In the ever-evolving world of business, tax compliance remains a top priority for companies of all sizes, including global players like Xerosoft Global. Tax laws are becoming more complex, and businesses are increasingly scrutinized by tax authorities. One of the most effective ways to ensure compliance and avoid costly penalties is by maintaining accurate and organized financial records. In this blog post, we will explore why accurate record-keeping is critical to your business’s tax compliance, with a particular focus on how Xerosoft Global handles this process to ensure smooth operations for their clients worldwide.

The Importance of Accurate Record Keeping for Global Operations

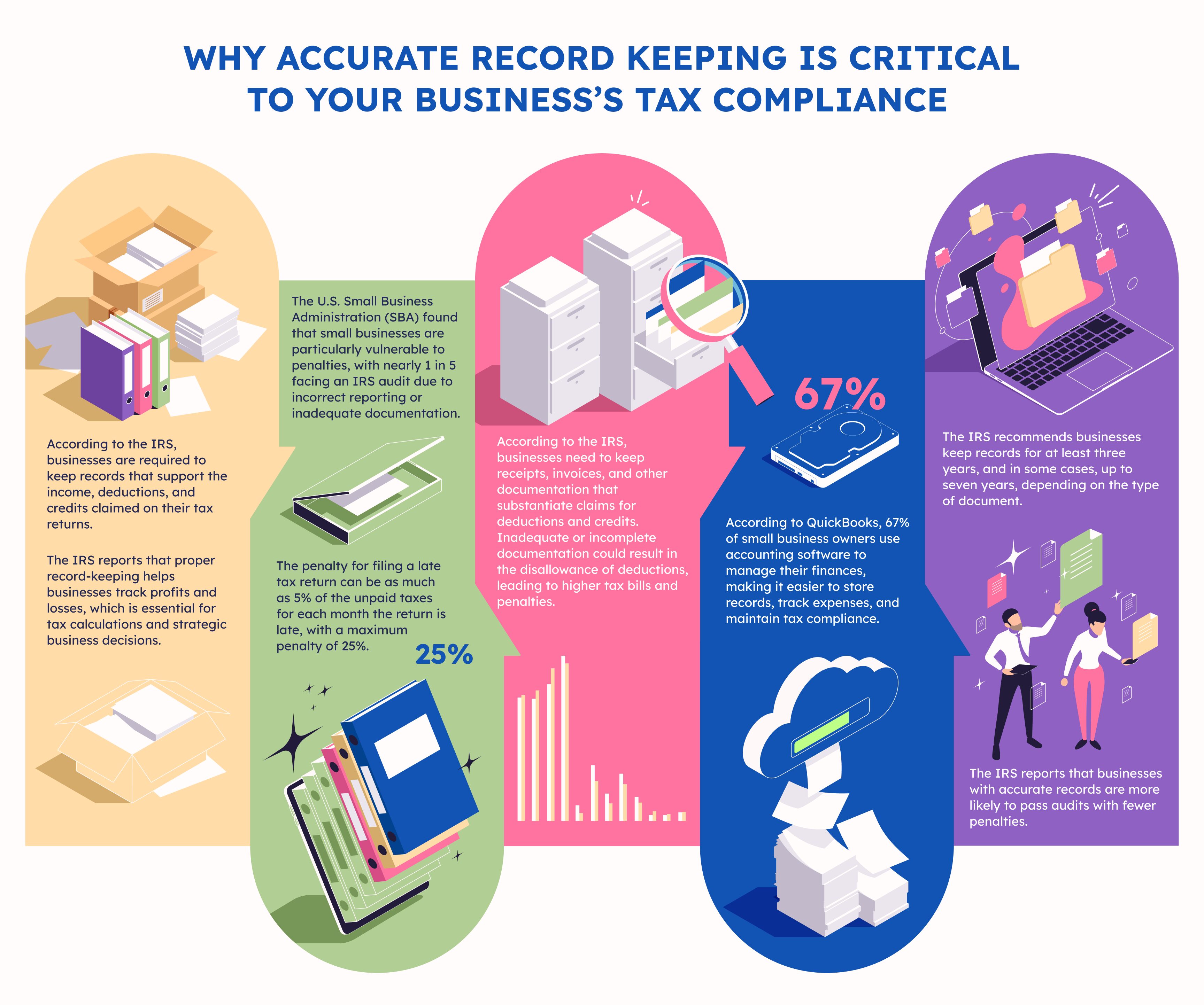

Accurate record-keeping is fundamental to ensuring that Xerosoft Global remains compliant with international tax laws and regulations. Operating in various jurisdictions means dealing with different tax systems, which can be complex and challenging to navigate. At Xerosoft Global, ensuring that financial records are maintained accurately and consistently across all regions is essential for minimizing the risk of audits, penalties, and fines. According to the IRS, businesses are required to keep records that support the income, deductions, and credits claimed on their tax returns1. Inaccurate or missing records can result in discrepancies in tax filings, which could trigger audits or penalties for failing to report or pay taxes correctly.

In addition to compliance, accurate records help Xerosoft Global make informed business decisions. Proper documentation allows businesses to assess the financial health of their operations across different markets, identify areas for cost savings, and better plan for future growth. The IRS reports that proper record-keeping helps businesses track profits and losses, which is essential for tax calculations and strategic business decisions2.

How Poor Record Keeping Can Lead to Penalties: The Risk for Global Businesses

For global businesses like Xerosoft, failure to maintain accurate records can result in a host of issues, including costly penalties. The U.S. Small Business Administration (SBA) found that small businesses are particularly vulnerable to penalties, with nearly 1 in 5 facing an IRS audit due to incorrect reporting or inadequate documentation3. The penalties for such violations can be significant, ranging from fines to the disallowance of deductions or credits that a business might otherwise be entitled to.

For example, Xerosoft Global, with its diverse range of services and international operations, must be diligent about complying with the tax regulations in each region it operates. Failure to maintain proper records for cross-border transactions or local business operations could result in a range of penalties. The IRS, for example, imposes penalties for underreporting income, failing to file tax returns on time, or not keeping proper records to support tax returns. The penalty for filing a late tax return can be as much as 5% of the unpaid taxes for each month the return is late, with a maximum penalty of 25%4. This can be devastating to a business, especially for one with global financial operations like Xerosoft Global.

The Role of Technology in Accurate Record Keeping for Xerosoft Global

Technology plays a key role in ensuring that Xerosoft Global maintains accurate financial records across various tax jurisdictions. Cloud-based accounting software and automated tax filing tools have made record-keeping more efficient. According to QuickBooks, 67% of small business owners use accounting software to manage their finances, making it easier to store records, track expenses, and maintain tax compliance5. This is particularly useful for global operations, where Xerosoft Global’s teams in different countries can access real-time data and ensure compliance with local tax laws.

Automated tools help Xerosoft Global avoid errors by automatically importing transactions from bank accounts and other sources, thus reducing the risk of human error. Furthermore, these tools help organize receipts and invoices digitally, simplifying the process of retrieving documents when filing tax returns or responding to audits.

How Accurate Record Keeping Supports Tax Deductions for Xerosoft Global

Accurate record-keeping is also crucial for maximizing tax deductions, a key area where Xerosoft Global benefits. The IRS allows businesses to deduct certain expenses, such as office supplies, employee salaries, and equipment purchases, but these deductions must be backed by proper documentation. Without accurate records, Xerosoft Global may miss out on legitimate deductions, which could lead to higher taxable income and increased tax liabilities.

Maintaining clear and organized records allows Xerosoft Global to substantiate its claims for deductions in every jurisdiction it operates. For instance, when working in different countries, Xerosoft must ensure that it complies with each jurisdiction’s tax laws while maximizing potential deductions on business expenses. According to the IRS, businesses need to keep receipts, invoices, and other documentation that substantiate claims for deductions and credits. Inadequate or incomplete documentation could result in the disallowance of deductions, leading to higher tax bills and penalties6.

Preparing for an Audit: The Importance of Record Retention for Xerosoft Global

One of the primary reasons businesses need to maintain accurate records is to prepare for a potential audit. Global businesses like Xerosoft Global, operating in multiple tax jurisdictions, are often more prone to audits due to the complexity of their financial transactions. To mitigate this risk, Xerosoft must keep detailed records for each region, as required by local tax authorities. The IRS recommends businesses keep records for at least three years, and in some cases, up to seven years, depending on the type of document7. For Xerosoft Global, this could include retaining documents related to cross-border transactions, employee compensation in different countries, and regional tax filings.

Having organized and complete records allows Xerosoft Global to respond quickly and accurately to any audit inquiries. The IRS reports that businesses with accurate records are more likely to pass audits with fewer penalties8. This is especially crucial for a business operating across multiple regions with diverse tax systems.

Conclusion: Ensuring Tax Compliance Through Accurate Record Keeping

Accurate record-keeping is essential for businesses like Xerosoft Global to remain compliant with international tax laws, reduce the risk of audits, and maximize tax deductions. By investing in modern accounting technology and following best practices for record retention, Xerosoft ensures that its financial operations are transparent, compliant, and efficient. Ultimately, businesses that prioritize accurate record-keeping will not only stay compliant with tax regulations but also build a strong foundation for long-term financial success and growth.

For Xerosoft Global, maintaining accurate records across all markets is not just about avoiding penalties; it’s about ensuring a smooth and efficient operation that can scale across borders without compromising compliance.

References:

- Internal Revenue Service (IRS). (2023). Recordkeeping for Small Businesses.

- IRS. (2023). Tax Filing and Record-Keeping Requirements.

- U.S. Small Business Administration. (2022). The Impact of Tax Audits on Small Businesses.

- IRS. (2023). Late Filing Penalties.

- QuickBooks. (2023). How Small Businesses Use Accounting Software.

- IRS. (2023). Deductions and Documentation Requirements.

- IRS. (2023). How Long to Keep Tax Records.

- IRS. (2023). Tax Audit Process and Record Retention.