Corporate tax filing is a critical responsibility for businesses, yet it’s also one of the most complex and error-prone processes. Mistakes during tax filing can lead to penalties, audits, and reputational damage, making it essential for businesses to approach this task with accuracy and compliance. By understanding common errors and adopting proactive strategies, businesses can avoid these pitfalls and maintain smooth operations. With Xerosoft Global’s expertise, companies can ensure that their corporate tax filings are handled with precision and adherence to regulations.

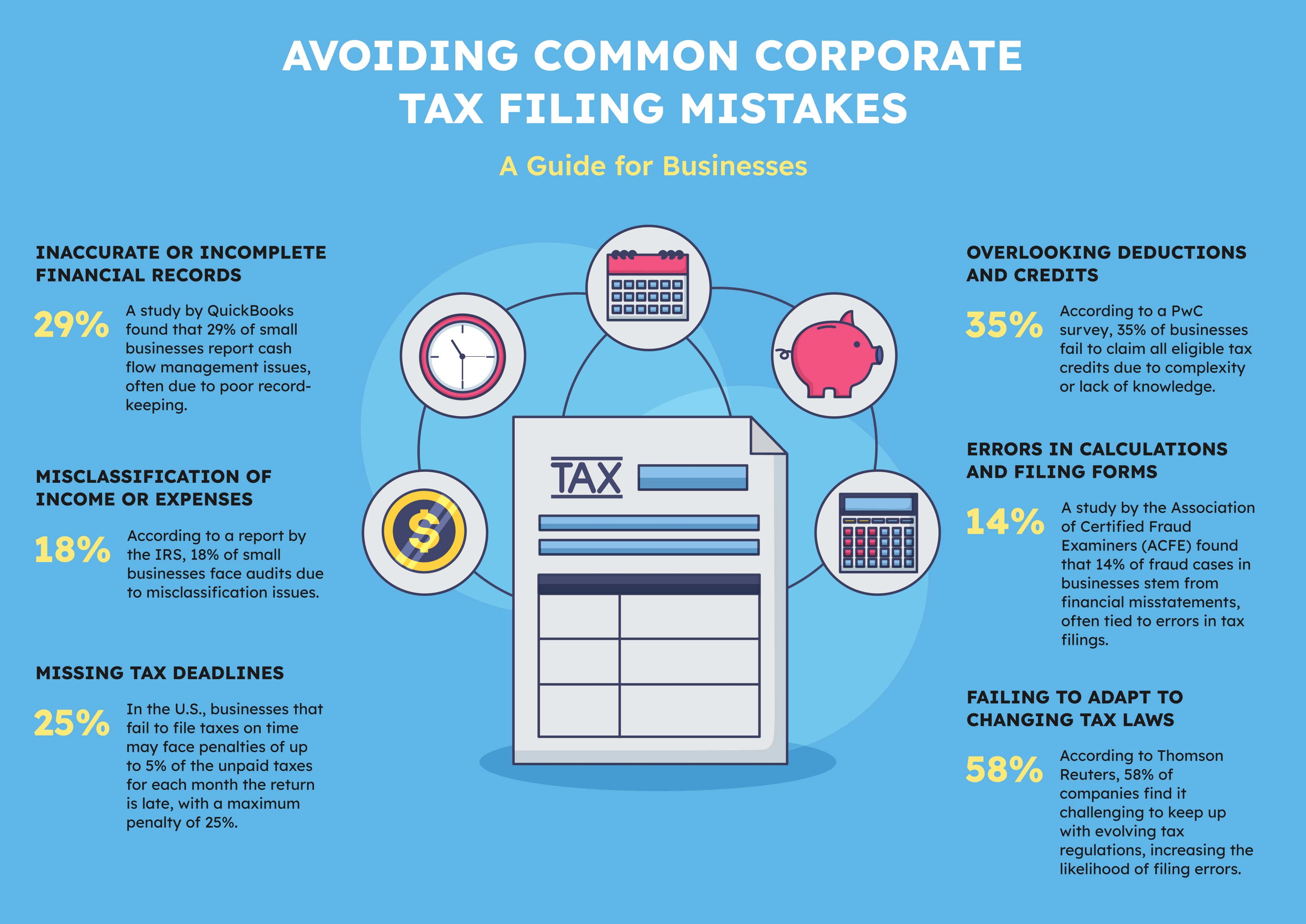

1. Inaccurate or Incomplete Financial Records

One of the most common mistakes businesses make is failing to maintain accurate or complete financial records. Without proper documentation, it becomes difficult to substantiate deductions, credits, or income declarations. A study by QuickBooks found that 29% of small businesses report cash flow management issues, often due to poor record-keeping¹. This can lead to discrepancies in tax filings, triggering audits or penalties.

How Xerosoft Global Helps:

Xerosoft Global provides end-to-end bookkeeping and record management services, ensuring that all financial records are accurate, organized, and up-to-date. This minimizes errors and ensures that tax filings are backed by solid documentation.

2. Misclassification of Income or Expenses

Misclassifying income or expenses is another frequent error in corporate tax filing. For example, failing to distinguish between operating and capital expenses can result in incorrect tax calculations. According to a report by the IRS, 18% of small businesses face audits due to misclassification issues².

How Xerosoft Global Helps:

Xerosoft Global’s tax experts ensure that all income and expenses are correctly categorized according to the latest tax laws. Our team uses advanced accounting software to classify transactions accurately, reducing the risk of costly mistakes.

3. Missing Tax Deadlines

Missing corporate tax deadlines can lead to significant penalties and interest charges. In the U.S., businesses that fail to file taxes on time may face penalties of up to 5% of the unpaid taxes for each month the return is late, with a maximum penalty of 25%³.

How Xerosoft Global Helps:

Xerosoft Global ensures that all corporate tax deadlines are met by implementing a proactive tax calendar and automated reminders. We handle the preparation and submission of tax returns, eliminating the stress of missed deadlines.

4. Overlooking Deductions and Credits

Businesses often miss out on valuable deductions and credits due to a lack of understanding of applicable tax laws. For instance, research and development (R&D) tax credits, employee benefits deductions, or depreciation allowances are frequently overlooked. According to a PwC survey, 35% of businesses fail to claim all eligible tax credits due to complexity or lack of knowledge⁴.

How Xerosoft Global Helps:

Xerosoft Global’s tax professionals are well-versed in identifying and maximizing deductions and credits for businesses. We ensure that your company takes full advantage of available tax benefits while remaining compliant with regulations.

5. Errors in Calculations and Filing Forms

Calculation errors and mistakes in filling out tax forms are common, particularly for businesses with complex financial structures. These errors can lead to incorrect tax liabilities and increased scrutiny from tax authorities. A study by the Association of Certified Fraud Examiners (ACFE) found that 14% of fraud cases in businesses stem from financial misstatements, often tied to errors in tax filings⁵.

How Xerosoft Global Helps:

Xerosoft Global uses advanced tax software to perform accurate calculations and review all forms before submission. Our multi-step review process ensures that your tax filings are error-free, providing you with confidence in your submissions.

6. Failing to Adapt to Changing Tax Laws

Tax laws and regulations change frequently, and businesses that fail to stay updated risk non-compliance. According to Thomson Reuters, 58% of companies find it challenging to keep up with evolving tax regulations, increasing the likelihood of filing errors⁶.

How Xerosoft Global Helps:

Xerosoft Global stays ahead of regulatory changes, ensuring that your business remains compliant. Our team monitors updates to tax laws across regions, so you never have to worry about falling behind.

Conclusion: Ensure Compliance with Xerosoft Global

Corporate tax filing is a complex but essential aspect of running a successful business. From maintaining accurate records to staying updated on tax laws, there are numerous factors to consider. Mistakes can lead to penalties, audits, and lost opportunities for tax savings. By outsourcing your corporate tax filing to Xerosoft Global, you gain access to a team of experts dedicated to accuracy and compliance.

With our comprehensive tax services, businesses can navigate the complexities of corporate tax filing confidently. Contact Xerosoft Global today to learn how we can help your business avoid common tax filing mistakes and ensure long-term financial success.

References:

- QuickBooks, “Why Accurate Bookkeeping Matters,”

- IRS, “Common Tax Filing Errors,”

- IRS, “Late Filing Penalties,”

- PwC, “Unlocking Tax Savings,”

- ACFE, “Report to the Nations on Occupational Fraud and Abuse,”

- Thomson Reuters, “Challenges in Corporate Tax Compliance,”