Opening a business bank account is a crucial step for any entrepreneur, as it separates personal and business finances, improves financial management, and establishes credibility. However, navigating the process can be more challenging than anticipated, particularly for startups and foreign business owners. This article explores the common obstacles businesses face when opening a bank account and how Xerosoft Global helps you overcome them, ensuring a smooth and efficient process.

Navigating Complex Documentation Requirements

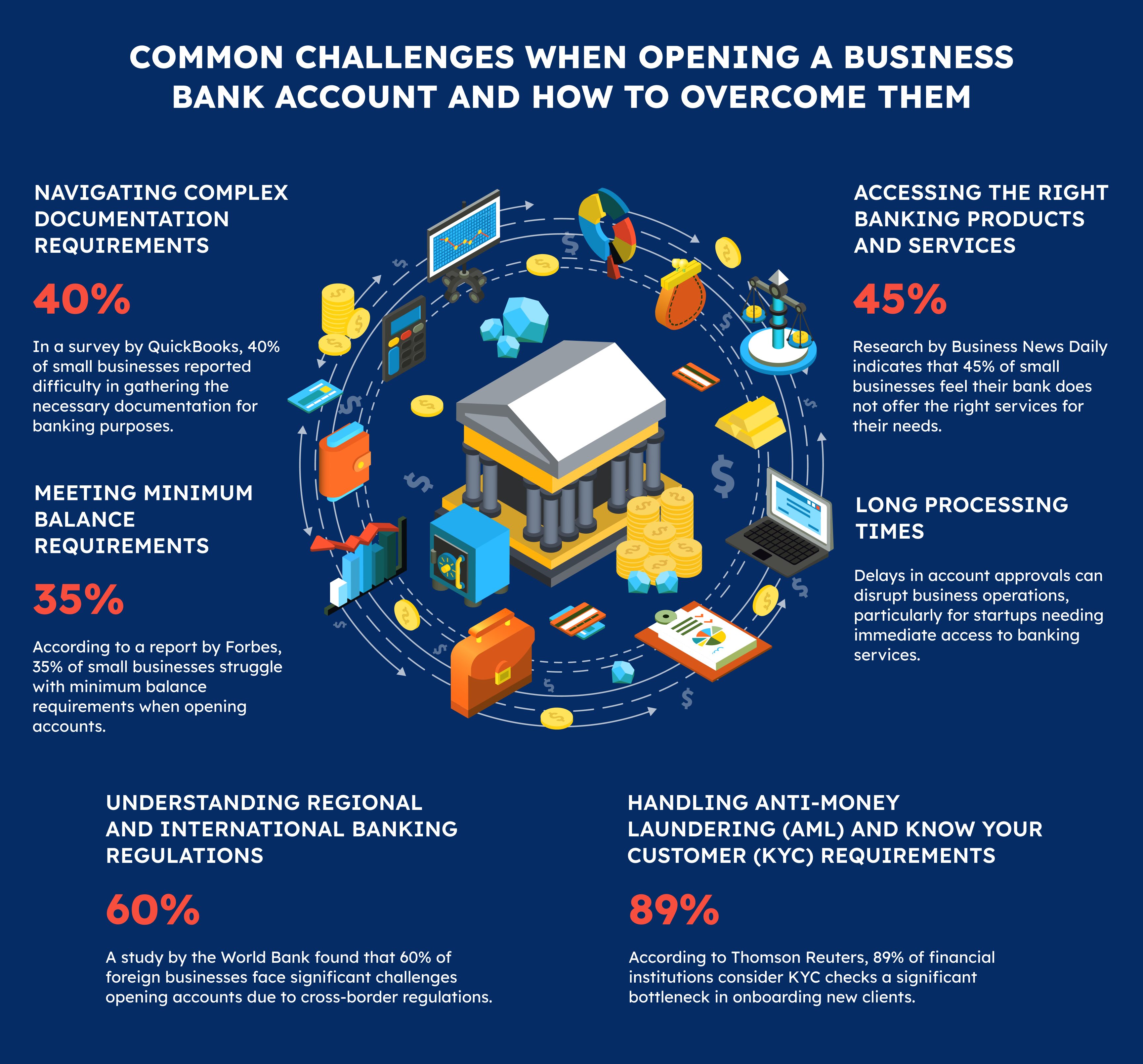

One of the most common hurdles is the extensive documentation required by banks. Businesses must provide a range of documents, including proof of incorporation, ownership details, and compliance with anti-money laundering (AML) regulations. In a survey by QuickBooks, 40% of small businesses reported difficulty in gathering the necessary documentation for banking purposes¹.

Solution:

Xerosoft Global assists businesses in compiling and organizing the required documentation. We ensure your paperwork is complete, accurate, and compliant with local banking regulations, expediting the account-opening process.

Meeting Minimum Balance Requirements

Many banks require businesses to maintain a minimum balance to avoid fees. For startups or small businesses, meeting these requirements can strain finances, especially in the early stages. According to a report by Forbes, 35% of small businesses struggle with minimum balance requirements when opening accounts².

Solution:

Xerosoft Global helps you identify banks that offer flexible account options tailored to small businesses. Our team provides recommendations on banks with lower or no minimum balance requirements, ensuring you choose the best fit for your financial needs.

Understanding Regional and International Banking Regulations

For businesses operating internationally or owned by foreigners, navigating banking regulations across multiple jurisdictions adds complexity. Banks often have strict due diligence requirements for foreign-owned businesses, and failing to comply can lead to delays or account rejections. A study by the World Bank found that 60% of foreign businesses face significant challenges opening accounts due to cross-border regulations³.

Solution:

Xerosoft Global specializes in assisting foreign entrepreneurs with incorporation and banking in Singapore. We guide you through the regional regulatory landscape, ensuring compliance with all local and international banking standards.

Handling Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

Banks implement strict AML and KYC policies to prevent financial crimes. While necessary, these requirements often result in lengthy verification processes, especially for businesses with complex ownership structures. According to Thomson Reuters, 89% of financial institutions consider KYC checks a significant bottleneck in onboarding new clients⁴.

Solution:

Xerosoft Global ensures your business is fully prepared for AML and KYC checks. We assist in providing transparent ownership details, verifying directors’ credentials, and maintaining compliance with banking policies to accelerate approvals.

Accessing the Right Banking Products and Services

Choosing the wrong type of account or banking services can hinder your financial operations. Businesses often need specific features, such as multi-currency accounts, payment gateways, or integration with accounting software. Research by Business News Daily indicates that 45% of small businesses feel their bank does not offer the right services for their needs⁵.

Solution:

Xerosoft Global works closely with you to understand your business requirements and recommend banks offering the best products and services. We focus on aligning your banking needs with solutions that facilitate growth and streamline operations.

Long Processing Times

Delays in account approvals can disrupt business operations, particularly for startups needing immediate access to banking services. Banks often take several weeks to process applications, verify documents, and approve accounts.

Solution:

Xerosoft Global expedites the account-opening process by liaising directly with banks, ensuring all requirements are met upfront. Our established relationships with banking institutions help minimize delays and ensure a timely setup.

Simplify Banking with Xerosoft Global

Opening a business bank account is essential but fraught with challenges, from navigating complex documentation requirements to managing compliance and meeting minimum balance thresholds. These obstacles can be time-consuming and stressful, especially for startups and foreign entrepreneurs.

Xerosoft Global streamlines the process, ensuring you meet all requirements while selecting the banking solutions best suited to your business. With our expertise, you can focus on growing your business while we handle the complexities of banking. Contact Xerosoft Global today to simplify your business banking experience.

References:

- QuickBooks, “The Challenges of Small Business Banking,”

- Forbes, “Best Banks for Small Businesses,”

- World Bank, “Ease of Doing Business Report,”

- Thomson Reuters, “Cost of Compliance Report,”

- Business News Daily, “Best Banks for Small Businesses,”