Small and medium-sized enterprises (SMEs) are the backbone of the global economy, contributing up to 40% of GDP in emerging markets alone¹. However, one of the most significant challenges these businesses face is managing their bookkeeping efficiently. Accurate bookkeeping is critical for financial health, regulatory compliance, and long-term growth. Yet, SMEs often encounter obstacles that can disrupt operations and lead to costly errors. This article explores the top bookkeeping challenges for SMEs and how Xerosoft Global’s expertise can provide effective solutions.

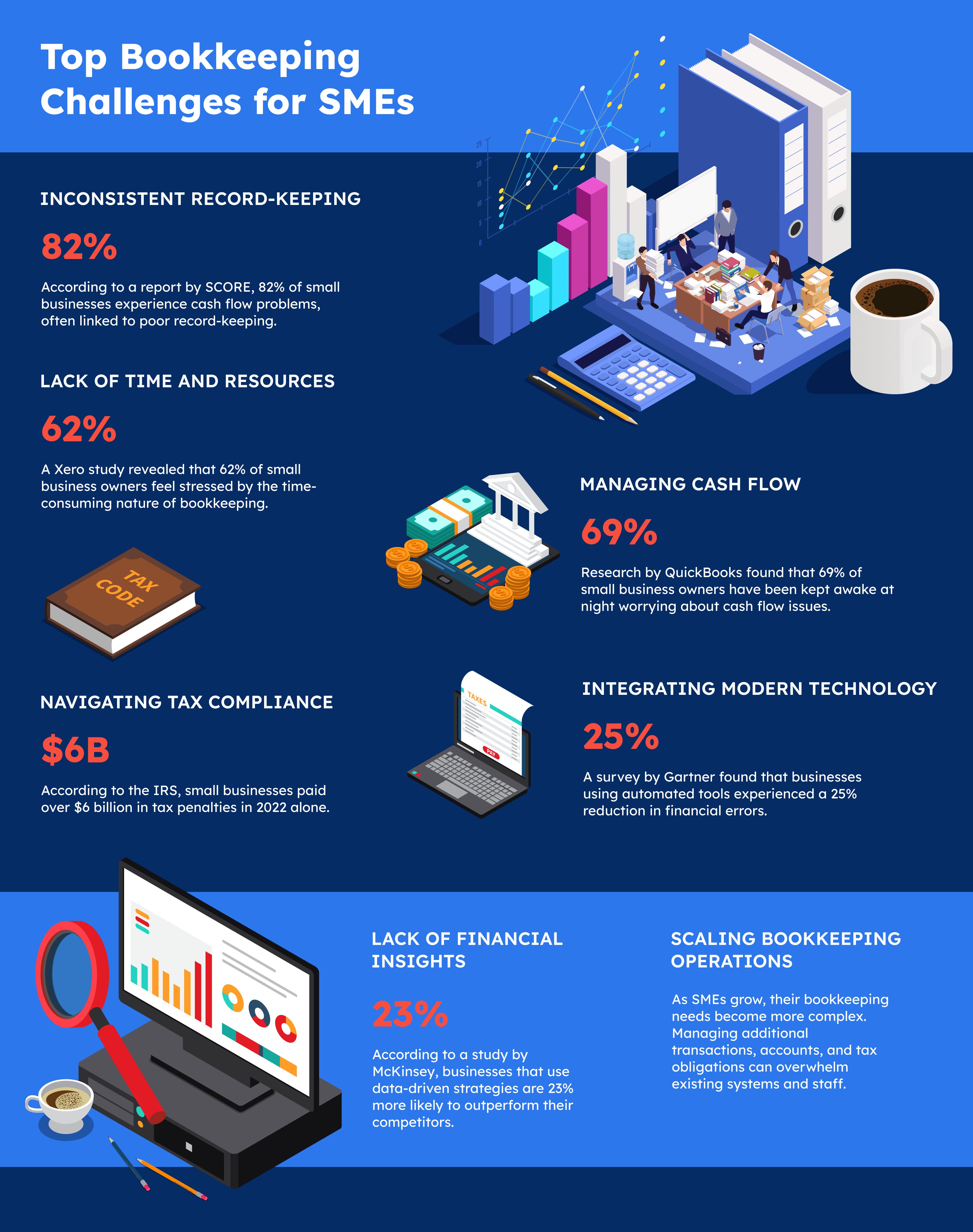

Inconsistent Record-Keeping

Inconsistent record-keeping is one of the most common issues SMEs face. Many businesses struggle to maintain up-to-date financial records, leading to inaccuracies that can affect decision-making and compliance. According to a report by SCORE, 82% of small businesses experience cash flow problems, often linked to poor record-keeping².

How to Solve It:

Xerosoft Global ensures accurate and consistent record-keeping through advanced bookkeeping software and a dedicated team of experts. Our services help SMEs maintain organized financial records, ensuring you always have a clear picture of your business’s financial health.

Lack of Time and Resources

Many SME owners juggle multiple responsibilities, leaving little time for accurate bookkeeping. Inadequate resources, such as skilled staff or modern tools, further exacerbate the problem. A Xero study revealed that 62% of small business owners feel stressed by the time-consuming nature of bookkeeping³.

How to Solve It:

Outsourcing bookkeeping to Xerosoft Global frees up valuable time for business owners to focus on growth and strategy. Our team handles day-to-day bookkeeping tasks efficiently, ensuring accurate and timely financial reporting.

Managing Cash Flow

Cash flow management is a critical challenge for SMEs. Poor cash flow management can result in missed payments, delayed investments, and even business failure. Research by QuickBooks found that 69% of small business owners have been kept awake at night worrying about cash flow issues⁴.

How to Solve It:

Xerosoft Global provides detailed cash flow reports and actionable insights to help SMEs monitor and manage their cash flow effectively. Our real-time reporting tools ensure that you always know where your money is going and how to optimize it.

Navigating Tax Compliance

Staying compliant with tax regulations is a complex task, especially for SMEs operating in multiple jurisdictions. Filing errors or late submissions can result in penalties that strain resources. According to the IRS, small businesses paid over $6 billion in tax penalties in 2022 alone⁵.

How to Solve It:

Xerosoft Global ensures your business remains compliant with all tax regulations by providing accurate record-keeping and timely tax filings. Our team stays updated on the latest tax laws, minimizing your risk of penalties.

Integrating Modern Technology

Many SMEs rely on outdated methods, such as manual bookkeeping, which increases the likelihood of errors and inefficiencies. A survey by Gartner found that businesses using automated tools experienced a 25% reduction in financial errors⁶.

How to Solve It:

Xerosoft Global leverages cutting-edge bookkeeping software to automate repetitive tasks and improve accuracy. Our technology solutions integrate seamlessly with your existing systems, providing real-time data and reports to enhance decision-making.

Lack of Financial Insights

Without accurate financial data, SMEs struggle to make informed decisions. Many small business owners lack the expertise to analyze financial reports effectively, which can hinder growth and profitability. According to a study by McKinsey, businesses that use data-driven strategies are 23% more likely to outperform their competitors⁷.

How to Solve It:

Xerosoft Global provides comprehensive financial reporting and analysis services, offering actionable insights tailored to your business goals. Our expert team helps you understand key financial metrics, empowering you to make smarter decisions.

Scaling Bookkeeping Operations

As SMEs grow, their bookkeeping needs become more complex. Managing additional transactions, accounts, and tax obligations can overwhelm existing systems and staff.

How to Solve It:

Xerosoft Global’s scalable bookkeeping solutions adapt to your growing business needs. Whether you’re expanding locally or internationally, our team ensures your financial operations keep pace with your growth.

Overcome Bookkeeping Challenges with Xerosoft Global

Bookkeeping is a vital but challenging aspect of running an SME. From inconsistent record-keeping to navigating tax compliance and integrating modern technology, the hurdles can be overwhelming. However, partnering with Xerosoft Global ensures these challenges are met with expertise and efficiency.

With our tailored bookkeeping solutions, advanced tools, and dedicated professionals, Xerosoft Global helps SMEs streamline their financial operations, improve cash flow management, and maintain compliance. Contact us today to learn how we can support your business’s financial health and long-term success.

References:

- World Bank, “Small and Medium Enterprises (SMEs) Finance,”

- SCORE, “Why Small Businesses Fail,”

- Xero, “The Challenges of Bookkeeping for Small Businesses,”

- QuickBooks, “The Importance of Cash Flow for Small Businesses,”

- IRS, “Tax Penalties for Small Businesses,”

- Gartner, “The Benefits of Automation in Financial Reporting,”

- McKinsey, “Data-Driven Strategies for Business Success,”