Payroll management is a critical function for every business. Beyond ensuring that employees are paid accurately and on time, payroll must comply with complex tax laws, benefits regulations, and reporting requirements. Mismanagement can lead to employee dissatisfaction, hefty penalties, and reputational damage. Xerosoft Global offers comprehensive payroll services designed to streamline this vital process, ensuring accuracy and compliance every step of the way.

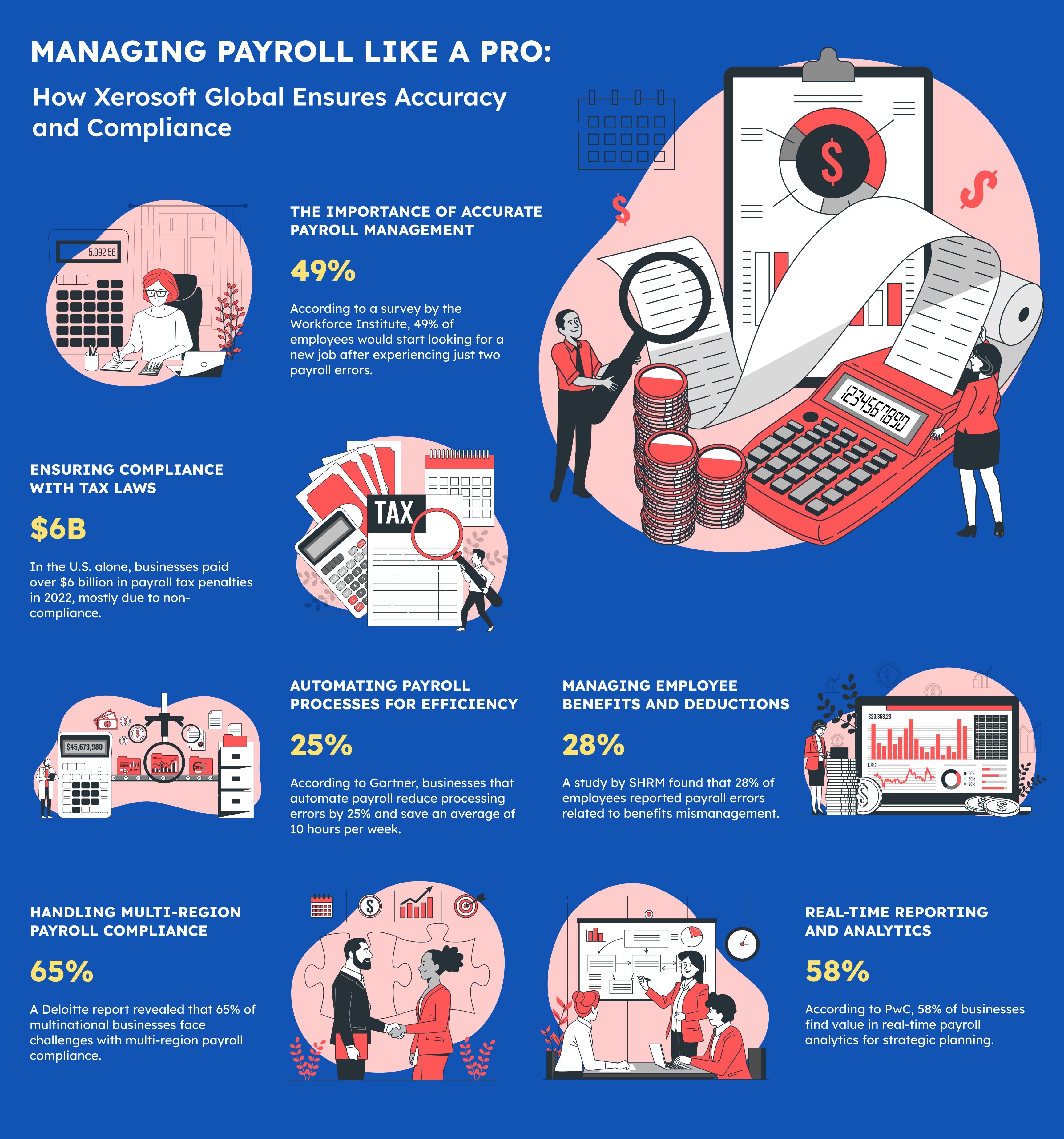

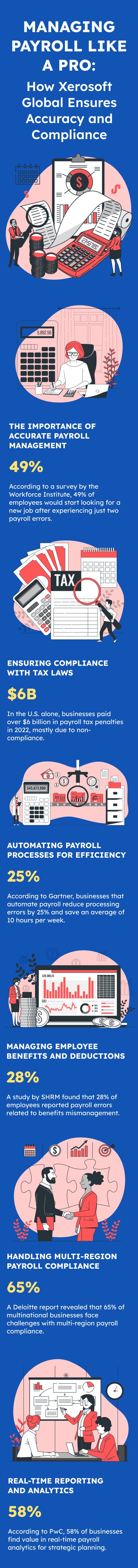

1. The Importance of Accurate Payroll Management

Accurate payroll management is essential for maintaining employee trust and satisfaction. According to a survey by the Workforce Institute, 49% of employees would start looking for a new job after experiencing just two payroll errors¹. Payroll errors not only impact employee morale but can also lead to costly tax fines and audits.

How Xerosoft Global Helps:

Xerosoft Global uses advanced payroll software and rigorous review processes to ensure that every paycheck is accurate and delivered on time. Our attention to detail minimizes errors, reducing the risk of employee dissatisfaction and financial penalties.

2. Ensuring Compliance with Tax Laws

Payroll compliance involves adhering to tax laws, social security contributions, and benefits regulations, which can vary significantly by jurisdiction. In the U.S. alone, businesses paid over $6 billion in payroll tax penalties in 2022, mostly due to non-compliance².

How Xerosoft Global Helps:

Our team stays updated on the latest tax laws and regulatory changes across jurisdictions. From calculating payroll taxes to filing returns, Xerosoft Global ensures compliance, helping your business avoid fines and audits.

3. Automating Payroll Processes for Efficiency

Manual payroll processes are time-consuming and prone to errors. According to Gartner, businesses that automate payroll reduce processing errors by 25% and save an average of 10 hours per week³. Automation ensures that payroll runs smoothly, even during peak periods or when managing a large workforce.

How Xerosoft Global Helps:

Xerosoft Global integrates cutting-edge payroll automation tools into your operations, streamlining calculations, deductions, and reporting. Automation improves efficiency and ensures that payroll is processed accurately every time.

4. Managing Employee Benefits and Deductions

Payroll management also involves handling employee benefits, including health insurance, retirement contributions, and other voluntary deductions. Mismanagement of these deductions can result in compliance issues and employee dissatisfaction. A study by SHRM found that 28% of employees reported payroll errors related to benefits mismanagement⁴.

How Xerosoft Global Helps:

Xerosoft Global ensures that all employee benefits and deductions are calculated accurately and comply with applicable laws. We provide detailed reports, so you and your employees have full transparency over benefit contributions.

5. Handling Multi-Region Payroll Compliance

For businesses operating in multiple regions, payroll compliance becomes even more complex due to differing tax laws, labor regulations, and reporting requirements. A Deloitte report revealed that 65% of multinational businesses face challenges with multi-region payroll compliance⁵.

How Xerosoft Global Helps:

We specialize in multi-region payroll management, ensuring compliance with local and international laws. Xerosoft Global’s payroll experts handle everything from exchange rate calculations to region-specific tax filing, so you can focus on growing your business.

6. Real-Time Reporting and Analytics

Timely and accurate reporting is essential for effective payroll management. Businesses need real-time insights into payroll expenses, tax liabilities, and compliance risks to make informed decisions. According to PwC, 58% of businesses find value in real-time payroll analytics for strategic planning⁶.

How Xerosoft Global Helps:

We provide real-time payroll reports and analytics, offering insights into your payroll operations. Our detailed reports help you monitor expenses, track compliance, and identify opportunities for cost optimization.

Conclusion: Elevate Your Payroll Management with Xerosoft Global

Managing payroll accurately and compliantly is vital for employee satisfaction, regulatory compliance, and financial stability. With complexities ranging from tax laws to multi-region compliance, businesses need a reliable partner to handle these challenges effectively.

Xerosoft Global offers a comprehensive payroll solution tailored to your business needs. From ensuring compliance with ever-changing tax laws to automating payroll processes, we provide the tools and expertise necessary to streamline payroll operations. Let Xerosoft Global help you manage payroll like a pro, giving you peace of mind and the freedom to focus on growing your business.

References:

- Workforce Institute, “The Ripple Effect of Payroll Problems,”

- IRS, “Penalties for Payroll Tax Non-Compliance,”

- Gartner, “The Benefits of Payroll Automation,”

- SHRM, “The Impact of Payroll Errors on Employee Engagement,”

- Deloitte, “Global Payroll Management Challenges,”

- PwC, “Payroll Analytics: Unlocking Strategic Value,”