In the face of constant global disruptions, businesses are increasingly confronted with the challenge of market volatility. This uncertainty, driven by fluctuating consumer preferences, political instability, or economic downturns, can often catch businesses off guard. However, those with a strong strategic planning foundation have a significant advantage. Through proactive, adaptable strategies, businesses can not only withstand such disruptions but use them as stepping stones toward greater resilience and success. This article delves into how strategic planning is essential in navigating market volatility, ensuring that companies stay ahead of the curve, even in the most uncertain times.

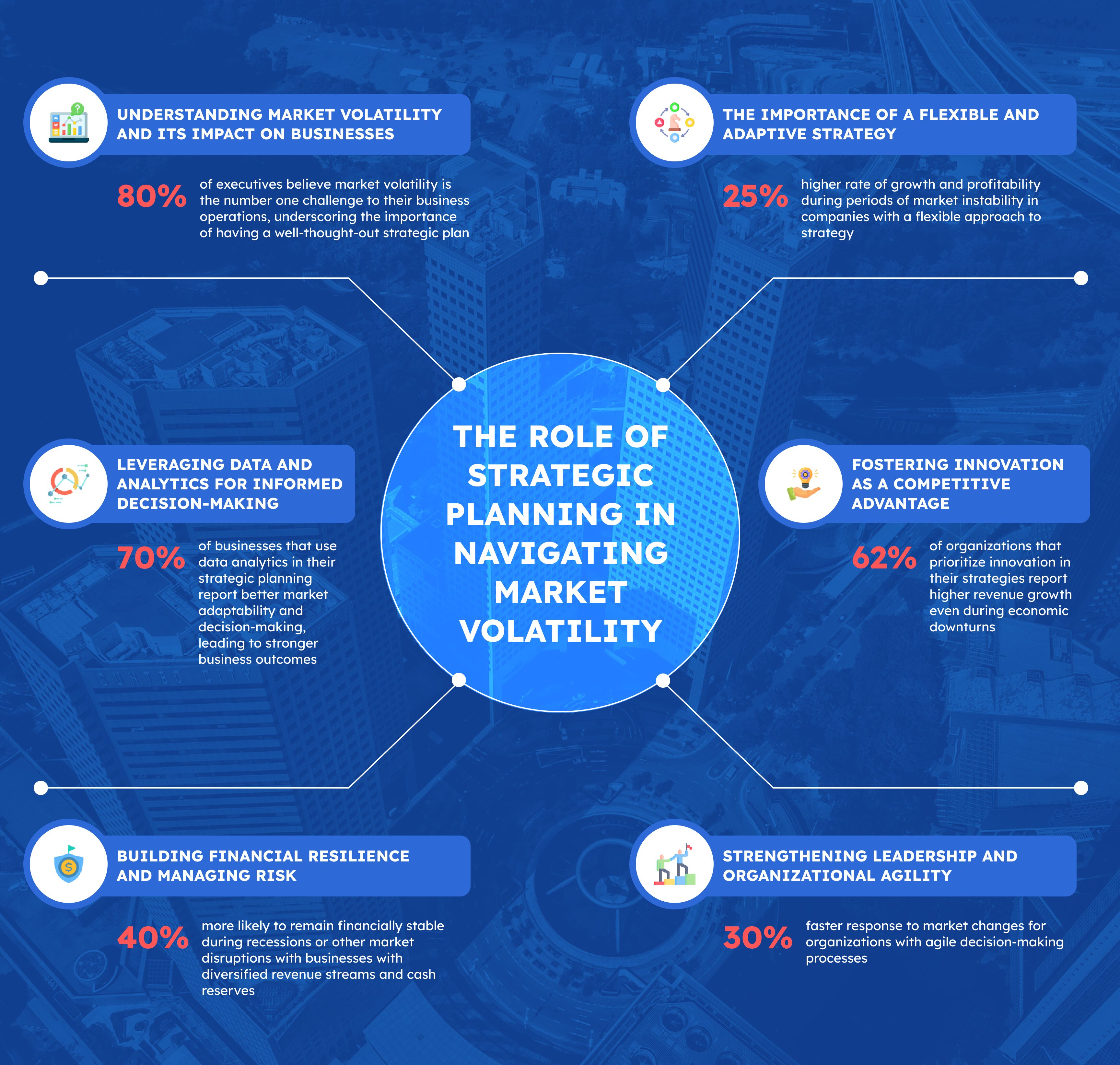

1. Understanding Market Volatility and Its Impact on Businesses

Market volatility refers to the sharp fluctuations in financial markets, including stock prices, commodity prices, and interest rates, caused by various factors like economic crises, government policy changes, or global events. For businesses, these shifts can disrupt operations, erode profits, and increase risks.

Why it matters:

A survey by Deloitte reveals that nearly 80% of executives believe market volatility is the number one challenge to their business operations, underscoring the importance of having a well-thought-out strategic plan. Companies without proactive strategies are more likely to experience negative financial impacts during such volatile periods.¹

2. The Importance of a Flexible and Adaptive Strategy

The key to surviving market volatility lies in a flexible and adaptive strategy. Businesses that stick to rigid plans may struggle to adjust in the face of sudden changes. Strategic planning needs to incorporate flexibility to allow businesses to quickly pivot, reallocate resources, and seize new opportunities in real time.

Why it matters:

A study by McKinsey highlights that companies with a flexible approach to strategy saw a 25% higher rate of growth and profitability during periods of market instability. This flexibility enables businesses to respond to changing circumstances without losing sight of their overall goals.²

Key Considerations for Flexibility in Strategic Planning:

- Regularly assess market trends and economic indicators

- Identify potential risks and create contingency plans

- Establish a dynamic decision-making framework for swift responses

- Ensure strong communication channels across teams for a coordinated effort

3. Leveraging Data and Analytics for Informed Decision-Making

In times of uncertainty, data-driven decision-making is critical. By analyzing real-time data, businesses can gain a deeper understanding of market conditions, consumer behavior, and competitive landscapes, enabling more accurate predictions and proactive responses.

Why it matters:

According to a report by PwC, 70% of businesses that use data analytics in their strategic planning report better market adaptability and decision-making, leading to stronger business outcomes. By leveraging data, companies can identify emerging trends, adjust their strategies, and respond to disruptions faster.³

Businesses can leverage data to:

- Identify emerging trends and market opportunities

- Monitor customer behavior shifts and adjust offerings accordingly

- Assess competitor activity and respond proactively

- Optimize operational efficiency to reduce costs

4. Fostering Innovation as a Competitive Advantage

Market volatility often drives innovation. A culture of innovation, supported by strategic planning, allows businesses to adapt, pivot, and stay ahead of competitors. Innovation doesn’t always mean creating new products—it can involve refining processes, improving customer service, or optimizing business models.

Why it matters:

A study by Accenture found that 62% of organizations that prioritize innovation in their strategies report higher revenue growth even during economic downturns. This focus on innovation helps businesses not only survive market volatility but also thrive by creating new revenue streams and strengthening customer loyalty.⁴

Strategic planning should encourage teams to think creatively and take calculated risks, ultimately positioning the business to capitalize on opportunities during times of market instability.

5. Building Financial Resilience and Managing Risk

Financial resilience is a cornerstone of navigating market volatility. With a strong financial foundation, businesses can absorb shocks and continue operations even during periods of instability. Strategic planning should focus on building this resilience through risk management and diversification.

Why it matters:

According to a report by the World Economic Forum, businesses with diversified revenue streams and cash reserves are 40% more likely to remain financially stable during recessions or other market disruptions. Diversifying income sources and maintaining liquidity are essential to weathering economic downturns.⁵

Risk management strategies may include:

- Diversifying revenue streams to reduce dependency on one market or product

- Maintaining cash reserves or accessing credit lines to cushion against downturns

- Hedging against financial risks such as currency fluctuations or commodity price changes

- Implementing cost-control measures to ensure financial stability

6. Strengthening Leadership and Organizational Agility

Strong leadership and organizational agility are crucial when managing volatility. Leaders need to make quick, informed decisions, communicate effectively, and align teams to execute the strategy. Businesses that promote organizational agility are better equipped to adapt to changes without losing momentum.

Why it matters:

A report by Bain & Company found that organizations with agile decision-making processes respond 30% faster to market changes, allowing them to stay competitive during uncertain times. Leaders who empower teams and foster a culture of collaboration ensure that the business can pivot quickly and strategically when necessary.⁶

To enhance leadership and agility:

- Invest in leadership development and decision-making skills

- Empower teams to act independently and make decisions within their scope

- Foster a collaborative, open environment that encourages cross-functional teamwork

- Ensure that the organizational structure is flexible enough to support rapid change

7. Xerosoft Global’s Expertise in Strategic Planning for Volatile Markets

At Xerosoft Global, we understand that in an unpredictable market, strategic planning is essential for long-term success. We partner with businesses to develop resilient, data-driven strategies that focus on adaptability, financial stability, and innovation. Through our consulting services, we help companies:

- Develop customized strategic plans that align with market conditions and long-term goals

- Leverage data analytics to inform decision-making and spot new opportunities

- Build financial resilience through robust accounting and compliance frameworks

- Optimize operational efficiency and risk management processes

Whether you’re navigating economic uncertainty, regulatory changes, or technological disruptions, Xerosoft Global is here to help you stay ahead of the curve and drive sustainable growth.

Conclusion: Thriving in an Uncertain Market

In today’s volatile market, businesses that invest in strategic planning—focused on flexibility, innovation, data-driven decisions, and financial resilience—are better positioned to not just survive but thrive. By leveraging the expertise of firms like Xerosoft Global, companies can navigate uncertainty with confidence and maintain their competitive edge, no matter what challenges arise.

References:

- Deloitte. (2023). “The Impact of Market Volatility on Business Operations.” Deloitte Insights.

- McKinsey & Company. (2022). “The Role of Flexibility in Business Strategy.” McKinsey & Company.

- PwC. (2022). “Data Analytics: Transforming Strategic Decision-Making.” PwC.

- Accenture. (2023). “Innovation in Times of Market Volatility.” Accenture.

- World Economic Forum. (2023). “Building Financial Resilience During Market Disruptions.” World Economic Forum.

- Bain & Company. (2023). “The Benefits of Organizational Agility in Responding to Market Changes.” Bain & Company.