Effective bookkeeping is essential for maintaining the financial health of your business. However, as your company grows, managing financial records can become increasingly complex and time-consuming. Recognizing when to outsource your bookkeeping can save you time, reduce costs, and enhance accuracy. Here are five signs that indicate it might be time to consider outsourcing your bookkeeping, along with insights into how Xerosoft Global can assist.

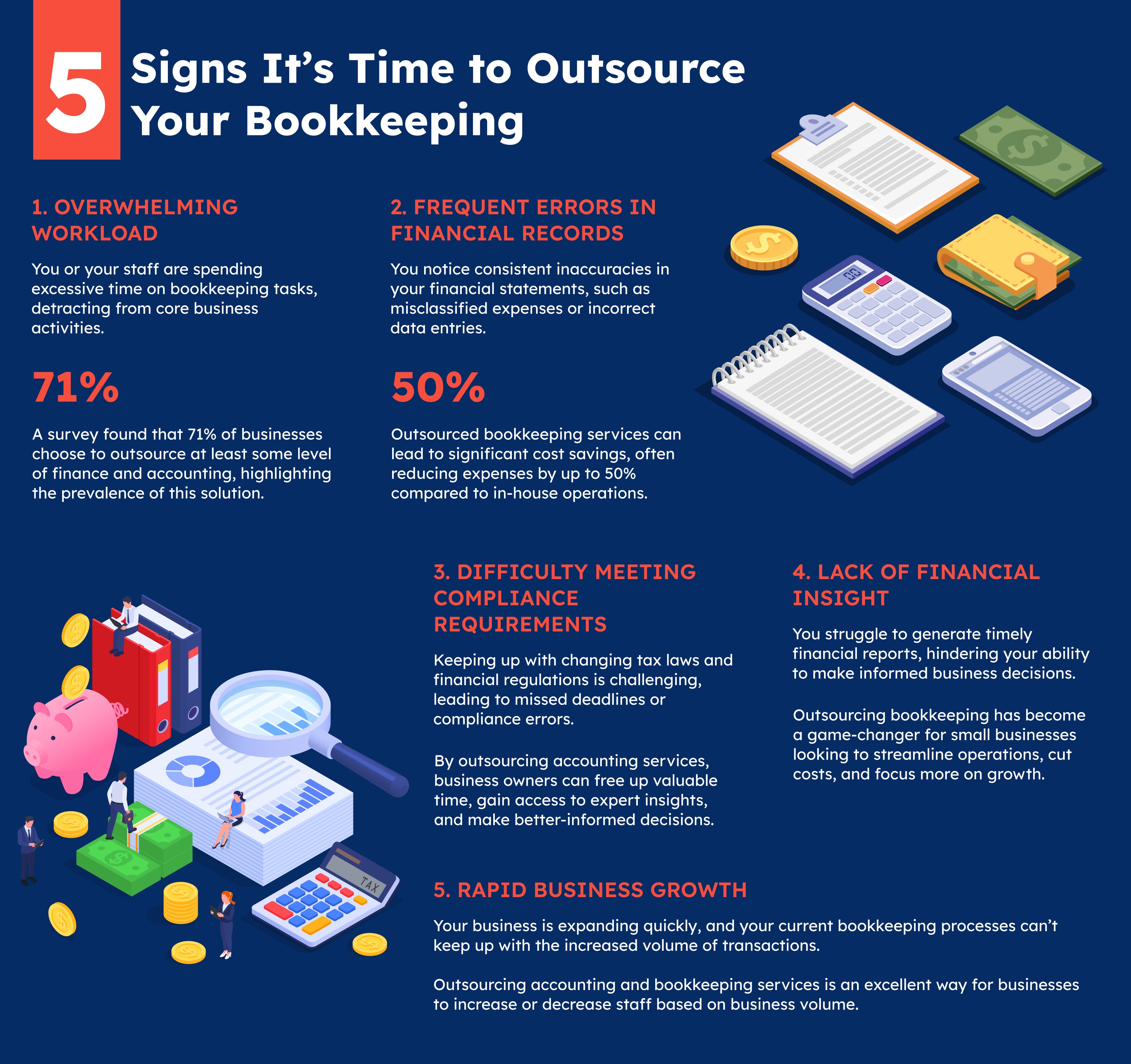

1. Overwhelming Workload

Sign:

You or your staff are spending excessive time on bookkeeping tasks, detracting from core business activities.

Insight:

As businesses expand, financial transactions become more complex, leading to increased time spent on bookkeeping. Outsourcing can alleviate this burden, allowing you to focus on strategic initiatives. A survey found that 71% of businesses choose to outsource at least some level of finance and accounting, highlighting the prevalence of this solution¹.

How Xerosoft Global Helps:

Xerosoft Global offers comprehensive bookkeeping services, managing your financial records efficiently so you can concentrate on growing your business.

2. Frequent Errors in Financial Records

Sign:

You notice consistent inaccuracies in your financial statements, such as misclassified expenses or incorrect data entries.

Insight:

Errors in bookkeeping can lead to poor financial decisions and potential compliance issues. Outsourcing to professionals reduces the risk of mistakes, ensuring accurate and reliable financial information. Outsourced bookkeeping services can lead to significant cost savings, often reducing expenses by up to 50% compared to in-house operations².

How Xerosoft Global Helps:

Our team at Xerosoft Global utilizes advanced accounting software and best practices to maintain precise financial records, minimizing the risk of errors.

3. Difficulty Meeting Compliance Requirements

Sign:

Keeping up with changing tax laws and financial regulations is challenging, leading to missed deadlines or compliance errors.

Insight:

Staying compliant with evolving regulations is crucial to avoid penalties. Outsourcing ensures that experts are handling your bookkeeping, keeping your business aligned with current laws. By outsourcing accounting services, business owners can free up valuable time, gain access to expert insights, and make better-informed decisions³.

How Xerosoft Global Helps:

Xerosoft Global stays abreast of regulatory changes, ensuring your financial practices comply with all applicable laws and standards.

4. Lack of Financial Insight

Sign:

You struggle to generate timely financial reports, hindering your ability to make informed business decisions.

Insight:

Accurate and timely financial reporting is essential for strategic planning. Outsourcing provides access to detailed financial analyses, offering insights that drive business growth. Outsourcing bookkeeping has become a game-changer for small businesses looking to streamline operations, cut costs, and focus more on growth⁴.

How Xerosoft Global Helps:

We provide regular financial reports and insights, empowering you to make data-driven decisions for your business.

5. Rapid Business Growth

Sign:

Your business is expanding quickly, and your current bookkeeping processes can’t keep up with the increased volume of transactions.

Insight:

Rapid growth can strain existing bookkeeping systems, leading to inefficiencies. Outsourcing offers scalable solutions that adapt to your business’s evolving needs. Outsourcing accounting and bookkeeping services is an excellent way for businesses to increase or decrease staff based on business volume⁵.

How Xerosoft Global Helps:

Xerosoft Global provides scalable bookkeeping services that grow with your business, ensuring seamless financial management during expansion.

Recognizing these signs can help you determine when it’s time to outsource your bookkeeping. Partnering with a professional service like Xerosoft Global can enhance accuracy, ensure compliance, and free up valuable time for you to focus on your core business activities. Contact us today to learn how we can support your business’s financial health.

References

- Capterra, “Should You Outsource Bookkeeping?”

- Whiz Consulting, “Accounting and Bookkeeping Outsourcing Facts,”

- Delaware Business Times, “Why Outsourcing Accounting Services Makes Sense for Growing Businesses,”

- My IRS Tax Relief, “The Benefits of Outsourcing Bookkeeping for Small Business Growth,”

- MicroSourcing, “Why Outsourcing Accounting and Bookkeeping Services Makes Sense,”