insights: Our detailed financial reports help you make data-driven decisions.

Benefits of Professional Bookkeeping for Startups

Improved Financial Clarity

With accurate records, you’ll have a clear understanding of your cash flow and profitability.

Reduced Risk of Errors

Professional bookkeeping minimizes the risk of costly mistakes in financial reporting or tax filings.

Enhanced Compliance

Expert assistance ensures adherence to local tax laws, avoiding penalties and audits.

Time Savings

Outsourcing bookkeeping allows you to focus on strategic priorities, like product development and customer acquisition.

According to Deloitte, businesses that invest in professional financial management grow 25% faster than those that don’t³.

Build a Strong Financial Foundation with Xerosoft Global

Bookkeeping is a critical component of running a successful startup. By implementing best practices and seeking professional support, you can avoid common pitfalls and set your business up for long-term success.

Xerosoft Global offers expert bookkeeping services tailored to the needs of startups. From accurate record-keeping to compliance management, we provide the tools and expertise you need to streamline your finances and focus on scaling your business. Contact us today to learn how we can help your startup thrive.